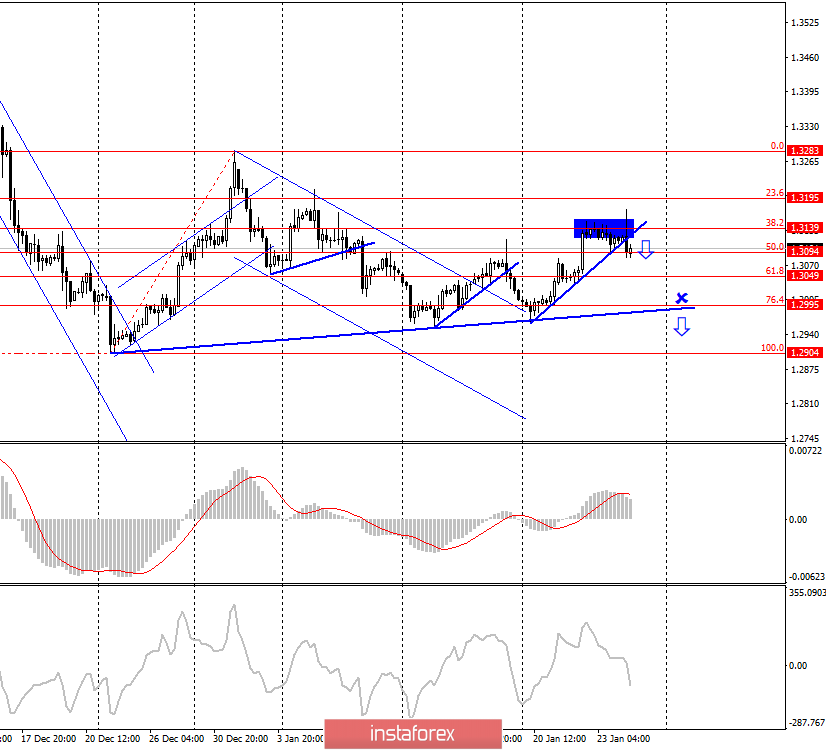

GBP/USD - 4H.

As seen on the 4-hour chart, the GBP/USD pair performed two rebounds from the corrective level of 38.2% (1.3139) at once and a reversal in favor of the US currency with consolidation under the small correction line. Thus, another signal was received for sales of the British with the goal of a global correction line or the Fibo level of 76.4% (1.2995). There are no emerging divergences today. Closing the pair's rate below the global correction line will significantly increase the probability of a further fall in the pound. The information background was favorable to the pound today. The index of business activity in the service sector was better than traders' expectations at 52.9, while the index of business activity in the manufacturing sector was also better at 49.8. However, these economic data did not help the pound, which a few days earlier showed growth without positive statistics. Now I expect the pair's quotes to fall by 100 points down, where I expect the situation to clear up near the global correction line. This is what the graphical indicators are saying now.

Forecast for GBP/USD and trading recommendations:

The trading idea is still in the sales of the pound. Near the level of 1.3139, there was a reversal with a close under the correction line. I recommend traders to sell with the goal of 1.2995, Stop Loss should be taken out for 1.3139.