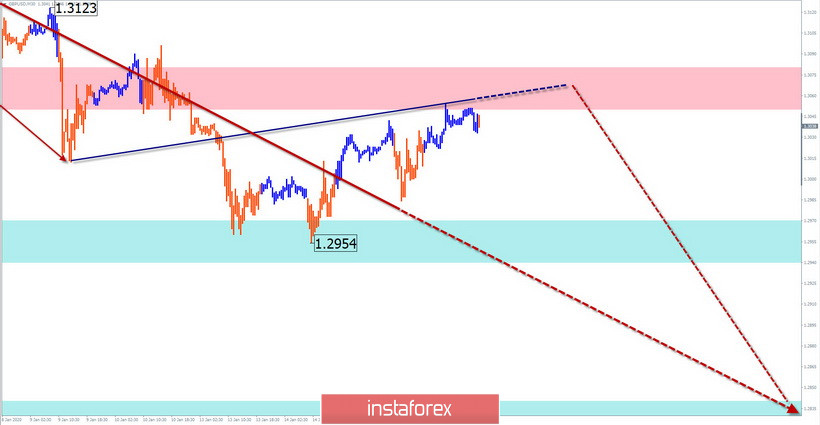

GBP/USD

Analysis:

In the bearish wave that has been dominating since the beginning of this year, conditions are being created for a final downward trend. The structure traces the first 2 parts (A-B). In the last part, the price rolls up from the beginning of the week.

Forecast:

Today, the current upward movement in the last few days is expected to end. If the exchange rate changes, it is possible to increase volatility, with a short-term breakthrough of the upper limit of the resistance zone. The moment when news blocks leave the US and the EU can serve as a reference point for the turnaround time.

Potential reversal zones

Resistance:

- 1.3050/1.3080

Support:

- 1.2970/1.2940

- 1.2840/1.2810

Recommendations:

Purchases of the pound today can be unprofitable. It is recommended to track the change in the direction of movement for selling the instrument in the area of the resistance zone.

USD/JPY

Analysis:

The Japanese yen continues to weaken against the US dollar according to the dominant trend since August last year. On January 8, a new section of the main course started. The nearest potential reversal zone of the chart could only briefly slow the growth of the pair's rate.

Forecast:

In the first half of the day, the movement is expected in the lateral plane. It is possible to go down to the support area. By the end of the day, you can expect the pair to activate and return to the upward rate.

Potential reversal zones

Resistance:

- 110.60/110.90

Support:

- 109.80/109.50

Recommendations:

Sales of the yen today are unpromising. At the end of all counter-movements of the pair, it is recommended to look for signals to enter long positions.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the tool's movements in time!