What happened with the pound yesterday is a real holiday. It's rapid rise was so sudden that it had a hypnotic effect at first. Market participants could not take their eyes off the vertical line aimed somewhere in the direction of the stratosphere. At the same time, the take-off speed clearly indicated the intention to reach the first space speed. The spell, however, gradually relaxed, and most of the speculators immediately began to ask stupid questions about what exactly happened to the pound. As you can easily guess, objective and balanced responses were received immediately, but it had to be corrected and adjusted, that its meaning changed beyond recognition.

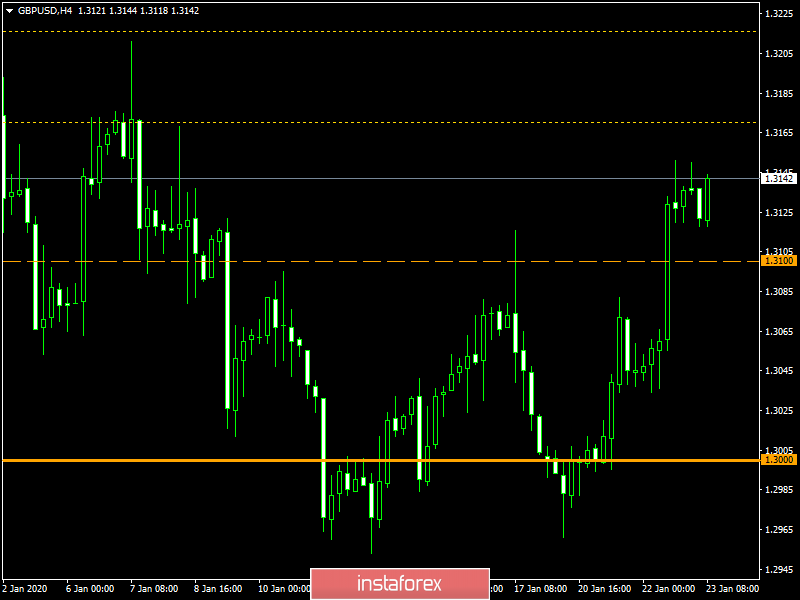

Naturally, everyone rushed to look at the British statistics first. However, the trouble is that data on government borrowing, which decreased by 4.0 billion pounds, was published an hour and a half before the pound flew into the upper atmosphere. At the same time, the net government borrowing did not just decrease, but has been declining for five months in a row, and its total amount of decline during this time is at almost 29.0 billion pounds. This did not impress anyone at all. What turned out though is that at the exact same time that the pound went up like a rocket, the CBI published its indices, and everyone immediately started shouting that it was all about them. The proof was instantly found in the form of the business optimism index, which rose from -44 to 23 points. Meanwhile, everyone somehow easily dismissed the index of industrial orders, which grew from -28 points to -22 points. What they focused on is that there is a fantastic increase in the business optimism index. I want to ask just one stupid question though. Can anyone, until yesterday, remember mentioning the CBI business optimism index in the context of its impact on the pound? After all, if it was the reason why such a holiday happened, then we should contemplate such a thing once a month. No one can remember anything like this though, so explaining the growth of the pound with an index that no one knows anything about is a classic example of pulling an owl on the globe. If the real financial situation of the state pales against the background of some kind of optimism of some entrepreneurs, then put out the light. If it turns out that the economy depends on the emotional mood of businessmen, then it is easier to close such an economy and forget about it as a nightmare.

Net government borrowing (UK):

So what really caused the pound to rise so suddenly? Practice shows that in a market squeezed in a narrow range, any indexes, even most macroeconomic indicators, can not breathe new life into the market. What they are capable of is a reversal in the central banks' policy. And so, on Tuesday, all forecasts said that at the end of the next board meeting of the Bank of England, the refinancing rate will be reduced from 0.75% to 0.50%. However, yesterday, forecasts were revised, and now, the reduction in the refinancing rate of the Bank of England is postponed until the third quarter. These forecasts were largely based on the value of interest rate futures.

In other words, what happened is at first, everyone was preparing to reduce the refinancing rate. However, we were told that we can relax, as the decision on the issue is postponed. As a result, everyone relaxed and happily began to buy the pound. That's the whole story. But most importantly, the upcoming board meeting of the Bank of England has lost all its intrigue.

The rate of refinancing (United Kingdom):

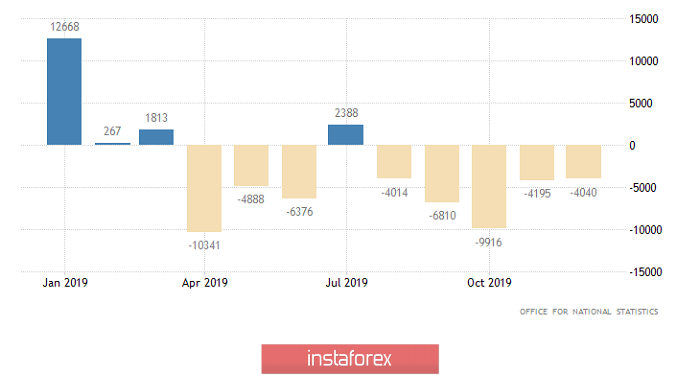

Pound's growth was only stopped by excellent statistics on the real estate market in the United States. First, it became known that real estate prices for the month increased by 0.2%. However, this did not impress anyone much, since the data coincided with the forecasts. Meanwhile, the same cannot be said for home sales in the secondary market, as it should have increased by 1.3%, but instead increased by 3.6% from 5.35 million to 5.54 million. This clearly demonstrates that the optimism of individual businessmen is a good thing, however, the reality is still more tangible.

Home sales in the secondary market (United States):

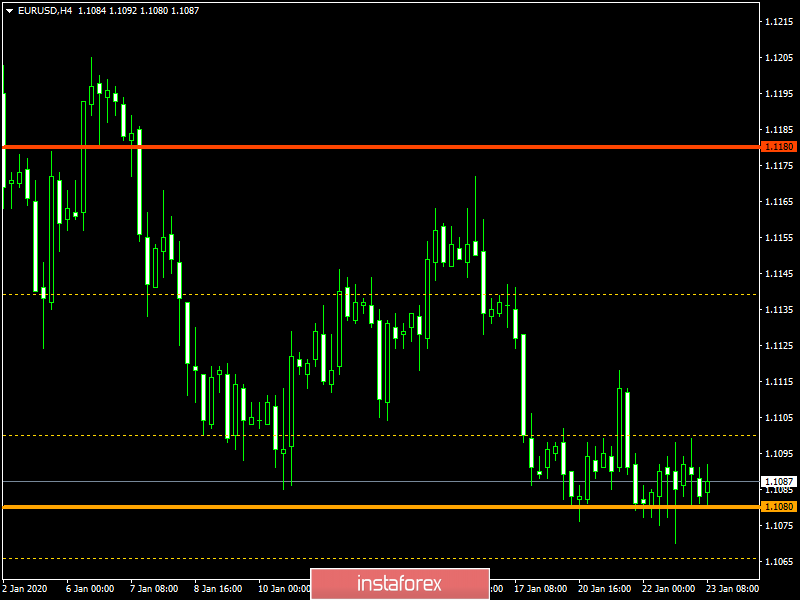

If the upcoming board meeting of the Bank of England is no longer of any interest to investors, then today's meeting of the Board of the European Central Bank is the most intriguing event of the month. It's worth mentioning right away that based on the results of this meeting, no practical changes are expected in the current monetary policy. The topic that is anticipated is the ECB's plans in the near future. In addition, adding to the intrigue is the fact that Christine Lagarde forbade ECB representatives from making any statements regarding the regulator's monetary policy. Such actions only make sense if Christine Lagarde is intending to make a loud statement today. In fact, at the moment, the European Central Bank continues to pursue an ultra-soft monetary policy that implies a gradual reduction in the interest rates. This policy has been implemented for almost a whole decade, and if nothing is changed, the next step will be to reduce the refinancing rate to negative values. The goal of this policy is very simple: to stimulate economic growth. However, if you look closely at this very economic dynamics in Europe, what seems to be the one being achieved is the opposite result. Why set a full radio silence mode? Is it to announce the beginning of normalization of monetary policy? We are waiting for an incredibly interesting press conference by Christine Lagarde. There, she will either confirm her commitment to the current exchange rate, or announce that the European Central Bank will gradually tighten the parameters of monetary policy in the near future. If everything remains the same, the single European currency will continue its dismal downward movement. On the other hand, if we hear about a change on political course, euro may arrange a performance that will make pound's performance yesterday a child's amateur one.

The rate of refinancing (Europe):

Christine Lagarde's press conference will begin at the same time that data on applications for unemployment benefits in the United States will be published. Because og this, no one will pay attention to them, especially since there is nothing to look at, as the overall balance should remain unchanged. The number of initial applications for unemployment benefits should increase by 8 thousand, while the number of repeated applications will be reduced by exactly this amount.

Number of repeated applications for unemployment benefits (United States):

Having an extremely low amplitude of oscillation, the EUR/USD currency pair is still concentrated within the range of 1.1080. In fact, the past days have formed a variable range from 1.1070 to 1.1100, where there is a distinct indecision for action. The range boundaries will likely play a role in the market, but not for long. As soon as there is a characteristic noise, a surge will break through the framework. If this happens, it is better to take a wait-and-see position outside the market. After clearing the circumstances, work on the course of the residual impulse.

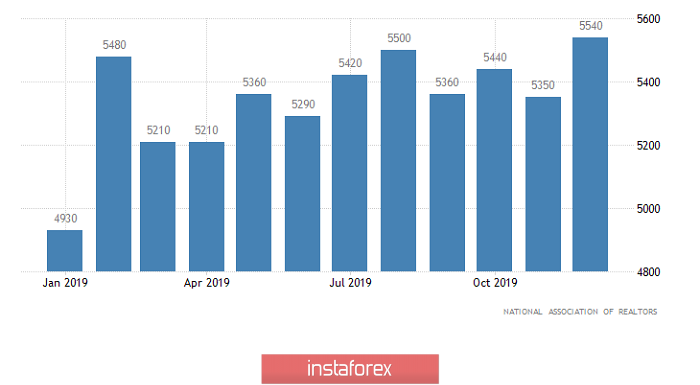

The GBP/USD currency pair showed activity, and formed an impulse candle towards the 1.3150 mark. There are odd that the local overbought will temporarily restrain the ardor of buyers, and form a slowdown in the range of 1.3115/1.3150. If that happens, it is worth to look at the price fixing points, as well as the dynamics of the EUR/USD pair.