Hello!

The trade war between the US and China is yielding its "fruits". Since 2009, world trade has declined by 0.5%, and it seems that this is far from the limit.

Compared to 2018, the trade turnover between the United States of America and the people's Republic of China fell by about 90 billion US dollars in the eleven months of 2019. This is the main reason for the decline in world trade by half a percent.

Also, the trade war between Washington and Beijing has created many other problems and uncertainties. For example, in the industrial processing sector - a significant increase in tariffs last year could lead to additional barriers, and this could become another serious problem for the global economy.

Now let's move on to the current situation for the main currency pair euro-dollar. Yesterday's data from the US on home sales in the secondary market was stronger than the forecast of 5.43 and amounted to 5.54. Macroeconomic statistics from the euro area were not provided yesterday.

But today, the single European currency has another day. It's a busy and very important day. The main event for the euro will be the ECB's interest rate decision, which will be published at 13:45 (London time). No changes are expected here. The European Central Bank will most likely not change the parameters of its monetary policy and will keep the main rate at zero.

Much more interesting for market participants will be the press conference of ECB President Christine Lagarde, which is scheduled to start at 14:30 (London time). As a rule, it is based on the tone and rhetoric of the head of the ECB that investors begin to actively sell or buy the single currency.

Weekly reports on initial applications for unemployment benefits from the United States are less important than the ECB's decision on rates and, especially, the press conference of the head of this department. However, in today's EUR/USD trading, data from the US for benefit requests must also be taken into account.

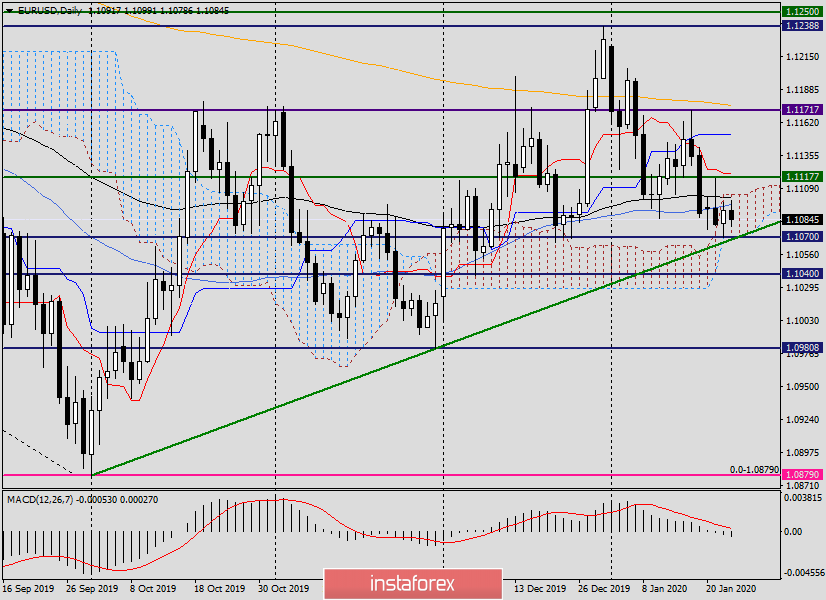

Now let's look at the daily chart of the euro-dollar and try to understand the further direction of the main currency pair of the Forex market.

Daily

As you can see, since January 13, the pair is consolidating in the range from 1.1173 to 1.1070. The fact that the euro bulls managed to overcome the mark of 1.1200 and, most importantly, confidently gain a foothold above this important and strong level indicates a lack of strength and weakness of the players to increase the rate. Most often, after such cases, the pair turns down and shows an active decline. However, in our case, this is not happening yet. Today is a very good day for this. In the case of Christine Lagarde's "dovish" tone, during her press conference and disappointing prospects for the economy of the currency bloc, the euro will come under serious selling pressure and will decline across the entire spectrum of the market.

In the case of a moderate tone or a moderately hawkish one, depending on the nuances of the ECB head's speech, the single currency can demonstrate a strengthening, and quite serious.

So, the main and very important support is at 1.1070. A true breakout of this level will indicate further downward prospects for EUR/USD.

If the nearest resistance of sellers is broken at 1.1103, the road to higher targets in the area of 1.1117 and 1.1152 will open.

On a day like this, when during Lagarde's press conference, volatility will go off the scale and anything can happen. I will not give clear trading recommendations and even more so offer to place pending orders. I believe that extra and not mandatory stops are unnecessary.

Good luck and have a good day!