What is happening on the market quite often reminds me of the behavior of a windy girl who still cannot decide what exactly she wants. For this reason, as well as rushing from side to side. So I think that either the market simply ignores macroeconomic statistics, or it reacts as if it is breaking into hysteria. Apparently, if you just come across a familiar word, which does not often happen with macroeconomic statistics, market participants begin to fuss and get excited.

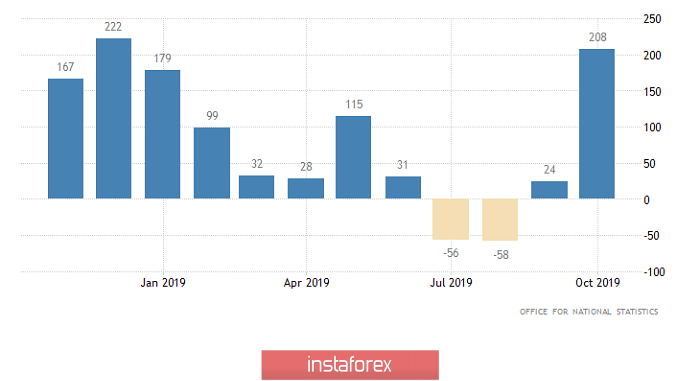

Such a word as unemployment is familiar to everyone without exception, so it is not surprising that the market reacted vigorously to labor market data in the UK. Moreover, there was something to be excited about. Of course, the unemployment rate itself, as well as the growth rate of average wages, taking into account premiums, remained unchanged. What can I say, even the number of applications for unemployment benefits remained exactly the same. And in theory, market participants should have remained indifferent to all this boring data. However, they were driven frantically by data on employment, which grew by 208 thousand, which is exactly twice as much as even the most optimistic forecasts. And it so pleased all those involved that they simply did not pay attention to the slowdown in the average wage growth rate from 3.5% to 3.4%, but without taking into account overtime. Here, however, it should be noted that these data turned out to be better than forecasts, since they expected a slowdown to 3.3%. So the growth of the pound is quite justified. Moreover, such data on the labor market led some nervous people to such a frenzy of excitement that they almost became crazy and pester passers-by, convincing them that the Bank of England has now no reason to lower the refinancing rate. But poor fellow, the Bank of England has long explained to everyone that reduction is necessary to smooth out the negative effects that will be caused by Brexit. And then rumors spread again that Brexit would still take place without a deal. Therefore, even if the UK unemployment rate would fall to 0.0%, this still does not cancel out what will happen after Brexit.

Employment Change (UK):

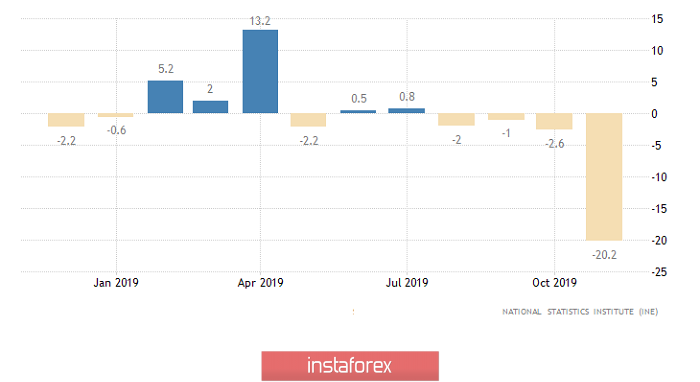

At the same time, the positive nature of labor market data in the UK made such a strong impression that even a single European currency began to increase. However, it is not so active and with the subsequent return exactly to the place from where it began its ascent. In addition, there is no doubt that the single European currency grew solely against the background of labor market data in the UK, as it happened in sync with the pound. At the same time, the single European currency had no reason to grow at all, which is why it ultimately could not consolidate its successes. Yes, you can, of course, poke your finger in the direction of the ZEW economic sentiment index, which has grown from 11.2 to 25.6 points. But as mentioned above, market participants get excited only at the sight of words familiar to them. The index of economic expectations does not apply to them, not even all specialists fully understand what really lies beneath this formulation. So, what can we say about ordinary traders? Still, production orders are a more understandable and tangible thing. Even if we are talking about Spain, which is only the fourth economy of the euro area. So, these same production orders decreased by 20.2%, which suggests that the growth prospects of European industry, which is going through hard times, looks extremely doubtful. Moreover, production orders in Spain have been declining for the fourth month in a row. As a result, it is clearly visible that the single European currency simply had no reason for growth. It was pushed up only by emotions, but they are not able to change reality.

Production Orders (Spain):

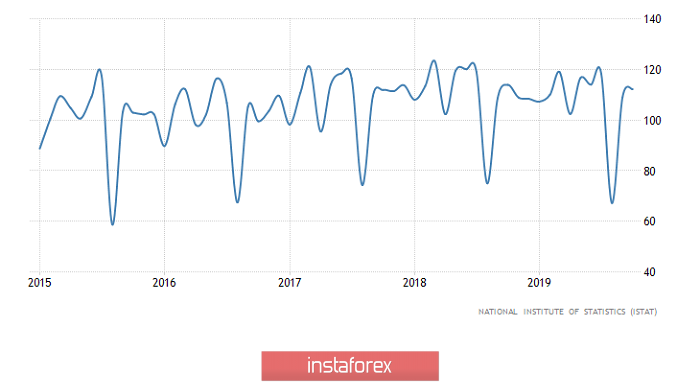

Today, production orders are published in Italy, and they are unlikely to be able to change the pessimistic attitude regarding the prospects of European industry. If you look in monthly terms, then orders should show a zero change. But in annual terms, the pace of their decline, and this is precisely the decline should accelerate from -1.5% to -2.4%, but this is already a question of the third eurozone economy. Thus, there is something to think about and be sad. But as yesterday, this data alone will not be able to cause any changes in the single European currency.

Production Orders (Italy):

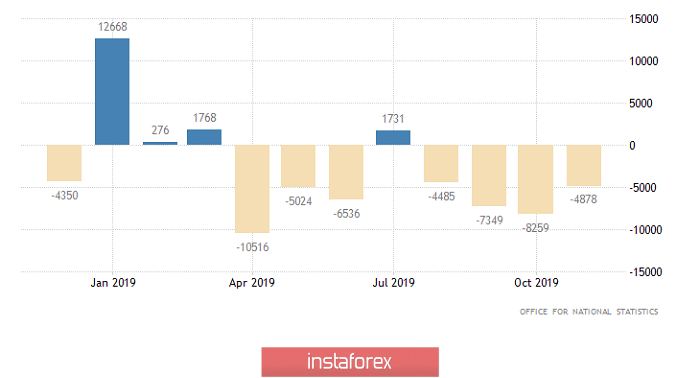

Meanwhile, the pound will quite possibly even try to make another growth attempt, although not as strong as yesterday. The fact is that in the UK the volume of government borrowing should be reduced by 4.6 billion pounds. Moreover, the public debt of the United Kingdom has already been decreasing for four months in a row, having decreased by 25.0 billion pounds during this time. Reducing the debt burden on the state, against the backdrop of the impending Brexit, with a little predictable result for the UK economy, is without a doubt a positive factor. However, the size of public debt is already so large that its overall reduction in principle does not fundamentally change the picture.

Net public sector borrowing (UK):

At the same time, the pound will most likely have to repeat the focus shown yesterday by the single European currency. It is a complete loss of all their gains. The fact is that they expect growth of 0.3% in housing prices in the United States. Moreover, housing sales in the secondary market should increase by 1.3%. That is, we can get sales growth in combination with price increases. Well, this, whatever one may say, is an exclusively positive factor. So, one should not be surprised at the confident strengthening of the dollar already in the late afternoon.

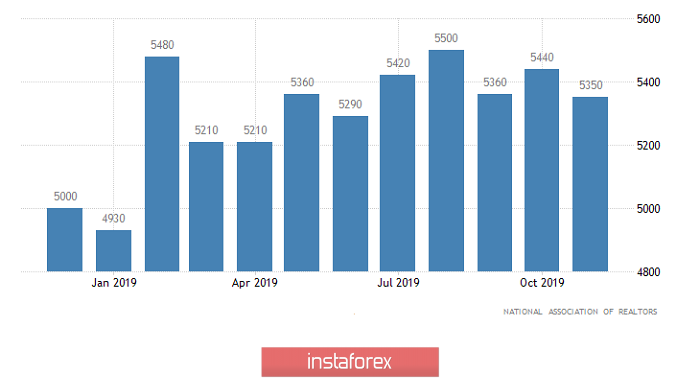

Secondary Home Sales (United States):

The single European currency may most likely decline to the level of 1.1050 at the end of the day. But most likely, it will stop slightly above this level.

For the pound, we should expect a return to around 1.3000.