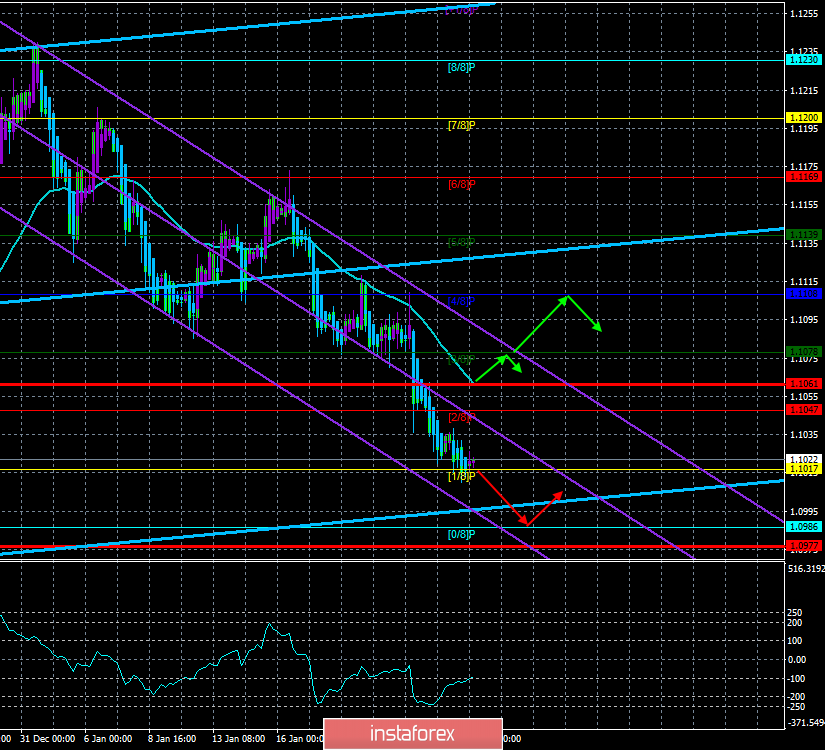

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - down.

CCI: -93.7618

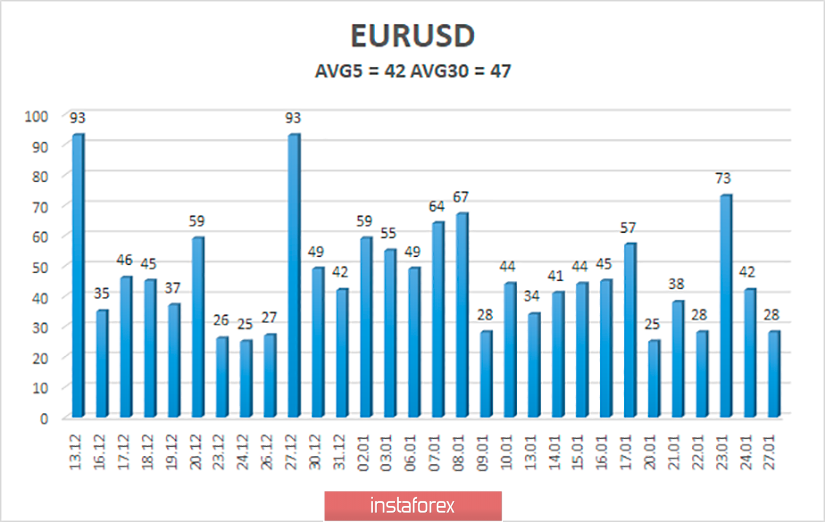

Today, January 28, the EUR/USD currency pair begins with a continuation of the same downward movement that began a few days ago. There has not been a single correction in all this time, and we expect a correction in the coming days as a necessary condition for the continuation of the downward trend. At the moment, the euro-dollar pair has fallen to the Murray level of "1/8" 1.1017, which it failed to overcome the first time, so a rebound from this level may trigger a round of corrective movement. The Heiken Ashi indicator has colored one bar purple, however, it is too small to signal the beginning of a correction already. The second closed purple bar will mean a higher probability of correction of the euro currency. Yesterday, there were no important macroeconomic publications or reports or news in the world. That's why yesterday's volatility was only 28 points. However, we warned about this in the morning. Today, interesting macroeconomic data will be available to traders, however, there will be few of them.

The only macroeconomic report of the day that deserves the attention of market participants is ordering for long-term goods in the United States for December and its derivatives. According to experts' forecasts, the main indicator will add 0.5%, which is quite a high value compared to the previous month, in which a decrease of 2.0% was recorded. Another equally important indicator of orders - excluding defense and transport - is projected with zero growth. We will also publish indicators excluding transport - forecast of +0.2% and excluding defense - forecast of +0.5%. In general, the forecasts are not very high. It will not be difficult to exceed them after the previous disastrous month. And exceeding the forecast values has always been a bullish factor, that is, in our case, a bearish one. However, is everything good now in the American economy for orders for long-term goods to start growing again? This is what we will find out today. If these macroeconomic reports are weak, the technical need for correction may coincide with the fundamentals.

Meanwhile, the political forces of America, which have been continuing open military operations against each other for about a year (we are talking about the confrontation between Donald Trump and the Democrats), have found a new battlefield on which to clash. This battlefield is a new virus discovered in China a few weeks ago and named "coronavirus". Former Vice President of the United States and the main candidate for the US presidency from the Democrats, Joe Biden, said that Donald Trump is probably the worst President of all in dealing with the new infection. "Repeated rejection of scientific findings makes Trump the worst option to lead our country during a global health challenge," Joe Biden said. According to Biden, diseases don't stop at borders, they can't be blocked by building a wall. "To stay safe, you need to help others be safe," Biden said. Biden also recalled that during the Ebola virus outbreak in 2014, Donald Trump advocated a ban on flights from countries where cases of the Ebola virus were recorded. At the moment, about 80 people have died in China from the new "coronavirus", and about 2,800 people have been infected with it. Cases of infection have already been recorded in Europe, the United States, Japan, Singapore, and other countries.

From a technical point of view, the downward movement can continue if the pair manages to overcome the Murray level of "1/8" - 1.1017. Thus, either traders will not wait for reports from overseas and will resume selling immediately in the European trading session, which will eloquently show their attitude to the euro at this time, or they will have to wait for the report on orders for durable goods and hope that it will be strong. Otherwise - correction.

The average volatility of the euro-dollar currency pair is currently 42 points. However, only one day out of the last five ended with a value above 42 points. Thus, we have volatility levels of 1.0977 and 1.1061 as of January 28. A downward reversal of the Heiken Ashi indicator will indicate a resumption of the downward movement. From a technical point of view, the downward trend is visible to the naked eye.

Nearest support levels:

S1 - 1.1017

S2 - 1.0986

S3 - 1.0956

Nearest resistance levels:

R1 - 1.1047

R2 - 1.1078

R3 - 1.1139

Trading recommendations:

The euro-dollar pair may start to adjust. Thus, sales of the European currency with the goals of 1.0986 and 1.0977 are relevant now, if the bears manage to overcome the level of 1.1017 or the Heiken Ashi indicator turns down. It is recommended to return to buying the EUR/USD pair with the goal of 1.1108 not before fixing the price above the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.