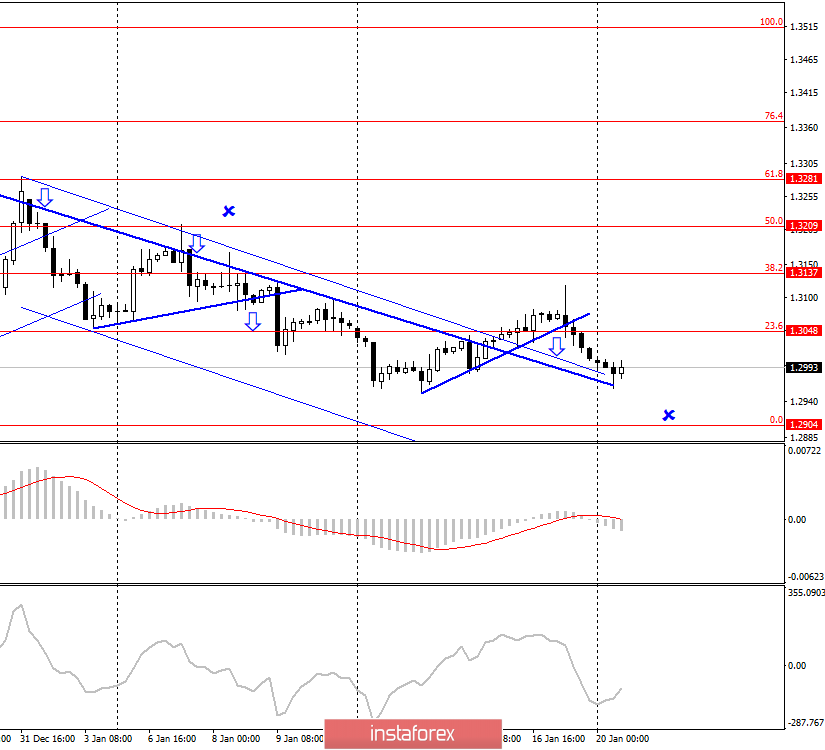

GBP/USD - 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation under the corrective level of 23.6% (1.3048) and the correction line. This signal is marked with a blue down arrow. Thus, we still have the last undeveloped target - the corrective level of 0.0% (1.2904). The pound-dollar pair exited two downward corridors at once, which eloquently indicates the possible end of the fall in quotes. At the same time, the information background continues to push the quotes down, so the fall can be continued. I continue to believe that the pair will fall to the level of 1.2904, although I admit that I expected this much earlier. In any case, those who opened positions on the signal of consolidation under the correction line can place the Stop Loss level above the level of 1.3048 to minimize possible losses on the transaction. Today, the divergence is not observed in any indicator. The information background on Friday was not on the side of the pound. Retail sales in the UK were significantly weaker than forecasts, so the demand for the pound fell on Friday and remains low today, Monday.

Forecast for GBP/USD and trading recommendations:

The trading idea is still to sell the pound with a target of 1.2904. Going beyond both of the corridors negate their relevance, at the same time, the "foundation" continues to prevail over the British. Fixing under the correction line and the Fibo level of 23.6% is a new signal for sales.