The pound fell into a depression against the dollar again, dropping to the area of the 29th figure today. The British currency was under pressure throughout the previous week, however, today the pair's bears were able to test a fairly important support level of 1.2980 (the upper boundary of the Kumo cloud on the daily chart). The pair is falling mainly for two reasons.

Firstly, traders are concerned about the prospects of the negotiation process between London and Brussels. Almost all experts in unison say that the 11-month time range is not enough to agree on a trade agreement. But Boris Johnson continues to insist on the contrary, making investors nervous.

The second reason for concern is the position of some Bank of England representatives amid a slowdown in the British economy. In particular, today Gertjan Vlieghe added fuel to the fire, which allowed a reduction in the interest rate in the foreseeable future. After this statement, the pound paired with the dollar could not hold the 30th figure and fell to the 29th price level for the first time this year.

The January meeting of the English regulator will be held in two weeks, on the 30th. The previous - December - meeting ended on a major note. To the surprise of many experts, members of the central bank did not announce a rate cut (as many currency strategists warned about), and also did not rule out a rate hike in 2020 - naturally, provided that numerous risks do not materialize ("hard" Brexit, a decline in industrial production, inflation, GDP, the escalation of the trade war, etc.).

That is why today's Vlieghe's statement took many traders by surprise. Although in fact he is a consistent representative of the "dovish wing" of the Bank of England. On the eve of the December meeting, rumors were circulating in the market that he would join his colleagues - Saunders and Haskell - who had voted in favor of rate cuts over the past few meetings. And although these rumors were not confirmed, it is not surprising that Vlieghe continues to voice a rather soft position regarding the prospects of monetary policy.

In his view, the British economy needs support from the BoE - especially if key macroeconomic data continues to show signs of slowdown. Let me remind you that at its last meeting of the regulator, it revised the forecast for the growth of British GDP in the fourth quarter in the direction of deterioration - from +0.2% to +0.1% q/q. At the same time, the central bank acknowledged that the investment climate in the country could significantly improve in the near future, as many companies and enterprises will return to those investment projects that were frozen due to the risks of the hard Brexit.

However, this is a matter of the coming months, while at the moment the main macroeconomic reports in Britain are published (as a rule) in the red zone. For example, Britain's GDP growth rate today came out worse than expected - on a monthly basis, the indicator fell back into the negative area (-0.3%). In quarterly terms, the key indicator increased by only 0.1% - this is the weakest growth rate since June last year.

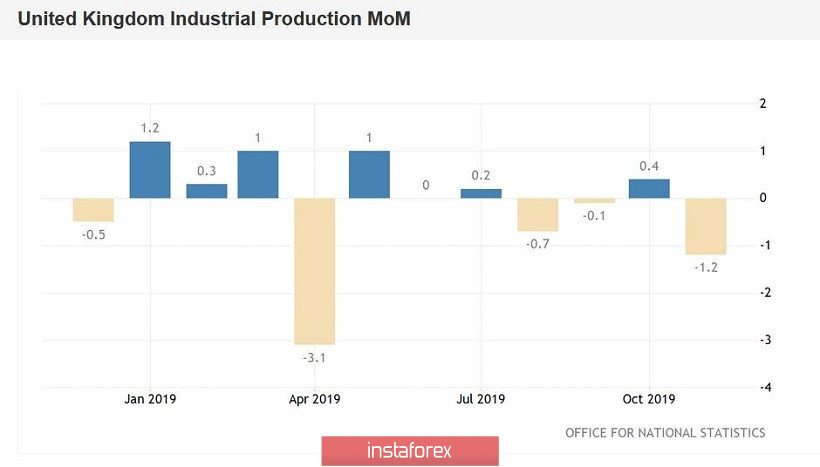

Previously published indicators also leave much to be desired. In particular, the British labor market was disappointing - unemployment, although it remained at the same level (3.8% with a forecast of growth of up to 3.9%), the number of applications for unemployment benefits increased significantly - to almost 29 thousand (with a forecast of 20 thousand ) Salaries also disappointed. The level of average earnings (including bonuses) grew to only 3.2%. This is the weakest growth since April of this year. Production activity remains weak - according to data published today, production in the manufacturing sector collapsed (in monthly terms) to -1.7%, with a forecast of decline to -0.2%. Only the construction sector demonstrated positive dynamics. But the indicator of changes in the volume of industrial production in Britain again turned out to be in the negative area - both in monthly and in annual terms.

Obviously, if key macroeconomic indicators continue to disappoint, the BoE will resort to lower rates. Here it is worth recalling that back in the middle of last year, Mark Carney warned that the central bank would not "automatically" respond to events around Brexit. That is, in the event of the implementation of the hard scenario, the central bank will not resort to easing monetary policy at the next meeting — but even with the soft option, the regulator will not increase the interest rate only on the basis of approval of the deal. That is why the focus of GBP/USD traders again shifted to the British macroeconomic reports and comments of representatives of the BoE. Today's price dynamics once again confirms this fact.

All this suggests that the British will show a downward trend in anticipation of the next test - on Wednesday the main data on inflation growth in the UK will be published. According to the consensus forecast, the December consumer price index should reach the same levels as in November (general index at the levels of 0.2% m/m, 1.5% y/y, the core index - 1.7%). If inflation also disappoints, the GBP/USD pair, first, will break through the support level of 1.2980 and go to the middle line of the Bollinger Bands indicator on the daily chart (1.2850). If inflationary dynamics will pleasantly surprise investors, the pair will have a chance to return to the region of the 30th figure.