So, the long-awaited event took place yesterday: US President Donald Trump and Vice Premier of the State Council of the PRC Liu He signed the first phase of the trade deal, the negotiation process on which lasted more than six months. The fact of a ceasefire in a trade war was not a surprise - traders played this informational occasion in December. Therefore, the main intrigue was the details of the agreement reached.

The dollar did not find any support for itself here. As a result of the signing ceremony, it became clear that the main negotiations on the most complex, key and strategically important issues are yet to come. Even the parties postponed the issue of canceling the introduced tariffs to the second phase of the negotiation process. This fact disappointed the dollar bulls: today's truce looks too shaky. And if the first phase of the negotiations was not easy for the parties, the second stage will be incomparably harder. All this suggests that it will be difficult for dollar bulls to develop a large-scale upward trend this year, since the "Damocles Sword" of US-Chinese relations will hang over the greenback for several months. In turn, today, the European currency received some support from the ECB - the published minutes of the December meeting showed that a wait-and-see attitude would be preserved.

But let's start with events from the US. According to the agreements reached, China pledged to import US products, agricultural products and energy products from the United States for two years worth $200 billion. In turn, Washington finally abandoned the "December" duties, which were supposed to take effect a month ago. The White House planned to increase duties on the import of many Chinese goods, including mobile phones, smartphones, toys and laptops.

At the same time, Donald Trump decided to maintain the current duties on Chinese goods, although earlier there were rumors of a "complete amnesty". According to the head of the White House, the issue of canceling the remaining additional tariffs will be discussed in the framework of the discussion of the second phase of the trade transaction. It is obvious that the American president simply retained the lever of pressure on Beijing in order to change the role of the "good and bad cop" during the further dialogue.

This tactic worked last year, but now many experts doubt that China will make significant concessions to Washington. After all, the second phase provides for significant changes in the industrial policy of China and the expansion of access for US financial companies to the Chinese market - the US is demanding structural reforms from the Chinese. However, most analysts doubt that the negotiations of the second stage will be completed before November of this year, that is, before the US presidential election. Given the precarious political situation of Trump, the Chinese will certainly not be in a hurry to burden themselves with such obligations.

In other words, according to the vast majority of analysts, the second stage of negotiations will be much tougher. As part of the first stage of the dialogue, the countries made relatively insignificant concessions to each other - at least in comparison with what is to be discussed this year. Under such conditions, the dollar did not find reasons for strengthening - and, in my opinion, it is quite justified.

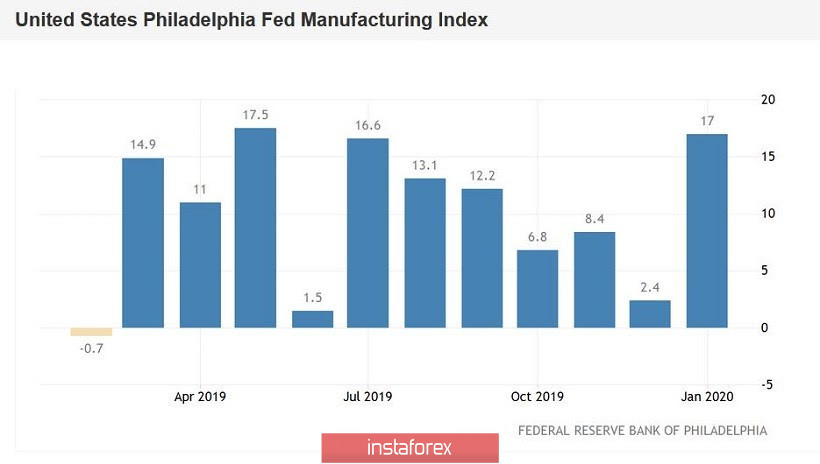

Nevertheless, the upward impulse of the EUR/USD pair also did not receive its continuation - the pair fell back to the level of 1.1130 during the US session. Thus, traders responded to the release of quite good macroeconomic data. After the publication of weak Nonfarms and slurred inflation indicators, today's numbers have pleased dollar bulls. December data on retail sales were above zero, reaching 0.3%. Excluding car sales, this figure exceeded forecast values, reaching 0.7% (i.e., a 5-month high). I was also surprised by the Fed-Philadelphia manufacturing index. This indicator immediately jumped to 17 points, with a forecast of growth of only 3.7 points.

Such a fundamental picture returned the demand for the US currency, which made it possible for EUR/USD bears to extinguish the upward impulse. Nevertheless, the pair still remains within the 11th figure, waiting for the next news drivers.

The European currency also received little support today. The published minutes of the last ECB meeting confirmed the wait-and-see attitude of the regulator. Members of the central bank expressed cautious optimism about the latest macroeconomic reports (first of all, we are talking about restoring core inflation) and noted the weakening concern about foreign trade. And although the ECB has listed and continuing risks (for example, in the field of industrial production), traders drew attention to a rather hawkish wording. Regulator members said the ECB's monetary policy could be adjusted to avoid "unwanted side effects." A rather encouraging phrase, given the dynamics of inflationary processes in the eurozone.

Thus, today's confrontation between bulls and bears of EUR/USD ended in a draw. After the price jumped to the level of 1.1170, the pair plunged to the daily low of 1.1128. But sellers also could not enter the 10th figure, after which the price got stuck in a flat. In my opinion, the dollar is still vulnerable, while the positive effect of today's releases will quickly disappear. From a technical point of view, the pair is still on the middle line of the Bollinger Bands indicator on the daily chart, thereby demonstrating the uncertain positions of both bulls and bears. The support level is 1.1050 (the lower line of the Bollinger Bands indicator, which coincides with the upper boundary of the Kumo cloud on D1), and the resistance level is 1.1210 (the upper line of Bollinger Bands is on the same time frame).