After a rough start due to the conflict in the Middle East, gold calmed down and recovered. The precious metal quotes have chosen the consolidation range of $1545-1570 per ounce, and investors are weighing all the pros and cons of restoring the bullish trend. The external background for XAU/USD buyers remains favorable: despite the signing of a trade agreement between Washington and Beijing, tariffs on $360 billion of Chinese imports remain in force, Britain has not yet left the EU, and Donald Trump is dissatisfied with a significant deficit in American foreign trade and threatens Brussels with higher duties on car deliveries from the Old World. However, the "bears" for gold are not born yesterday.

The combination of a strong economy and the US dollar, as well as stock indexes that feel comfortable near historical highs, do not allow the "bulls" to seriously count on the return of the initiative. This requires adjustments to the S&P 500 and the USD index, including those caused by a slowdown in US GDP. Many gold fans believe this. No matter how much Donald Trump praises the US economy at the world economic forum in Davos, they ask provocative questions: if everything is good, why is the Fed lowering rates? Why does the Central Bank launch QE and claim that it is not a quantitative easing program? Because it is about buying bonds?

In my opinion, Jerome Powell's persistent reluctance to link the Fed's balance sheet expansion to QE is due to concerns about increased market turbulence due to the exit from the program. In the end, the balance will have to be brought back to normal, and as history shows, hints of curtailing the quantitative easing program unnerve investors.

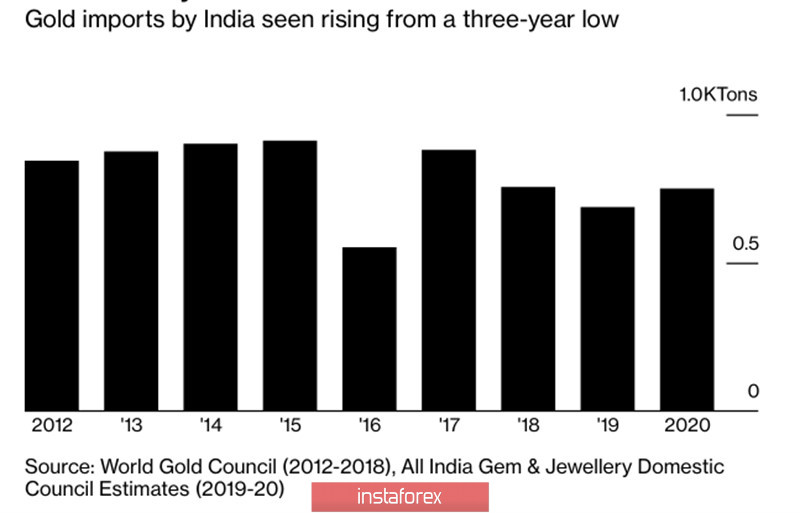

Information about China's first reduction in gold consumption over the past three years and the drop in Indian imports of precious metals to a 3-year low is twofold. There is a logical explanation for this dynamic: in the conditions of a slowing economy and rising prices, it makes sense to expect a reduction in gold consumption. According to the All India Jewelry Council, imports will increase from 690 tons to 750 tons in 2020.

Dynamics of Indian gold imports

In my opinion, the decline in demand for the precious metal from the largest consumers is the result of the XAU/USD rally, and not the reason. If the welfare of the population under the influence, including trade wars, decreases, and prices rise, interest in purchases fades.

According to the OECD, the World Bank and the IMF, the world economy will recover very slowly in 2020. At first glance, this is good news for gold, but in fact, everything will depend on the US. If the US GDP continues to please, the USD index will resume its rally, which will adversely affect the positions of the precious metal.

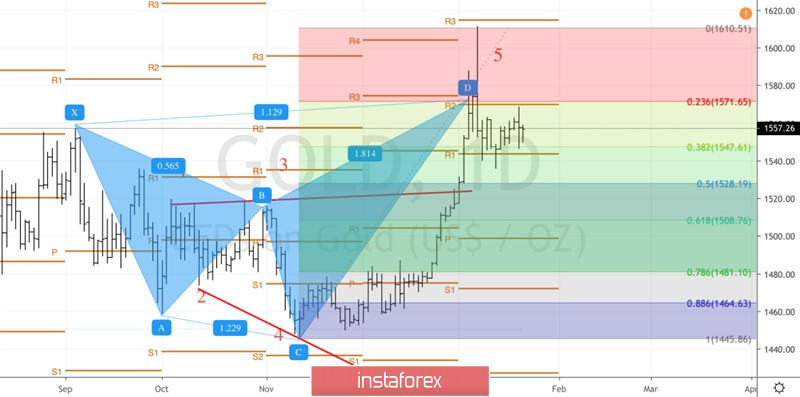

Technically, the daily gold chart shows the formation of the "surge and shelf" pattern. A breakthrough of the upper limit of the consolidation range ("shelf") of $1545-1570 per ounce will create prerequisites for the recovery of the upward trend. On the contrary, a successful storm of support at $1545 will increase the risks of developing a corrective movement in the direction of $1525 and $1505.

Gold, the daily chart