Economic calendar (Universal time)

There is almost no important news in the economic calendar today. You can pay attention to the index of the business climate in Germany (9:00) and the sale of new housing in the United States (15:00).

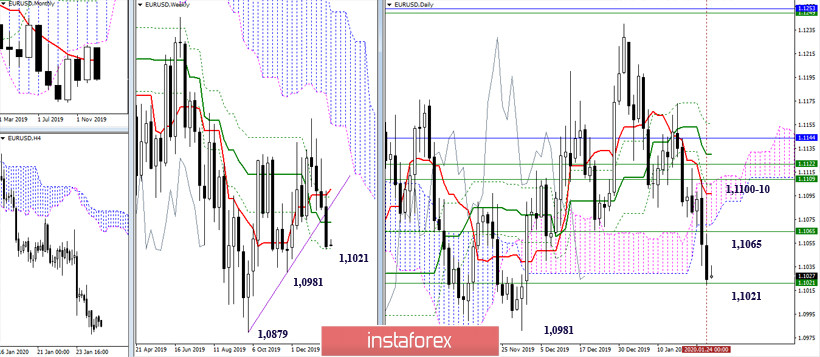

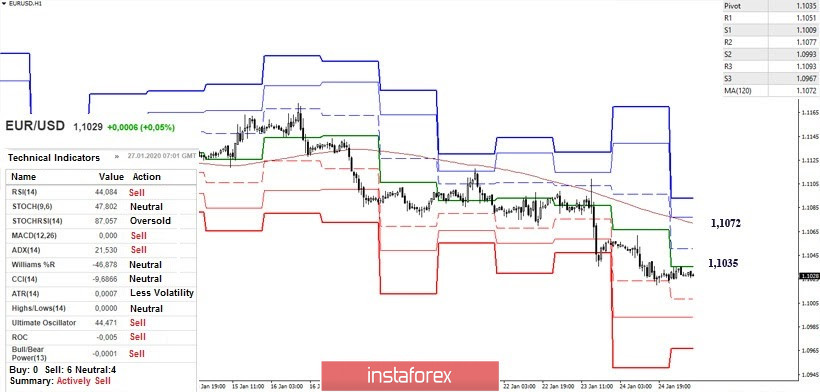

EUR / USD

On Friday, the players on the downside continued to decline and reached an important support of 1.1021 (the final milestone of the weekly golden cross). This week, the main focus will be on the result of interaction with the met support (1.1021) and the nature of the monthly candle for January. Further market prospects will be formed on the basis of how far the downside players can now hold the situation and indicate the maximum potential in these areas. The closest bearish landmarks at the moment are the minimum extremes of 1.0981 and 1.0879. Resistances are now located at 1.1065-71 (lower border of the daily cloud + weekly Kijun) and 1.1100-10 (daily levels + weekly Fibo Kijun).

In case of the continuation of decline in support of the classic pivot levels, the levels of 1.1009 - 1.0993 - 1.0967 can be noted today. Despite the current advantage of players on the downside, the pair has been in the zone of the emerging upward correction for several hours. Therefore, consolidation above 1.1035 (central Pivot level) will increase the chances of developing a full upward correction, and breaking through another key resistance 1.1072 (weekly long-term trend) will allow us to consider the prospects for the formation of effective rebound from the met support 1.1021 (weekly Fibo Kijun) senior times.

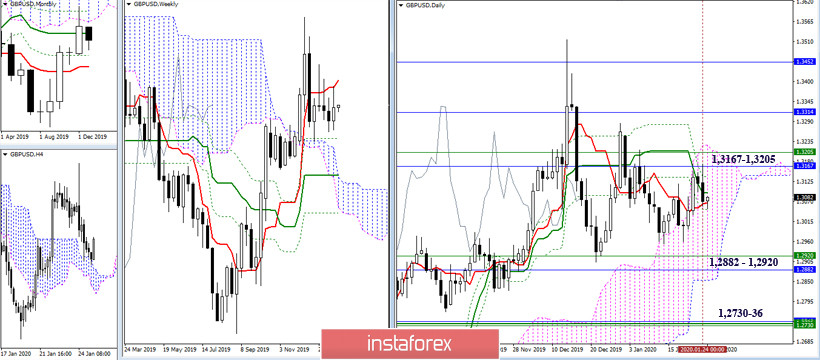

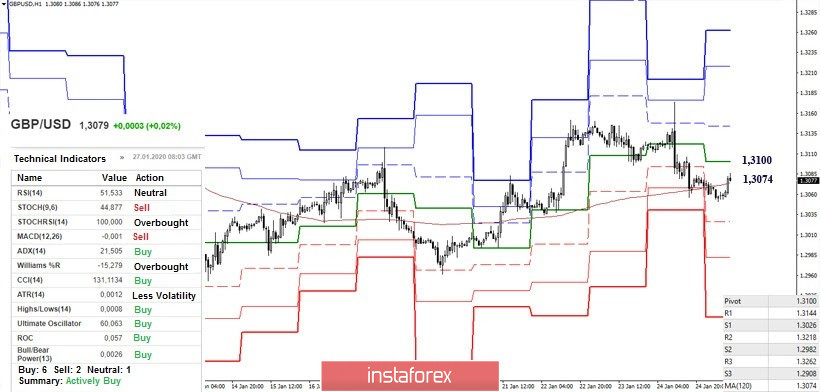

GBP / USD

On Friday, the players on the upside failed to close last week with maximum optimism while consolidation and uncertainty within the boundaries of the daily cloud and the levels of higher time intervals are preserved. The most important nearest resistances are now located in the area of 1.3167 - 1.3205 (monthly Kijun + weekly Tenkan + upper border of the daily cloud), then 1.3314 - 1.3445 - 1.3514 (monthly levels + maximum extreme) will have a value. In this situation, the main support is concentrated within 1.2882 - 1.2920 (Fibo Kijun of the month and week + the lower border of the daily cloud) and 1.2730-36 (monthly Tenkan + weekly Kijun + weekly Senkou Span B).

In the lower halves, players on the downside are fighting for a key level - a weekly long-term trend (1.3074). The following reference points for the decline are located today at 1.3026 (S1) - 1.2982 (S2) - 1.2908 (S3). Restoring the positions of the players to increase and returning to their side key levels 1.3074 (weekly long-term trend) and 1.3100 (central Pivot level) can change the current distribution of forces again and create conditions for the next increase to the most important resistances of the higher halves 1.3167 - 1.3205. On H1, this area is strengthened by R1 (1.3144) and R2 (1.3218) today.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)