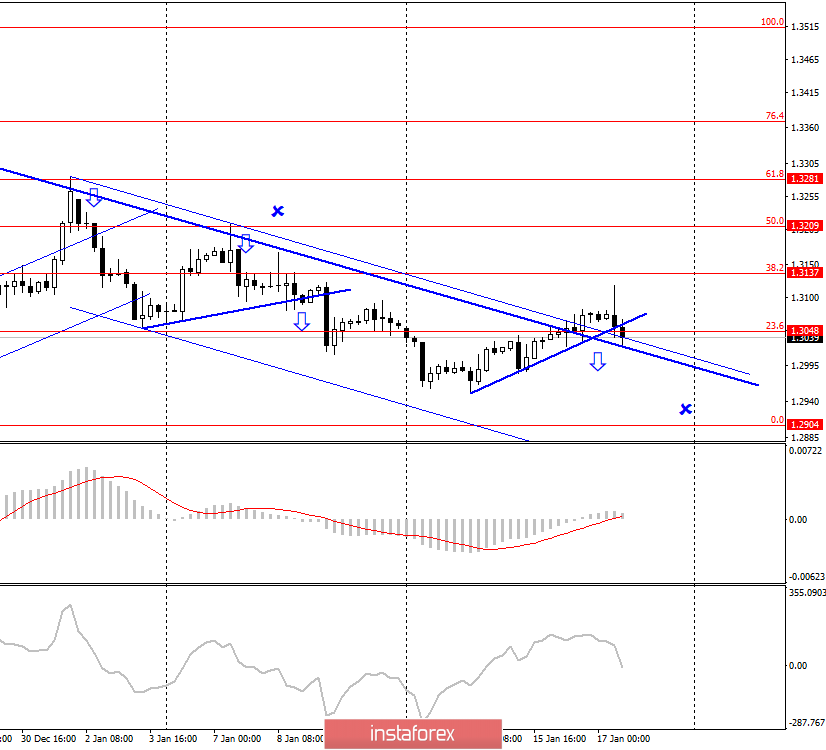

GBP/USD - 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation above the corrective level of 23.6% (1.3048). Along with this consolidation, quotes of the pair closed above two trends and corridors. I have built a small correction line based on the movement of the last days, and if the pair closes below it, then traders will again be able to count on a reversal in favor of the US currency and a resumption of the fall in the direction of the corrective level of 0.0% (1.2904). As we can see, the goal remains the same, however, too long growth of the pound before the expected fall suggests a possible different scenario. In any case, I recommend trying to sell the pair when it is fixed below the Fibo level of 23.6% and the correction line. The "foundation", in the case of the pound-dollar pair, remains in favor of the dollar. Retail sales in the UK declined by 0.6% m/m in December, with forecasts of +0.7%. These numbers were supposed to cause the British dollar to fall, however, the pair continues to trade with a small amplitude, showing no particular desire to move at the end of the trading week.

Forecast for GBP/USD and trading recommendations:

The trading idea is still to sell the pound with a target of 1.2904. Going beyond both corridors cancels their relevance, at the same time, the "foundation" can cause a new fall, as well as fixing under the corrective line and the Fibo level of 23.6%.