USD/JPY

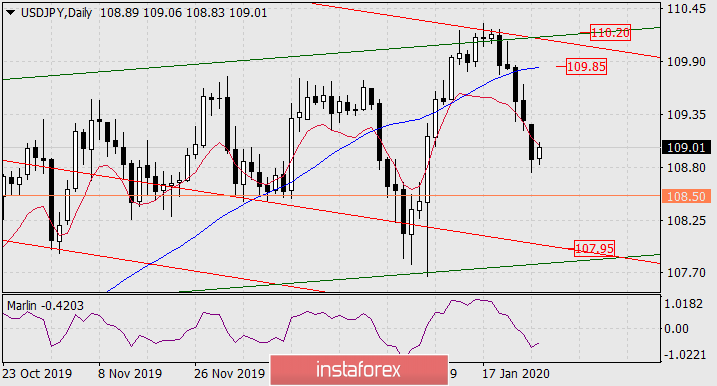

Due to the Asian nature of the observed market fears, the Japanese yen may not completely fulfill the role of a safe haven currency. Since cases of new coronavirus diseases have appeared in Japan, the yen may weaken against the dollar. Yesterday, the USD/JPY pair fell by 37 points, the price overcame the balance line support on the daily chart, but the price has not fully consolidated below it, for this the current day should also close below it. The Marlin oscillator is in the decline zone.

The immediate goal of 108.50 as a strong record level remains relevant, but the technical picture on the lower chart warns of a likely reversal.

The price has formed a consolidation on H4, causing an ambiguous interpretation. Visually, this formation indicates the intention of the price to continue to decline, but its internal structure, based on high trading volumes (only January 8 was higher), indicates the probable closure of short positions, and when some positive, or vice versa, strong negative news arrives, investors will start to purchase the dollar. The daily target of 109.85 on the MACD line coincides with the MACD level of the lower H4 chart. Uncertainty for this currency pair is strong.