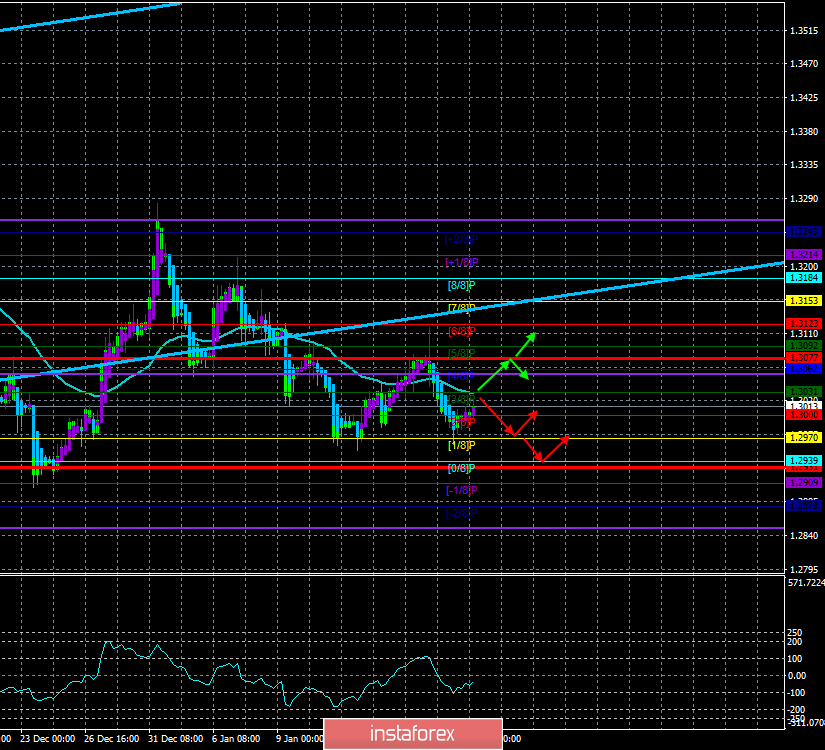

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - sideways.

The moving average (20; smoothed) - down.

CCI: -42.1766

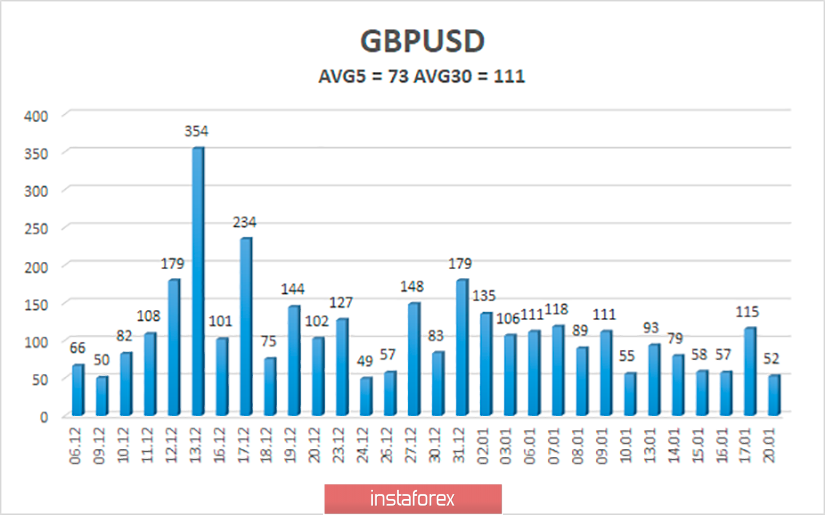

The GBP/USD currency pair also began to adjust in trading on Wednesday, and its volatility decreased to a rather weak value - 73 points per day. Moreover, traders at the third attempt failed to overcome the Murray level of "1/8" - 1.2970, which casts doubt on the further fall in the pound's quotes. Although from a fundamental point of view, it is the British currency that should continue to fall. At the moment, nothing terrible has happened yet. The initiative remains in the hands of the bears, the correction has just begun. Traders can now only wait for the completion of this correction, as well as a significant day for the whole of the UK - January 31, when Brexit officially begins, and the country will go into a "transition period". It is difficult to say what will happen after January 31. In principle, all top UK officials regularly reassure the country's population and its business, assuring that the country has prepared for life outside the EU, while at the same time stating that certain changes for the worse will certainly also occur, but in the end, in a few years, the country will prosper, respectively, the current losses will be justified. However, for Forex currency traders, the prospect for several years ahead is not very interesting. Market participants are interested in current statistics and open deals based on them. We believe that macroeconomic statistics in Albion will continue to deteriorate. The Bank of England will reduce the key rate soon, which will further worsen the position of the British currency. On the other hand, there is nothing else to do.

Today, there will be several important publications in the UK. First, we will know the change in the average salary for November. This figure is expected to increase by 3.1% if the premium option is considered, and by 3.4% if the non-premium option is considered. Also, the unemployment rate for November (forecast – 3.8%) will be published, as well as the number of applications for unemployment benefits for December with a forecast of 24.5 thousand. What can we say about these indicators? The unemployment rate is unlikely to cause any reaction, wages and unemployment claims may differ from the forecast values. Despite the overall negative macroeconomic background from Britain, it is wages that have shown strong growth since July 2017. In July 2017, an increase of 1.8% was recorded, and in September 2019 - 4%. Now the growth rate has slowed down a bit, but it is unlikely to fall too much in December. In general, statistics in the UK today are secondary but can cause serious movements. The question is, will it support the British currency?

Meanwhile, according to Prime Minister Boris Johnson, the UK's migration system will become more equal after Brexit. Under the new system, all people will be treated the same regardless of where they come from. At the moment, special privileges are enjoyed by EU citizens who can live and work in Britain without a visa; citizens of other countries are required to meet several criteria to be able to stay long-term in the Kingdom. Also, many British companies first consider applications from EU residents, and only then from residents of other countries. Under the new system, all candidates without exception will be awarded points for professional and personal qualities. "Thanks to the new system, we will be able to attract the best personnel from all over the world, wherever these people live," Johnson said.

The technical picture of the pound-dollar pair now implies a continuation of the correction. Thus, traders should wait for the Heiken Ashi indicator to turn down. We still believe that the bulls are extremely weak, so we should not expect a strong strengthening of the pound.

The average volatility of the pound-dollar pair over the past 5 days is 73 points and is declining again. According to the current level of volatility, the working channel on January 21 is limited to the levels of 1.2931 and 1.3077, and we believe that the pair will again strive for the lower border of this channel. The reversal of the Heiken Ashi indicator will indicate the completion of the correction movement.

Nearest support levels:

S1 - 1.3000

S2 - 1.2970

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3031

R2 - 1.3062

R3 - 1.3092

Trading recommendations:

The GBP/USD pair is being adjusted. Thus, traders are advised to sell the pound again with the goals of 1.2970 and 1.2939 after the Heiken Ashi turns down and when the price is located below the moving average. It is not recommended to buy the British currency now, as the pair is located below the moving average, and the bulls remain extremely weak.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.