Economic calendar (Universal time)

Today, among the usual statistics in the economic calendar, only the indicator of basic orders for durable goods (USA, 13:30) and the consumer confidence index (USA, 15:00) can be distinguished.

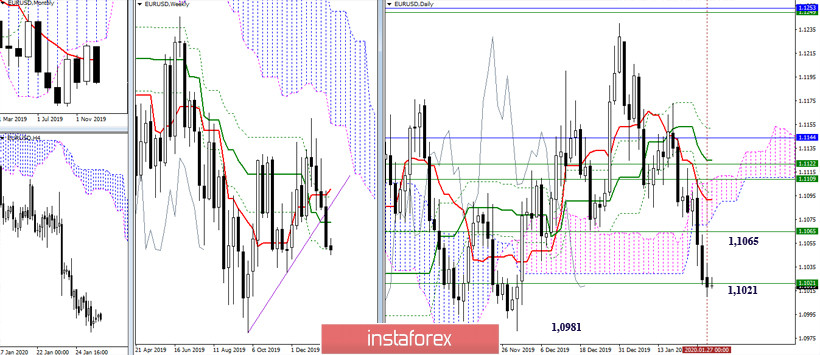

EUR / USD

The trend and potential of the previous week contributed to the renewal of the minimum, but so far, it has not been possible to actively continue the decline. The reason is the strength and attraction of the met support 1.1021 (the final boundary of the weekly golden cross). As a result, the pair continues to remain in the zone of influence of this level. Now, conclusions and expectations, as well as the main guidelines, have not changed today. The main task of the coming days is still reduced to the final performance of the month of January and the presentation of the result of the interaction with the final support of the weekly cross (1.1021). On the other hand, the interests of the players to decline, in case of breaking through the level of 1.1021, will be directed to the minimum extremes of 1.0981 and 1.0879, and the nearest resistance during bullish activity remains at 1.1065-71 (the lower border of the daily cloud + weekly Kijun) and 1.1100-10 (daily levels + weekly Fibo Kijun).

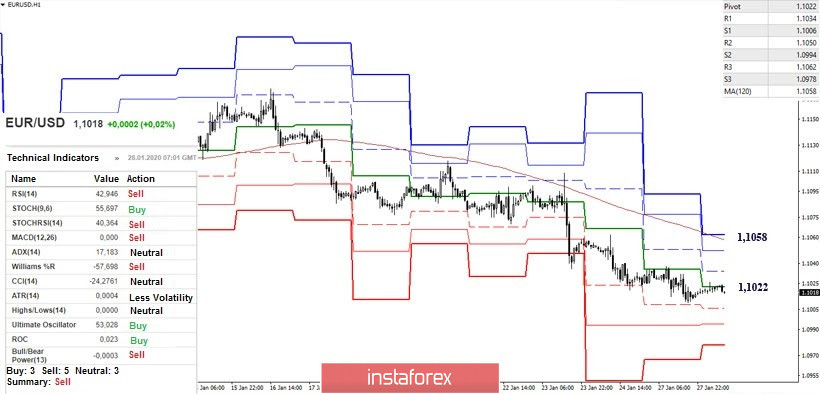

At the moment, the situation is similar to yesterday's circumstances at the time of analysis. The main advantage continues to remain on the downside, but the pair is in the process of generating an upward correction. At the same time, players for an increase test the first important line - the central Pivot-level of the day (1.1022), thus, consolidation above will allow us to consider new benchmarks and count on the implementation of a full upward correction. Today, the upsides are the intermediate resistance 1.1034 (R1) - 1.1050 (R2) and the weekly long-term trend (1.1058). When a downward trend is restored, intraday support can be made by the classic Pivot levels 1.1006 (S1) - 1.0994 (S2) - 1.0978 (S3).

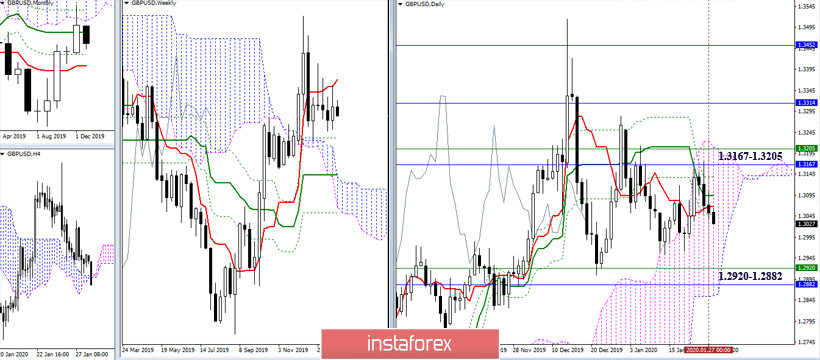

GBP / USD

Players on the downside seek to take the initiative in their own hands. The first significant result for them in this direction is updating the low of the last week (1.2961). Further, bears are waiting for support, located now in the region of 1.2920 - 1.2882 (Fibo Kijun of the month and weeks + the lower border of the daily cloud). At the same time, attraction in this situation is provided by the daily cross of 1.3068-94 (Tenkan + Kijun). The nearest most significant resistances are still located at the lines of 1.3167 - 1.3205 (monthly Kijun + weekly Tenkan + upper border of the daily cloud).

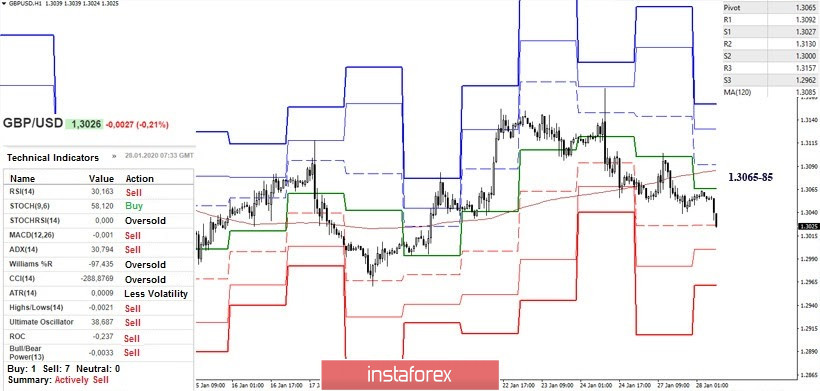

At the moment, we are witnessing the development of a downward trend. Today's classic Pivot levels 1.3027 (S1) - 1.3000 (S2) - 1.2962 (S3) can be supported today. Key lower resistance levels today hold defense at 1.3065-85 (central Pivot level + weekly long-term trend). Now, consolidation above will change the current balance of forces and will require a new assessment of the situation.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic ), Moving Average (120)