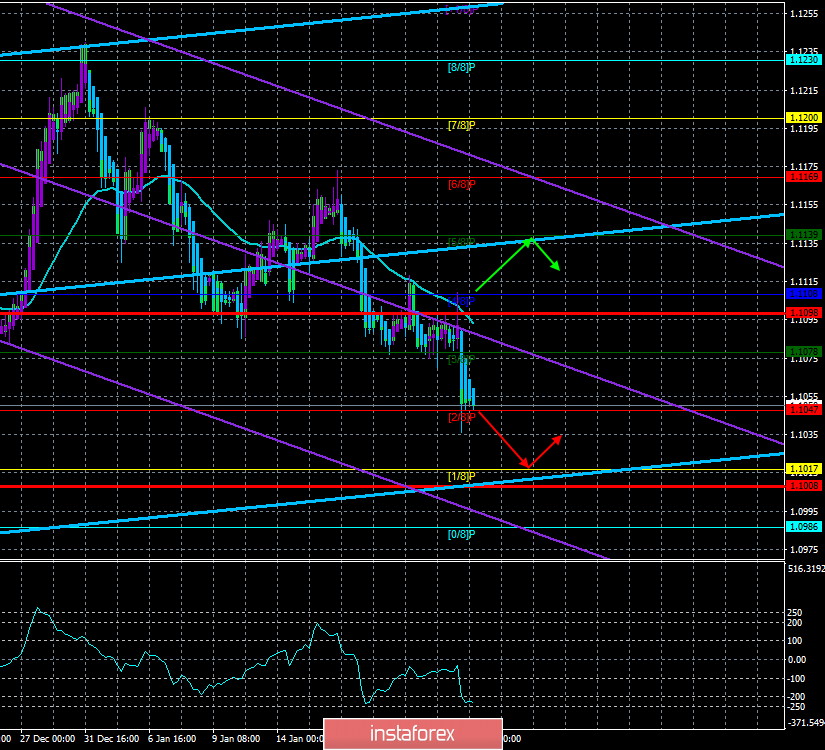

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - down.

CCI: -232.8767

Yesterday, the EUR/USD currency pair ended with a new fall, which we have been waiting for several days. It is probably not even necessary to talk about the reasons for the new decline in the European currency because they are already clear to all market participants. The results of the meeting of the European Central Bank were completely neutral, as the key rates remained unchanged, as well as the quantitative easing program. This is exactly what traders expected from the European regulator. But the performance of Christine Lagarde can be called "dovish", which provoked new and quite strong sales of the euro currency. Thus, at the moment, the quotes of the euro-dollar pair have fallen to the Murray level of "2/8" - 1.1047 and may continue to fall today, January 24, since, at the moment, there is no sign of the beginning of an upward correction. Fundamental and macroeconomic factors remain on the side of the US currency, despite the aggression of Donald Trump in the international arena, despite the Senate's consideration of the case of the impeachment of the American President, and despite the weak indicators of industrial production abroad. Just because things are worse in the EU than in America.

The fact that in Europe everything is much worse than in the States was confirmed by the head of the ECB Christine Lagarde. Of course, first of all, we got inflation, which in the last ten years only twice approached a confident 2% and even then only for a short time (for a few months). So, Ms. Lagarde said that key rates will remain at their levels until inflation starts to show a stable 2% or slightly less. Christine Lagarde likely meant that rates will not be raised until then, and it is unlikely that new monetary policy easing is excluded. Next, it went to industrial production, which we have talked about more than a dozen times, as the most significant indicator of the state of the EU economy. According to the ECB Chairman, industrial production slows down the entire European economy. On the risks to the EU economy, Lagarde said that they remain downward (that is, there are no changes compared to the previous ECB meeting). Lagarde did not forget about geopolitics, which is now expressed by trade wars between the States and their trading partners (if you can say so). Thus, Lagarde identified the "three pillars" on which the state of the EU economy now depends: geopolitics, inflation, and industrial production. And all three pillars" are experiencing obvious problems now. Geopolitics is unlikely to change soon, since, as we have already said, despite the shaky truce between the United States and China, most of the trade duties on Chinese imports remain in force. Moreover, Donald Trump himself said recently at a forum in Davos that he is ready to start a trade war with the European Union, since "the Europeans have used America for their purposes for many years", and now "it is time to trade honestly". We have already said that for the European Union, duties on automotive products will be a blow below the belt. As for industrial production (which may sink even more if Trump imposes duties) and inflation, there are no special signs of recovery of these indicators. Some might say that inflation has accelerated from 0.7% to 1.3% in recent months, but we don't think this acceleration is indicative. All the same, the consumer price index remains at very low values, far from the target. Approximately the same opinion is shared by Lagarde herself, who tried to "brighten up the black tones" and stated that there are certain signs of accelerating inflation, as well as certain signs of stabilization of the economic situation, but market participants did not believe her.

Thus, the euro currency is falling again and falling quite reasonably. Today, the European Union will publish preliminary values of business activity indices in the services and production sectors, and according to experts' forecasts, serious changes for the better should not be expected. First of all, this applies to business activity in the manufacturing sector, which concerns traders most of all. Then, on Friday, January 24, another performance by Christine Lagarde is scheduled. It is unlikely that its rhetoric will change to "hawkish" in a single day, so at best, the ECB head will simply not address monetary policy issues today, without creating additional pressure on the euro currency. In the United States, Markit's business activity indices for services and manufacturing will also be published today. All three indexes (including the composite index) are expected to have values in the range of 52.5-52.9, but we remember that the ISM indexes are more important, where industrial production in recent months has gone under the key level of 50.0. In general, we believe that today the euro currency will be able to count on the support of the market if only business activity in the manufacturing sector will grow significantly. It may not be to the value of 50.0, but at least to 47.5-48.0. Otherwise, you should not expect the euro currency to strengthen. The maximum is an upward correction.

The technical picture now shows readiness to continue the downward movement. If the Murray level of "2/8" is overcome, and the Heiken Ashi indicator does not turn up, then the downward movement will continue today with a high probability.

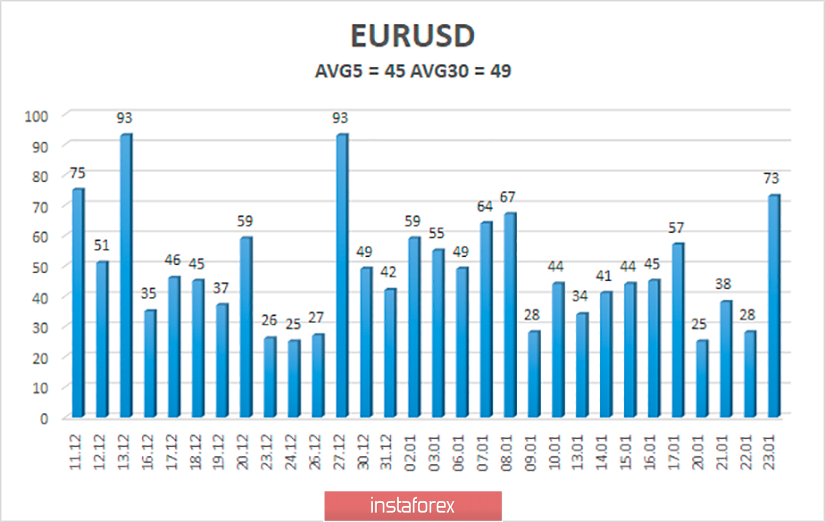

The average volatility of the euro-dollar currency pair is currently 45 points. Thus, we have volatility levels as of January 24 - 1.1008 and 1.1098. A reversal of the Heiken Ashi indicator to the top will indicate a new round of corrective movement. Also, to continue moving down, the euro-dollar pair needs to overcome the Murray level of "2/8" - 1.1047.

Nearest support levels:

S1 - 1.1047

S2 - 1.1017

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1078

R2 - 1.1139

R3 - 1.1169

Trading recommendations:

The euro-dollar pair resumed its downward movement. Thus, sales of the European currency with the goal of 1.1017 (1.1008) are relevant now, if the bears manage to overcome the level of 1.1047, otherwise – a round of correction. It is recommended to return to buying the EUR/USD pair with the goal of 1.1132 no earlier than fixing the price above the moving average line, however, even in this case, it should be remembered that the bulls remain extremely weak, and there are no fundamental factors for the pair's growth.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.