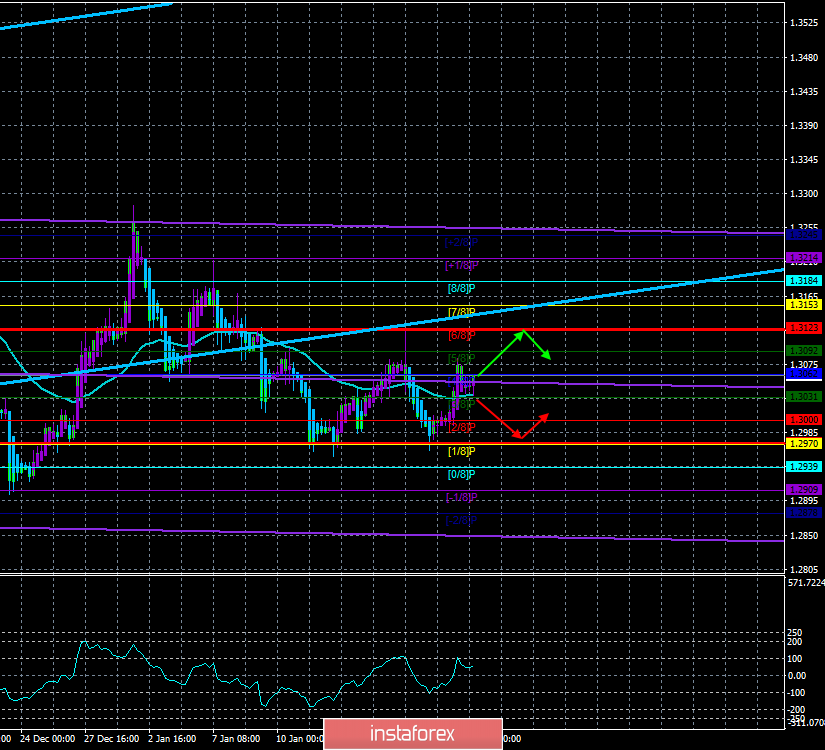

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - sideways.

The moving average (20; smoothed) - sideways.

CCI: 59.5524

The GBP/USD currency pair started a new round of corrective movement yesterday and settled back above the moving average. Thus, formally, the trend has now changed to an upward one, however, we would not recommend considering long positions, since the whole movement is like a flat. And it does not look like an upward trend in which it would be appropriate to buy the pound. Even today, the pair's quotes can be fixed back below the moving average line. The fundamental background remains on the side of the US dollar since almost any news or report in the UK has a "black" color. Macroeconomic statistics this week gave a little optimism to traders, however, we have already said that the main indicators of the state of the British economy remain in a deplorable state. Positive reports on wages and unemployment will not be enough to radically change the mood of market participants.

The closer the date of Brexit, the more this topic grows with new rumors and new information. For example, as recently as the day before yesterday, British Finance Minister Sajid Javid said that after the UK leaves the EU, no agreements will remain, so entrepreneurs and ordinary citizens of the country need to learn to live outside the EU. It was these words that caused concern in the European Commission, which does not quite agree with the wording about the lack of agreements after Brexit. Brussels reminds London that, despite Brexit, the UK will have to continue to adhere to environmental, social and competitive norms, otherwise the country will be subject to sanctions and fines, and all benefits may be suspended. The European Commission also said that the agreement reached earlier (probably referring to the agreement with Boris Johnson on Brexit) should be respected and fulfilled.

The closer Brexit and the end of the "transition period", the more it seems that Boris Johnson wants to withdraw the country from the Alliance without any agreements. All the Prime Minister's statements about the upcoming negotiations with Brussels reflect his not too strong desire to sign any agreements. Johnson wants to act in the style of Trump and sign a deal that will completely suit Britain. However, the EU is not China, and Britain is not the States. We believe that trade negotiations with Brussels may not just be difficult, but may well fail. Since Boris Johnson also refused to extend the duration of the "transition period", the chances of such a scenario increase even more. In any case, the British chose the Prime Minister themselves and put all the power in the country into his hands. We can only watch the British version of Donald Trump. There is an opinion that in 2020 a lot of news and events will be connected with the UK and with the name of Boris Johnson.

The British pound seems to be waiting for something in recent weeks. We can't say that volatility has fallen to minimum values, however, there is no pronounced trend movement now. For some reason, bears that have fundamental and macroeconomic support at their disposal have no desire to sell the pound-dollar pair below $1.30. Therefore, by and large, we can only wait for the market to stir up and the movements will be again such that it will be possible to work out. There are no major publications scheduled for today in the UK. Next week, the Bank of England will hold a meeting at which it may be announced that the key rate will be lowered. Perhaps this is the event that market participants are waiting for.

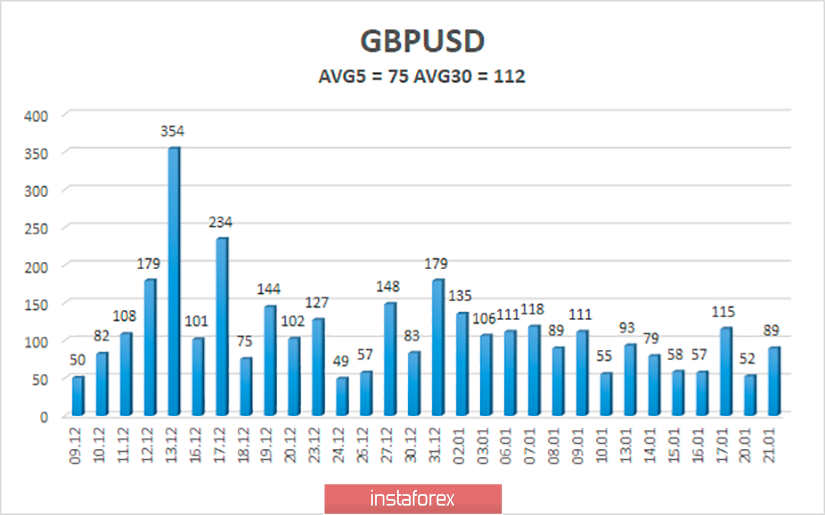

The average volatility of the pound-dollar pair over the past 5 days is 75 points and tends to decrease. According to the current volatility level, the working channel as of January 22 is limited to the levels of 1.2971 and 1.3122. Given the absence of a trend, any channel boundary can be worked out today. A downward reversal of the Heiken Ashi indicator will indicate a new round of downward movement.

Nearest support levels:

S1 - 1.3031

S2 - 1.3000

S3 - 1.2970

Nearest resistance levels:

R1 - 1.3062

R2 - 1.3092

R3 - 1.3123

Trading recommendations:

The GBP/USD pair is adjusted again. Thus, traders are advised to sell the pound again with the goals of 1.2970 and 1.2939 after the Heiken Ashi turns down and when the price is located below the moving average. It is not recommended to buy the British currency now, as the bulls remain extremely weak.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.