The world remembered the so-called trade war between the United States and China again, which was the reason that the dollar was not able to build on its success in the end amid a steady increase in inflation. Yesterday, all the most honest and transparent (I'm trying to master this strange term, the meaning of which no one seems to understand) the mass agitated and misinformative media created a storm in the glass because of the planned signing of the first phase of the trade agreement between Washington and Beijing today. Moreover, this does not mean a full agreement, but only a fixation of a number of points that no one wants to touch yet, because this hinders the advancement of the negotiation process in a direction that suits both parties. In fact, it's only known that the United States and Beijing will freeze all trade duties and tariffs, at least until the signing of the second phase of the agreement, which is not known when it will take place. And although some tried to present this as a sensation, in fact, this has long been known. However, the remaining provisions of the document being signed today are somewhat secret. This is precisely what has become the occasion for a lot of speculation, and it has even reached the point where it is speculated that the signing of this agreement will cause enormous economic damage to other countries. To some extent, the complete uncertainty regarding the contents of the first phase of the trade agreement frightens investors, which, of course, harms financial markets and contributes to a weakening dollar. But this only partially prevented the dollar from consolidating its gains after the publication of inflation data. After all, what we know, and this is the preservation of existing tariffs, for the most part is a defeat to the United States. This whole epic was started by Donald Trump just in order to change things in favor of American companies and the economy as a whole and moreover, due to China. However, the increase in customs duties led only to a slight decrease in sales of Chinese companies in the US market. Chinese goods are still significantly cheaper than American ones, so it is not surprising that consumers prefer to buy them. At the same time, American companies cannot boast of successes in the Chinese market. Now, if the document signed today only fixes the existing trading conditions, then China is the winner. All previously taken actions by Washington can only slow down the process of the flow of capital and wealth into the Middle Kingdom. However, they are not capable of changing this movement. Investors were simply reminded of this, and so they returned the dollar to the values with which the trading day began. As a result, any conclusions will be drawn after the signing of the agreement and its publication. Thus, the market will most likely stand still before some details become known.

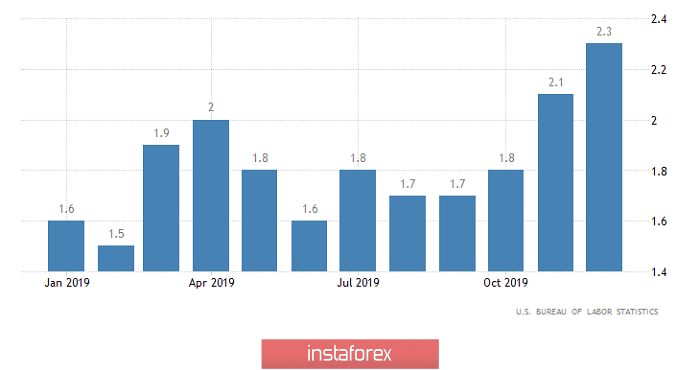

At the same time, the single European currency has been steadily declining since the morning. The reason was the expectation of the publication of inflation data in the United States and the lack of doubt that the forecasts would be confirmed, which is what happened. Inflation accelerated from 2.1% to 2.3%. Firstly, it is not just that investors like it, but it removes all doubts about the actions of the Federal Reserve System. Moreover, the regulator will no longer reduce the refinancing rate in the foreseeable future. Secondly, the fact that inflation has been growing for the fourth consecutive month and is two months above the target level previously set by the Federal Reserve System, suggests that in the near future there will be talk about the possibility of raising the refinancing rate. Therefore, the dollar should confidently go up.

Inflation (United States):

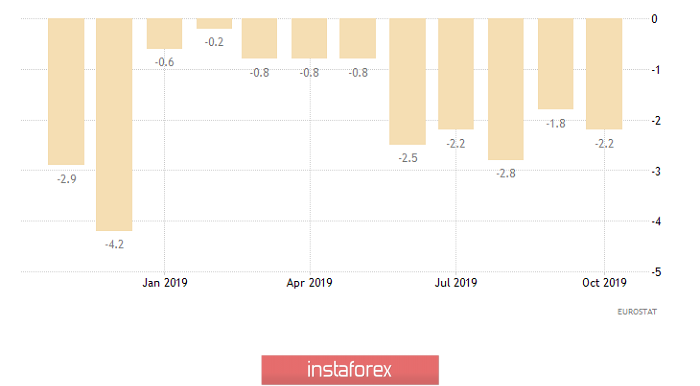

It is clear that investors will wait for at least some specifics regarding the content of the document that Beijing and Washington should sign today, and before that, no sudden movements are expected. However, a number of interesting macroeconomic data are published today. So, in Europe, a slowdown in the decline in industrial production is expected from -2.2% to -1.4%. Of course, this is still a recession, but the dynamics are clearly positive. Although the decline in industrial production in Europe has been going on for more than a year. In addition to pan-European data, data are also published for individual countries. So, in France, inflation accelerated from 1.0% to 1.5%, with a forecast of growth to 1.4%. In Spain, inflation accelerated from 0.4% to 0.8%. It is noteworthy that such inflationary dynamics, in anticipation of tomorrow's publication of inflation data throughout Europe, tells us that that the data may be significantly better than predicted. Most importantly, this indicates a high potential for inflation growth in the future.

Industrial Production (Europe):

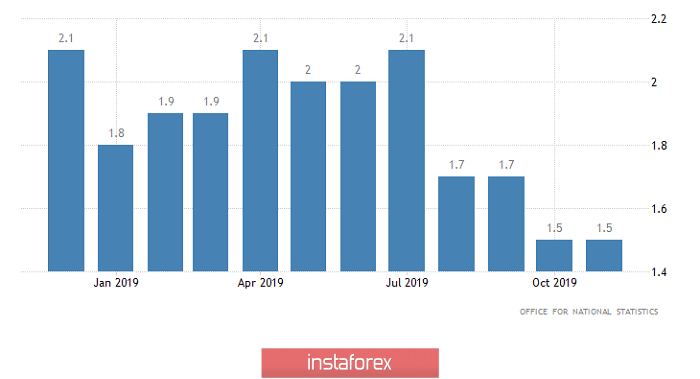

Inflation data will be published today in the UK, but it should remain unchanged so that investors would have ignored the news anyway without the help of all kinds of trade disputes between the two largest economies in the world.

Inflation (UK):

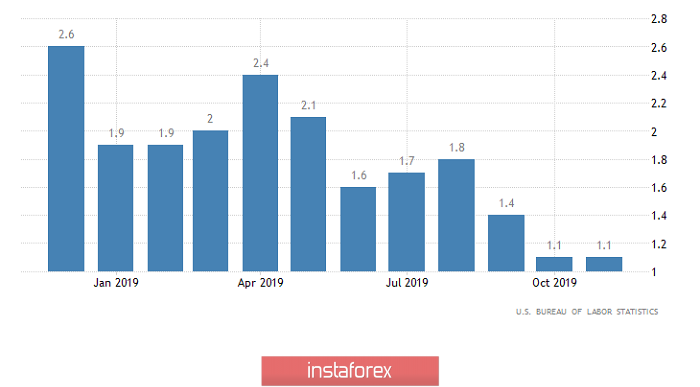

Well, the data on producer prices in the United States will complete the day. The growth rate of which may accelerate from 1.1% to 1.4%, which will further convince everyone that inflation will not obviously decline. This means that it is highly likely that representatives of the Federal Reserve will talk about the possibility of raising the refinancing rate in the near future.

Manufacturer Prices (United States):

It is obvious that the nerves of investors are tense to the limit, since they have no idea what to expect from the document signed today. At the same time, nobody wants to take a chance. So, the market will stand still while there will be no details, and any fluctuations will be almost unnoticeable. Now, the single European currency will be in the region of 1.1125 and then it is worth waiting for the growth of the single European currency to 1.1175. The fact is that the very fact of signing at least some agreement that can reduce tensions in terms of international trade will become an extremely optimistic factor. Investors, in turn, will believe in the prospects of the global economy and such things negatively affect the dollar.

The pound will move in the direction of 1.3100 after hanging around 1.3000 which is exactly for the same reasons.