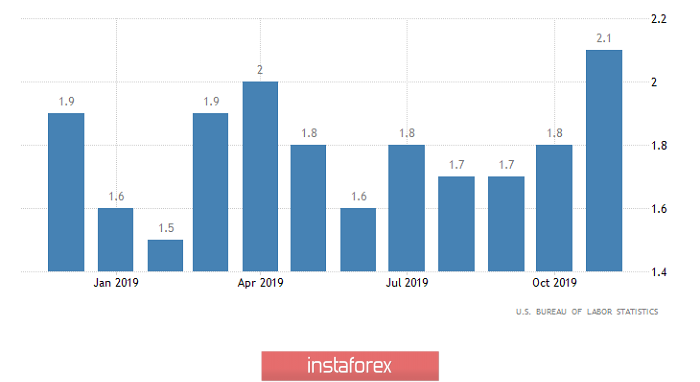

Oddly enough, the pound and the single European currency behaved quite differently yesterday. The pound was steadily declining, although not much, but the single European currency was quite standing still, because you need a microscope in order to see its growth. But all this is completely due to objective reasons, especially the fact that both the pound and the single European currency were left to their own devices due to the complete absence of news from the United States.

In part, the same uncertainty also explains some of the common European currency. Only secondary data were published for individual countries in the euro area. So, in Germany, the decline in wholesale prices slowed from -2.5% to -1.3%. And although this is encouraging about the possible increase in inflation in Germany, it should be noted that we are not talking about the whole of Europe, and also that a slowdown to -1.1% was predicted. But in Italy, the growth rate of retail sales slowed down from 1.0% to 0.9%, and although this is sad news, we must still admit that we are talking only about the third economy of the euro area, and its effect on the whole of Europe simply fades in Comparison with Germany. Therefore, European statistics clearly did not contribute to any noticeable progress. Well, the growth of the single European currency, although almost imperceptible, is largely due to the elementary overbought dollar.

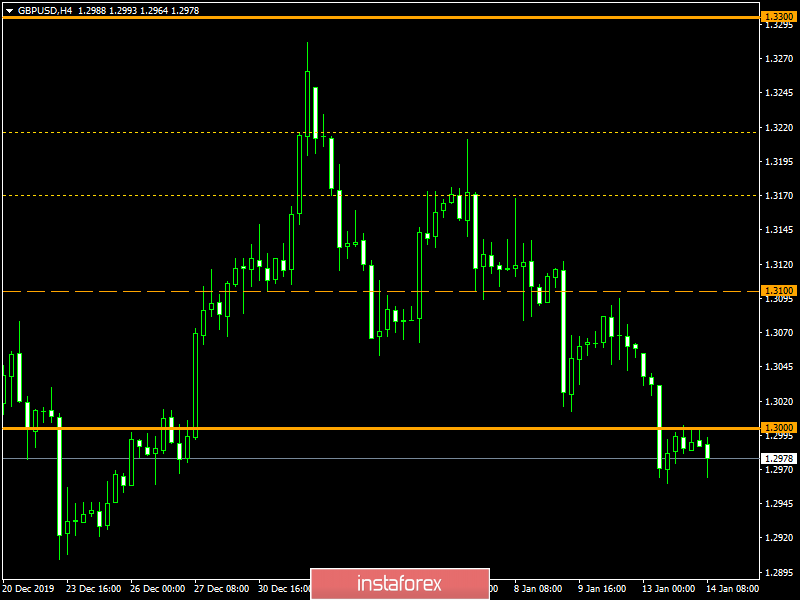

Wholesale prices (Germany):

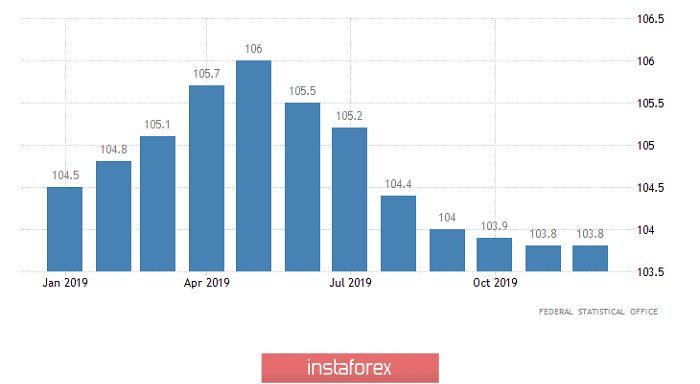

However, the pound fell noticeably, but it happened early in the morning, even before the publication of data on industrial production. The decline of which accelerated from -0.6% to -1.6%. At the same time, they expected acceleration of the recession to -1.4%, and it seems that investors either knew in advance that the data would turn out worse than forecasts, or simply began to prepare for the sad news in advance. And when they saw that the data really turned out to be worse than forecasts, they did not even pay attention to the fact that they overdid it a little. Like, and so it goes, what a horror is going on - the total deindustrialization of the United Kingdom. Moreover, industrial production has been declining for the eighth month in a row.

Industrial Production (UK):

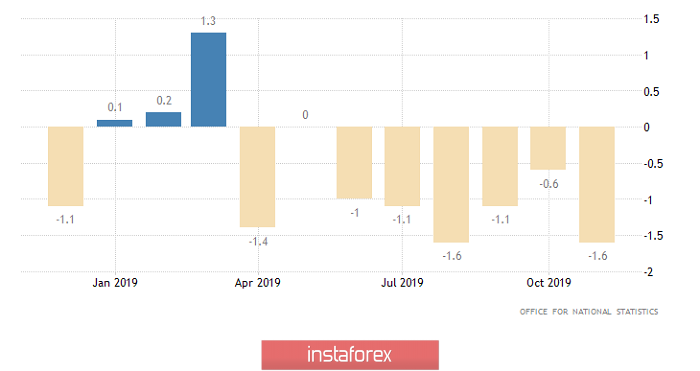

There is even less news today, but this is news from the United States and what is much more interesting is that inflation data is published. It is not surprising that investors are looking forward to publishing these data given the fact that inflation is one of the two main indicators taken into account when deciding on the monetary policy parameters of the Federal Reserve System. In addition, market participants expect inflation to accelerate from 2.1% to 2.3%, since increasing inflation alone is a good factor for the dollar. If we add to this that inflation will then accelerate for the fourth month in a row, then it is still more interesting. The fact is that in this case this will be a confirmation of Jerome Powell's words that the Federal Reserve is taking a break. That is, translated into human language, this means that the Federal Reserve will definitely no longer be bullies and will leave the refinancing rate alone in the near future. Moreover, inflation is not just accelerating, it is still consolidating above the target level that has long been designated by the Federal Reserve System. This indicates the possibility that soon some of the representatives of the Federal Reserve System will begin to talk about the possibility of increasing the refinancing rate. To simply put it, the dollar is optimistic about the future and has high expectations for today's inflation data.

Inflation (United States):

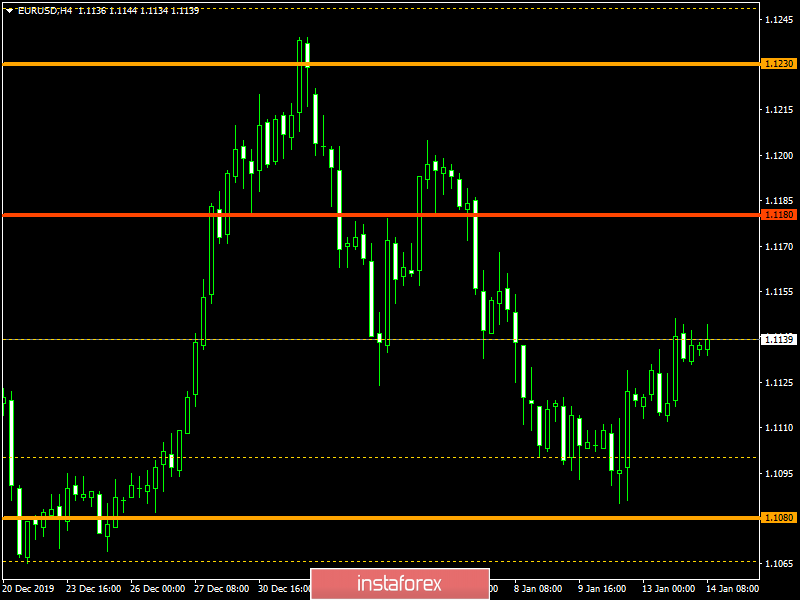

The euro / dollar currency pair is in the correction phase, after the quote managed to get closer to the range level of 1.1080. It is likely to assume a temporary chatter relative to the value of 1.1145, with variable price jumps. In the afternoon, the correction phase may be under pressure, resuming a downward move against the background of the news flow.

The pound/dollar currency pair quickly broke through the psychological level of 1.3000, forming a fixation platform under it. It is likely to assume that the downward interest may resume if the current sentiment is maintained and the price is fixed lower than 1.2960.