There have been so many screams about the fact that the first phase of a comprehensive trade agreement between the United States and China is disastrous for the Chinese economy. However, there were lonely voices saying that the opposite was true. And probably, the only thing that all agreed on is that the signing of this agreement will reduce tension and uncertainty in international trade. This alone is enough to make the dollar cheaper, because when the world is calmer, it always gets cheaper. Interest in investing in developing countries is just growing, and it is precisely on the part of American investors. Nevertheless, what was really solemnly signed yesterday? It turned out that there was nothing in the text of the agreement that the general public would not have known in advance. In fact, all significant points were previously voiced by representatives of the White House and precisely for this reason, it seems that China is the loser, as it is committed to increasing imports from the United States by $ 200 billion over the next two years. A similar demand by the United States is connected with the desire to eliminate an extremely strong imbalance in favor of China in matters of mutual trade. According to preliminary data, China's exports to the United States are $ 481.3 billion in 2019, while imports are only $ 150.6 billion. That is, the balance in favor of China is 330.7 billion dollars and this is only in one year. Therefore, the hysteria of Donald Trump is quite understandable. But even if China increases imports by $ 200 billion, nothing will still essentially change. The capital has flowed to China, and will continue to flow just a little slower.

What is much more interesting is that there is no specificity in the text of the agreement as to what will happen if China does not fulfill its obligations. It is worth noting that a similar situation in mutual trade between China and the United States is taking shape, despite all the duties and restrictions that the Donald Trump administration has carefully introduced since it moved to the White House. In addition, the agreement implies the freezing of all customs duties at the existing level at least until the presidential election in the United States. So basically nothing changes. Moreover, the decision of the United States Department of the Treasury to exclude China from the list of countries manipulating the exchange rate of its national currency remained almost without attention against the backdrop of the hype around this agreement itself. The thing is, that if a certain country falls into this list, barrage measures are automatically introduced to compensate for the advantages that a given country may receive from unfair competition. These measures go beyond the framework of the agreement signed yesterday. That is, China automatically gained additional advantages in trade issues, as all transactions and trade operations with the United States are simplified and cheapened. So it is not surprising that the official representatives of the Celestial Empire loudly declared that they could increase imports even more than by $ 200 billion. That is, China automatically gained additional advantages in trade issues, as all transactions and trade operations with the United States are simplified and cheapened. So it is not surprising that the official representatives of the Celestial Empire loudly declared that they could increase imports even more than by $ 200 billion. That is, China automatically gained additional advantages in trade issues, as all transactions and trade operations with the United States are simplified and cheapened.

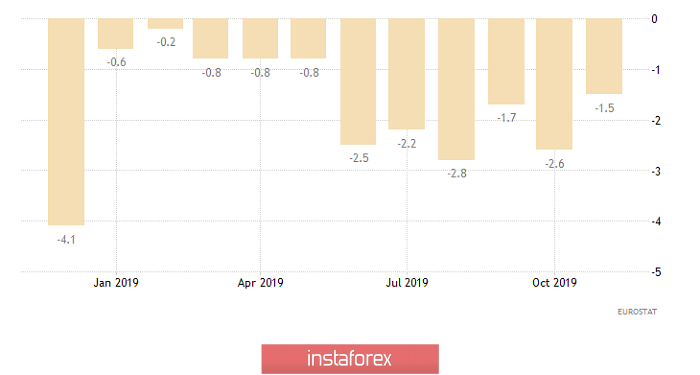

On the other hand, almost everything that happened in Europe was left without attention, against the backdrop of such large-scale events. This explains the long standing of the single European currency in place. Nevertheless, the decline in industrial production in Europe slowed down from -2.6% to -1.5%. The dynamics, of course, is positive, but this is still a recession, which has been going on for more than a year. However, the sad picture was brightened up by inflation data in France and Spain. So, inflation accelerated from 1.0% to 1.5% in the second economy of the euro area, and from 0.4% to 0.8% in Spain. This inspires confidence that inflation in Europe will still begin to grow and the European Central Bank will have no reason to lower the refinancing rate.

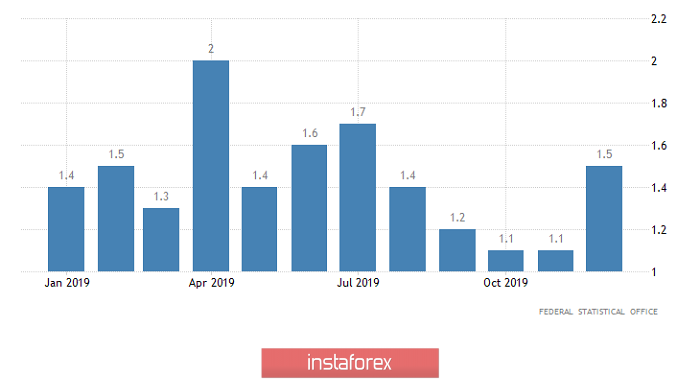

Industrial Production (Europe):

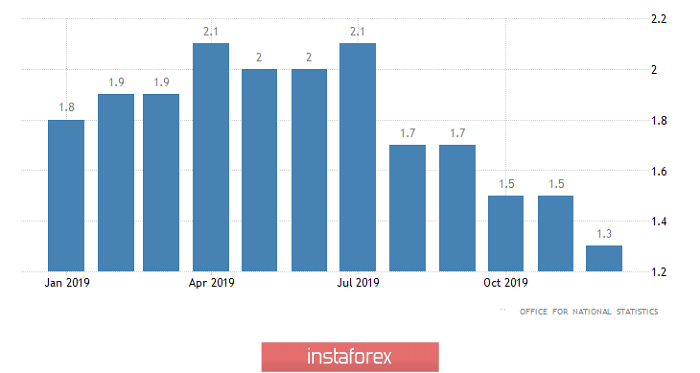

The pound behaved completely in an ugly way. More precisely, it led straight like a textbook. It declined from 1.5% to 1.3%, and immediately went down as soon as it became known that inflation did not remain unchanged. At the same time, talk intensified about the need to lower the Bank of England refinancing rate amid falling inflation, which added a certain piquancy to this situation. Well, as we are already closer to the signing of the agreement between Washington and Beijing, it went up together with the single European currency, largely recovering the losses incurred due to lower inflation.

Inflation (UK):

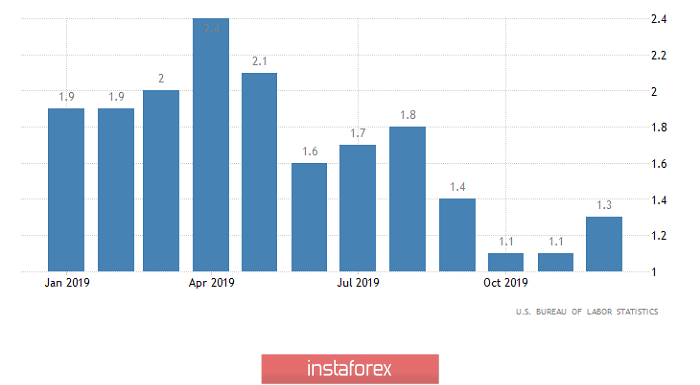

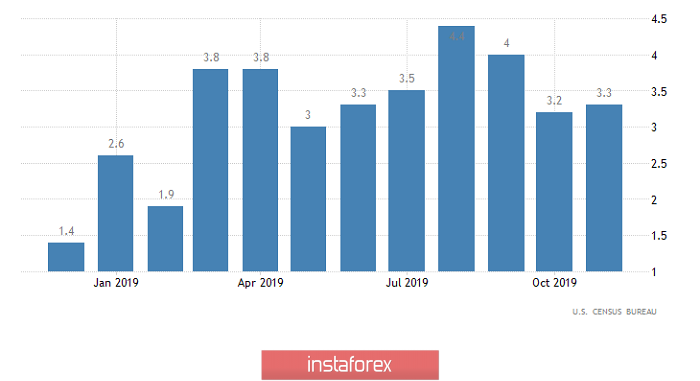

There is nothing to say about the fact that no one looked at American statistics at all. It is clear that all attention was focused solely on the signing of the first phase of the trade agreement. Nevertheless, it is worth taking a look at, since the growth rate of producer prices accelerated from 1.1% to 1.3%. This indicates that the potential for slowing inflation tends to zero. Rather, there is reason to think about the possibility of its further growth.

Manufacturer Prices (United States):

Today, only macroeconomic data from the United States is of interest, due to the fact that almost nothing is published. Thus, it is worth taking a look at the already published inflation data in Germany, which accelerated from 1.1% to 1.5% going in tune with inflation in France and Spain, and finally removing all doubt about the prospects for inflation in all of Europe.

Inflation (Germany):

Well, in the United States, a whole block of data is published that is of great interest. Firstly, these are the data on applications for unemployment benefits traditional for Thursday. The total number of which should be reduced by 6 thousand. This should happen due to a decrease in the number of repeated applications for unemployment benefits, as much as 11 thousand. As you might guess, the number of primary applications for unemployment benefits may increase by 5 thousand. Nevertheless, much more interesting is the data on retail sales, the growth rate of which is expected to slow down from 3.3% to 2.9%. Moreover, a quite noticeable decline in consumer activity completely eliminates optimism caused by the recent increase in inflation, so talking about the possibility of raising the refinancing rate of the Federal Reserve should be postponed until better times.

Retail Sales (United States):

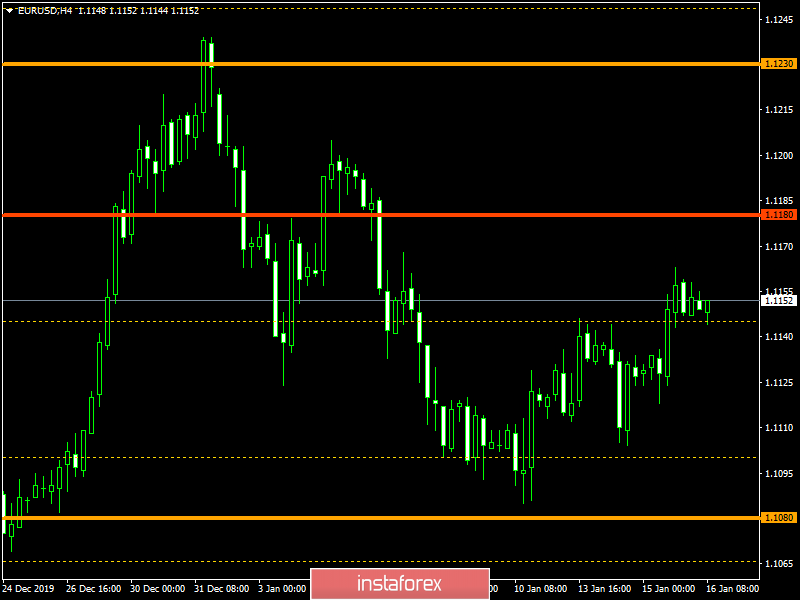

The euro/dollar currency pair could not resist and yet overcame the periodic level of 1.1145, having pulsed candles in the market. It is likely to assume a temporary fluctuation, where temporary slippage is not excluded below the level of 1.1145, but if, however, the quotes manages to fix higher than 1.1165, then the direction to the main level of 1.1180 will be open.

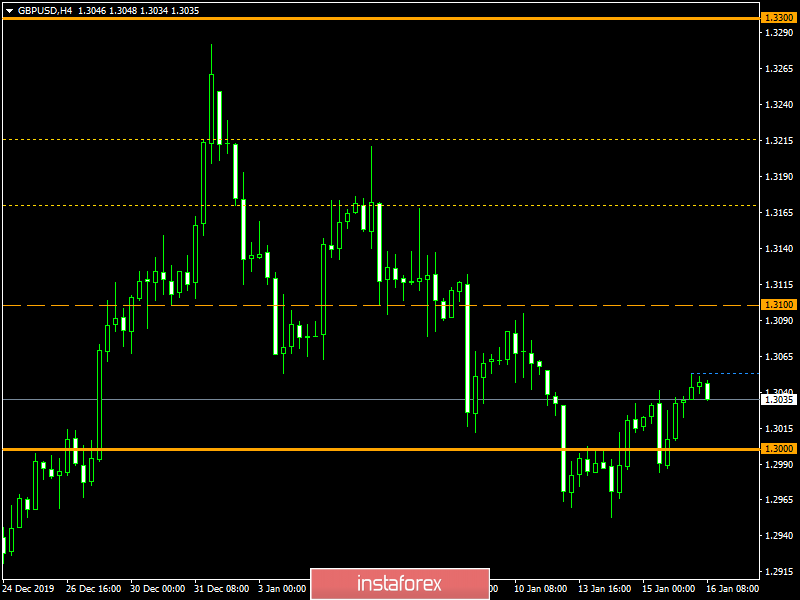

The pound/dollar currency pair continued to form a corrective move, where it managed to locally reach 1.3053, where it slowed down. If the quotes succeed in fixing above the value of 1.3055, then moving towards 1.3085-1.3100 will be open. Otherwise, we should wait for a reversal move towards the psychological level.