Economic calendar (London time)

Although there are very few important events in it, today's economic calendar is slightly more active than yesterday's. The following indicators can be noted:

10:30 change in the number of applications for unemployment benefits + average wage (UK);

11:00 index of economic sentiment in Germany.

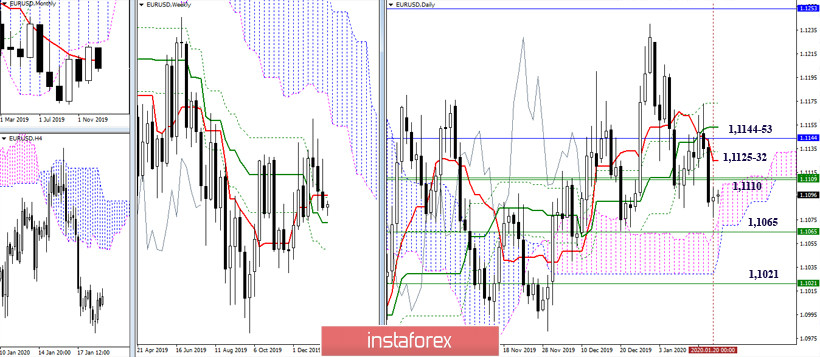

EUR / USD:

Euro updated its lows, but could not close the day below the previous weekly highs. We are observing another inhibition, as targets have not changed. Bearish interests are still focused on testing the boundaries of the daily cloud, overcoming the weekly medium-term trend (1.1065), and eliminating the weekly dead cross (1.1021). The path for the development of a new upward correction at this point will be blocked by the following resistances: 1.1110 (weekly Tenkan + Fibo Kijun) - 1.1125-32 (daily Tenkan + Fibo Kijun) – 1.1144-53 (monthly Tenkan + daily Kijun).

Players performing in the current rise on H1 have already managed to achieve some results. They've secured the support of most of the analyzed technical indicators, and managed to gain a foothold above the Central Pivot level of the day at 1.1091. The next stage in the development of bullish sentiment and advantages is the weekly long-term trend (1,1123). The rise and consolidation above (1,1123) will allow us to consider new upward benchmarks, while the reversal of the moving average may significantly affect the further balance of forces. If the Central Pivot level (1.1091) loses support and the low is updated, the classic Pivot levels S2 (1.1066) and S3 (1.1055) can provide support within the day.

GBP / USD:

A rebound from the daily short-term trend is not yet possible. Yesterday, the pair failed to update last week's lows (1.2953) and indicated a slowdown. The nearest significant resistances are now joining forces in the area of 1.3030-38 (daily Tenkan + Senkou span A). If the players aiming on the rise manages to get hold of the daily short-term, the situation may development in favor of the bears. Further lifting and new testing of the resistance zone 1.3171 – 1.3209, which combine many important levels on the senior halves, will significantly affect the current balance of forces.

Recently, there has been some uncertainty on the market, as the pair easily changes its location relative to key levels. The current situation at the smaller time interval also has the character of uncertainty. The bears have already lost the Central Pivot level of the day (1.2993), and the bulls have not yet captured the weekly long-term trend (1.3025). Further strengthening of bullish sentiment today is possible if the resistance of the classic Pivot levels R2 (1.3045) and R3 (1.3077) are overcome within the day. If the bearish activity returns, the support values will be S1 (1.2973) – S2 (1.2941) – S3 (1.2921).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)