Hello, dear colleagues!

Another trading week on the Forex currency market has ended. Except for the British pound and the Japanese yen, all other major currencies declined against the US dollar.

Since this article is devoted to the main currency pair euro-dollar, all attention will be focused on this trading instrument. The main blow to the single European currency and the decline in EUR/USD occurred on Thursday, January 23. Let me remind you that on this day, the European Central Bank (ECB) did not make any changes to its monetary policy, leaving interest rates and stimulus measures unchanged. The main interest rate remained at zero.

As for the press conference of ECB President Christine Lagarde, her speech was kept in a moderately soft tone. One of the main goals of the ECB is to achieve inflation just below 2%, however, this task can not be fulfilled, even though Lagarde's predecessor, Mario Draghi, resorted to more aggressive tools to stimulate the economy of the currency bloc.

During her speech, Christine Lagarde said that the ECB will take more careful account of climate risks. Recently, the climate theme has become very popular, one might even say fashionable.

As usual, there were words that in the event of a crisis, the European Central Bank may resort to additional measures of stimulation through monetary policy.

Naturally, market participants immediately reacted to the "dovish" rhetoric of the head of the ECB, after which the single European currency fell under a wave of sales.

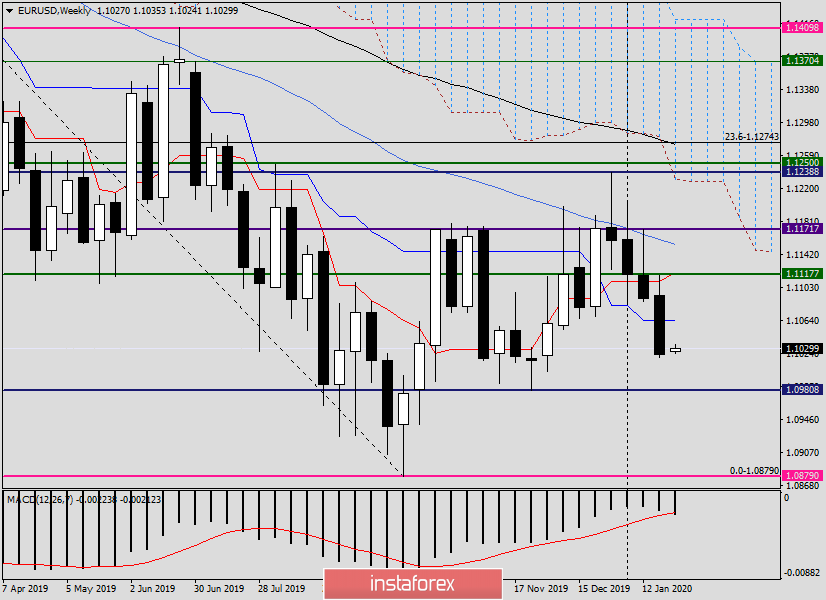

Weekly

As a result of the decline, the EUR/USD pair ended its weekly trading at 1.1024, breaking through several important support levels, such as 1.1070 and 1.1040.

However, the quote remained above the iconic psychological and technical mark of 1.1000 and did not even test its strength. Given the four-week decline in a row, as well as market sentiment, it is thought that the downward trend of the euro-dollar this week will continue. Although it is not necessary to say this with full confidence. It is necessary to observe how the price will behave in the event of a decline to the iconic level of 1.1000. And no one canceled the correction in the market, as well as the change in investor sentiment.

Also, macroeconomic statistics, which will be released on January 27-31, must be taken into account. There will be quite a lot of data, however, in my opinion, the main event will be the Fed's decision on rates and the accompanying statement of the Open Market Committee (FOMC) at 20:00 (London time). And half an hour after that, at 20:30 (London time), Fed Chairman Jerome Powell will hold a press conference. That is, the January meeting of the Federal Reserve will be complete. If the main refinancing rate is likely to remain at 1.75%, and the market is ready for this, then the main reaction of investors and the movement of the US currency will depend on what the head of the Fed will say at the press conference and in what tone his speech will be sustained.

As for the technical picture on the weekly chart, if the downward trend continues, the pair will fall into a strong price zone of 1.1000-1.0980. If a correction to the previous decline begins, its closest targets will be the Kijun line of the Ichimoku indicator, which runs at 1.1064, and the price zone of 1.1110-1.1117, where the Tenkan line is located and the highs of the previous week are marked.

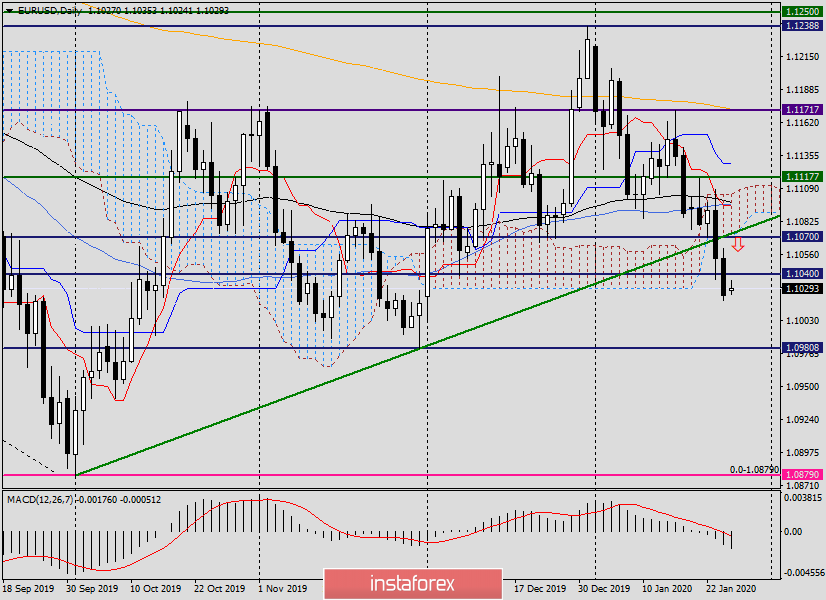

Daily

As seen on the daily chart, the pair went down from the Ichimoku indicator cloud and closed trading on January 24 below the support level of 1.1036. In the case of a return above this level, it is possible to rise to the area of 1.1095-1.1100, where there is a cluster of 50 MA, 89 EMA, Tenkan, and just above the upper border of the Ichimoku cloud.

In my opinion, the dedicated zone is very good for opening short positions, which I consider the main trading idea for EUR/USD at this point. We are looking for higher and more attractive prices for sales after the rise in the price zone of 1.1110-1.1117.

That's all for now. Tomorrow, we will look at smaller timeframes and try to find specific points to enter the market and (or) place pending orders.

Have a nice day!