The data that came out yesterday afternoon about the US economy showed that the rate of growth in the number of jobs in the US remains strong. At the same time, today's data on the number of people employed in the non-agricultural sector may be much better than economists' forecasts, which in turn, will support the US dollar and keep its growth against risky assets especially against the euro and the pound. It should be noted that the number of initial applications for unemployment benefits in the United States has been declining for four consecutive weeks.

According to the US Department of Labor, the number of Americans who first applied for unemployment benefits fell by 9,000 to 214,000 in the week of December 29 to January 4. Economists had expected it to be at 220,000. The four-week moving average also decreased by 9500, to 224,000. Meanwhile, the number of secondary applications from December 22 to 28 increased by 75,000 to 1.803 million.

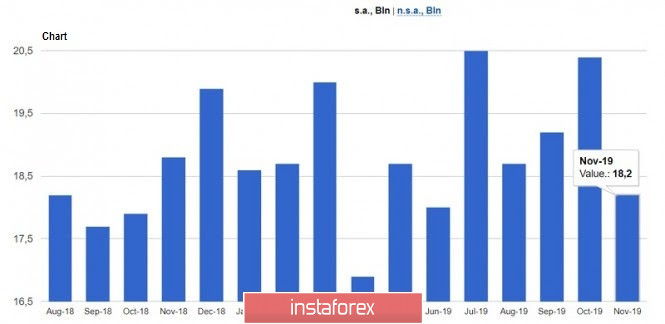

On the other hand, data released yesterday about the German economy did not return the demand for risky assets. At the beginning, the report on the growth of industrial production was ignored, and the investors were not very interested on the indicators of a reduction on exports. According to the statistics agency (Destatis), German exports decreased by 2.3% in November, as compared to the previous month which determined to 112.9 billion euros. Imports, on the other hand, decreased by 0.5%. Contrary, economists had expected a 0.9% drop in exports. Germany's trade surplus was 18.3 billion euros, while economists had forecasted 19.0 billion euros.

All this once again suggests that the German economy has not been able to recover at the end of last year, and is teetering on the brink of recession.

Yesterday afternoon, Federal reserve officials delivered a number of speeches, but mostly described the correct course of Fed last year, not making any forecasts for the near future. Richard Clarida, Vice Chairman of the US Federal Reserve, said that the US economy is starting 2020 in a good position. Moreso, the rate cuts in 2019 were well timed to provide support for the economy. Clarida also noted that there is currently no evidence that low unemployment puts excessive pressure on inflation, and in his opinion, the economic indicators in 2020 will be about the same as 2019's.

The President of the Federal Reserve Bank of St. Louis, James Bullard, also believes that the prospects for the US economy in 2020 will be positive. During the interview, Bullard noted that the current forecast suggests a soft landing for the economy, as Fed's rate cuts last year improved its prospects. According to the Fed representative, at the moment, monetary policy provides much more support to the economy than in 2018.

Let me remind you that in the near future, US will be visited by a delegation from China, which will include the Minister of Trade, the governor of the Central Bank, and the Deputy Ministers of Finance, Agriculture and Information Technology of China. All of them will arrive in Washington to sign the first phase of the trade agreement that will be held on January 15 at the White house. During the meeting, questions will also be raised about the second and more important phase, which includes a number of conditions for information technology, including Huawei.

Yesterday, Us President Donald Trump said that the next round of trade talks with China will begin soon, but will not be completed before the elections that will be held this fall in the US. As Trump noted, the goal of the second phase of the talks will be "opening up China." The American leader also did not forget about Iran, once again stressing that there will never be nuclear weapons, and the new sanctions will begin to act immediately.

As for the technical picture of the EUR / USD, the pair remained unchanged even though the bears pushed the euro to the support level of 1.1100. A break of this will provide the market with new sellers, and can collapse risky assets to the lows of 1.1040 and 1.0980. If the buyers of euro manage to regain the intermediate resistance of 1.1130, it is possible that the pair will bounce up to the highs of 1.1170 and 1.1210.

The main movement of EUR / USD today will be based on the indicators for the American labor market.