4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) – down.

CCI: -72.9885

Today, January 22, the EUR/USD currency pair starts in a downward movement. Yesterday, the euro-dollar pair managed to adjust to the moving average line, however, the bulls did not have enough strength to gain a foothold above it. Thus, the downward movement was resumed and the quotes fell to the Murray level of "3/8" - 1.1078. In general, we expect the downward movement to continue, since both the fundamental background and the macroeconomic background remain on the side of the US currency. Technical indicators point to a downward trend, so it is more preferable now. The volatility of the pair remains extremely low.

In macroeconomic terms, Wednesday will be a very boring and uninteresting day. No important publications are planned for today, either in the States or in the European Union. Thus, it is not necessary to count on the fact that volatility will increase. It is unlikely that any of the traders will be seriously interested in information about the index of national activity of the Federal Bank of Chicago or the index of housing prices in America. Thus, today, most likely, we will witness boring and sluggish trading. On the other hand, the results of the ECB meeting will be announced tomorrow, during which it may announce structural changes in the organization of the regulator's work, its goals for the coming years, as well as changes in the parameters and goals of monetary policy. According to most experts, the probability of lowering the key rate tomorrow is zero. No one expects it to change. Thus, the main event of the day will be the speech of Christine Lagarde, who will have to cover the changes in the ECB, if any decision is made on them during the meeting itself. It is expected that the meeting of the European Central Bank will be devoted to inflation. Recall that the Central Bank continues to be aimed at 2% inflation, however, this goal has not been achieved over the past 7-8 years. Thus, one of the decisions taken at the meeting may be to reduce the target inflation rate. It is with inflation that European economists associate the well-being of the eurozone and stable economic growth, and it is with inflation that they cannot cope. Just recently, in October 2019, we saw an inflation rate of 0.7% y/y, which could force the ECB to go for a new easing of monetary policy. However, in the next two months, the consumer price index still accelerated to 1.3% y/y, so at the meeting today, no one expects a reduction in key rates. Along with inflation, the producer price index shows weak values, as well as business activity in the manufacturing sector and the indicator of industrial production itself. The ECB attributes the fall in macroeconomic indicators to trade tensions in the world over the past year and a half. On the one hand, now China and the United States are on the path to reconciliation, on the other hand, most of the duties on Chinese imports to the United States are still in effect, which means it is still very early to talk about the end of the conflict. The quantitative easing program is also likely to remain unchanged at 20 billion euros per month. The ECB's balance sheet is expected to swell at this rate to 6 trillion euros by 2025.

Based on all of the above, we can assume that most traders are now in the waiting stage. Waiting for the results of the ECB meeting. If so, then you should not expect any serious movements of the pair today. From a technical point of view, a new round of corrective movement may begin on January 22, especially if an attempt to gain a foothold below the Murray level of "3/8" is unsuccessful. The lower channel of linear regression turned downwards, which indicates a change in the medium-term trend to a downward one.

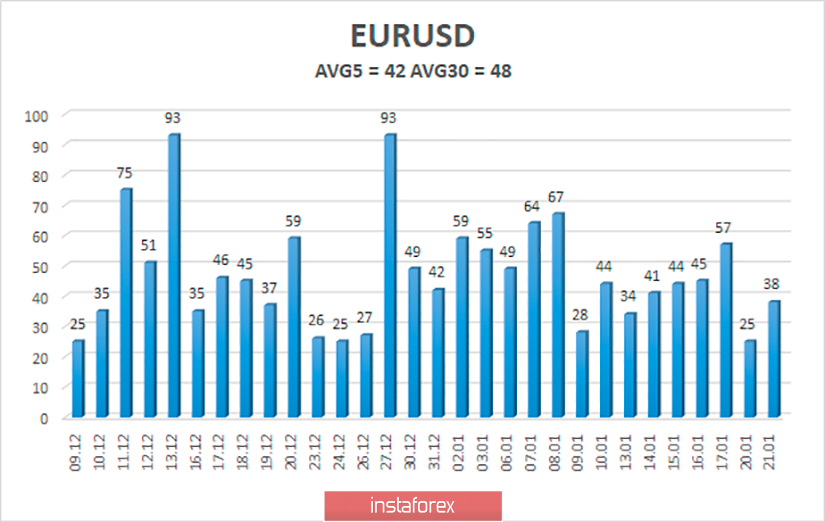

The average volatility of the euro-dollar currency pair is currently 42 points and is declining again. Thus, we have volatility levels of 1.1040 and 1.1124 as of January 22. A reversal of the Heiken Ashi indicator to the top will indicate a new round of corrective movement. Given the almost zero macroeconomic background, it is unlikely that the pair will work out any of the boundaries of the volatility channel today.

Nearest support levels:

S1 - 1.1078

S2 - 1.1047

S3 - 1.1017

Nearest resistance levels:

R1 - 1.1139

R2 - 1.1169

R3 - 1.1200

Trading recommendations:

The euro-dollar pair resumed its downward movement. Thus, sales of the European currency with the goal of 1.1047 are relevant now, if the bears manage to overcome the level of 1.1078, otherwise - a new correction. It is recommended to return to buying the EUR/USD pair with the goal of 1.1139 not before fixing the price above the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.