Economic calendar (Universal time)

The focus of today's economic calendar is on news and decisions from the ECB (12:45 and 13:30). In addition, the publication of data on crude oil reserves in the USA (16:00) may be of value.

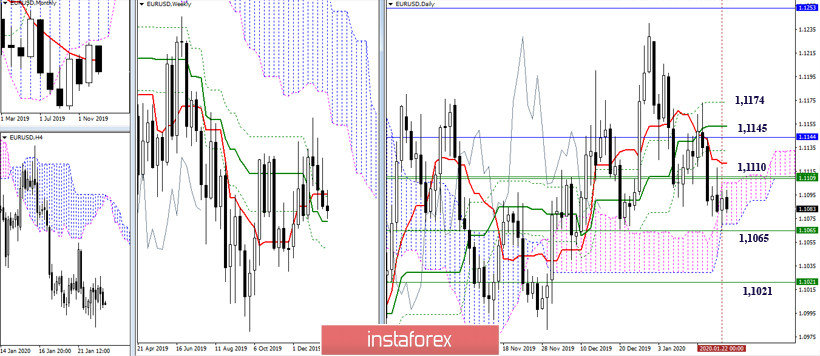

EUR / USD

The pair descended into the area of influence of the weekly medium-term trend (1.1065), which is now strengthening the support for the daily cloud, and slowed down. The uncertainty in this situation is caused by the presence in the daily cloud and the horizontal location of the weekly cross levels (1.1111 + 1.1065), within the borders of which, the euro has been working for the last few days. It is now quite difficult to quickly radically change the situation in favor of players to increase, since the strengthening of 1.1110 (weekly levels + the upper border of the daily cloud) follows a fairly wide resistance zone of the daily dead cross, which combined its efforts with the monthly short-term trend (1.1145) At the same time, the players' downside goals remain the same - exit from the daytime cloud and consolidate in the bearish zone,

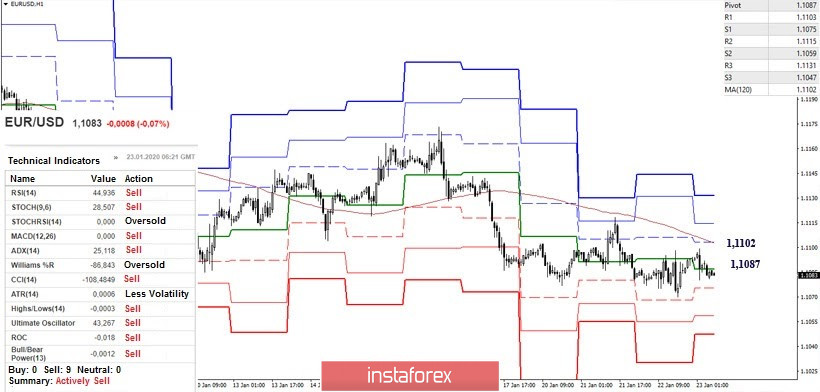

Players on the upside fight for the central Pivot level of the day (1.1087) again, then their interest will be focused on breaking through the weekly long-term trend (1.1102). Now, consolidation above can change the current balance, which is now on H1 on the side of the bears. The next resistance within the day today is 1.1115 (R2) and 1.1131 (R3). Another failure in this direction and updating the minimum (1.1070) will return the prospects for further decline. In this case, 1.1059 (S2) and 1.1047 (S3) will serve as downward benchmarks within the day.

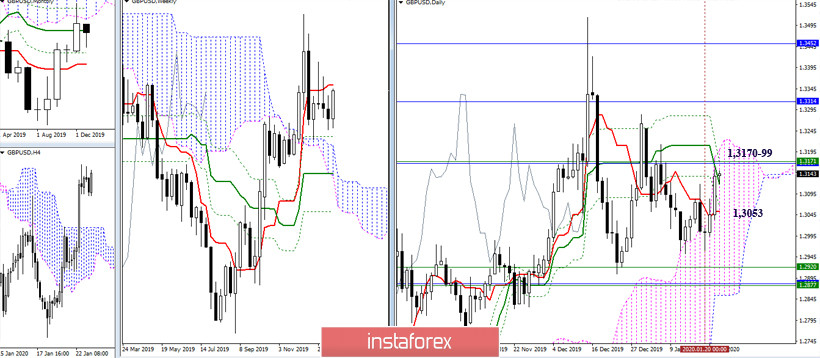

GBP / USD

Players on the upside managed to turn the next breaking into a productive upward correction. Thanks to this, they reached the daily medium-term trend, strengthened in the area of 1.3170 levels of upper halves (weekly Tenkan + monthly Kijun). The current task of developing and strengthening bullish sentiment is to overcome the resistance met, with further movement beyond the daily cloud (1.3199), and the daily dead cross will be eliminated. The nearest support is located today at 1.3053 (daily Tenkan).

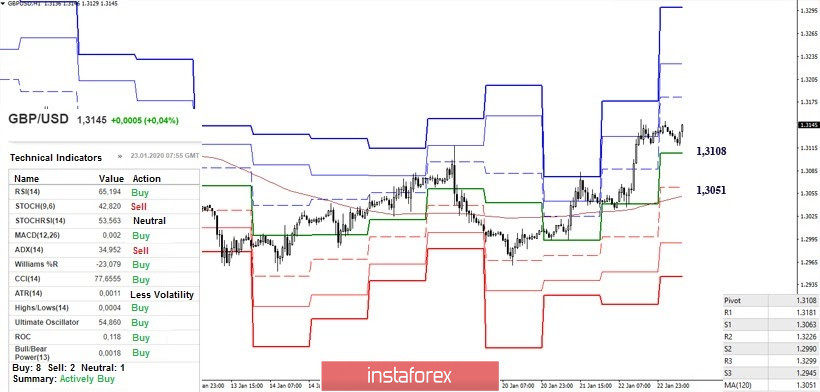

On H1, the advantage belong entirely to the players to the upside. On the other hand, Boeing is in the correction zone slightly weakens the bullish position at the moment. Leaving the correction zone (1.3152) will allow us to continue the increase, the reference points of which within the day in this situation are the resistance of the classic Pivot levels (1.3181 - 1.3226 - 1.3299). The first important support for the development of the downward correction is the central Pivot level, which is located at (1.3108) today, then the interests of the players to decline will be directed to the weekly long-term trend (1.3052).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)