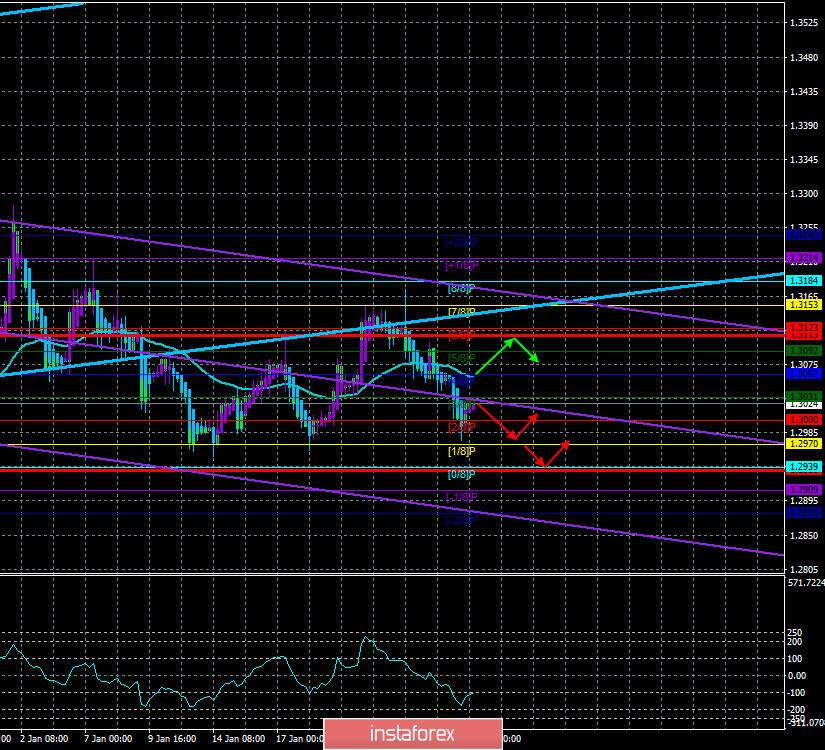

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - upward.

The lower channel of linear regression: direction - downward.

The moving average (20; smoothed) - down.

CCI: -96.4959

The GBP/USD currency pair also started to adjust the day before, while the volatility remains average. The Heiken Ashi indicator turned up, which served as a signal for correction. In general, we can state the fact that the pound-dollar pair failed to overcome the Murray level of "1/8" - 1.2970 for the fourth time, however, the pair did not even manage to get to this level. Therefore, we are waiting for a correction now, and if traders manage to stay below the moving average line, the downward trend will continue, and the pair will make a fifth attempt to continue forming a downward trend.

Meanwhile, the passions over Brexit are not abating. The European Union can not accept the idea that the UK will leave its membership in a few days, however, it is well aware that this event is already inevitable, and now we need to think about trade negotiations with Boris Johnson, who recently fancied himself as Donald Trump and already allows himself to say in the style of "The UK will sign an agreement with the EU only on terms that will be beneficial to itself". At the same time, the EU's chief Brexit negotiator, Michel Barnier, said that London, which was working to regain control of all spheres of life, had created trade barriers for itself where they did not exist. "Even without the UK, the EU forms a market of 450 million people. Our economic strength allows us to engage in a dialogue on an equal footing with other superpowers on issues such as the economy, climate change, security, and trade," Barnier said, hinting that the UK, without the EU, has ceased to be a "major player on the world stage." "Under the Brexit deal, the UK agreed to a system of customs checks and controls for goods entering Northern Ireland from the UK," Barnier said, which essentially means there is no border on the island of Ireland. Also, Michel Barnier believes that future negotiations between London and Brussels on trade relations after Brexit will be a "huge challenge". He promised that the EU will do everything possible to achieve success in the negotiations. Michel Barnier also said that the "deal" should be beneficial to both sides. "Deep partnership cannot be limited to trade alone, it must cover our domestic and foreign policy, security and defense," Barnier concluded.

Meanwhile, information has been received about when the negotiations between the groups headed by David Frost and Michel Barnier will begin – on March 3. About this, Barnier and his entourage have already expressed some of their thoughts. According to media reports, the European diplomat's entourage does not believe that a comprehensive agreement can be reached in 11 months. It is also reported that Barnier is rather skeptical about the chances of maintaining "good" relations with London. The EU's chief negotiator believes that "leaving the single market, leaving the Customs Union will have consequences," saying that the UK underestimates the risks and consequences of leaving the European Union. "There will be no compromises in the single market," Barnier said. "The UK will not be able to trade with the EU as if it remains a member."

All this means new potential problems for the UK. Lately, we rarely hear Boris Johnson, which can be considered the main character of the "Marlezon Ballet." We have repeatedly written that 2020 for the UK may be another year of falling economy and the national currency. So far, our assumptions are only confirmed. The pound needs to overcome the level of 1.2970 and then the downward movement will continue with renewed vigor.

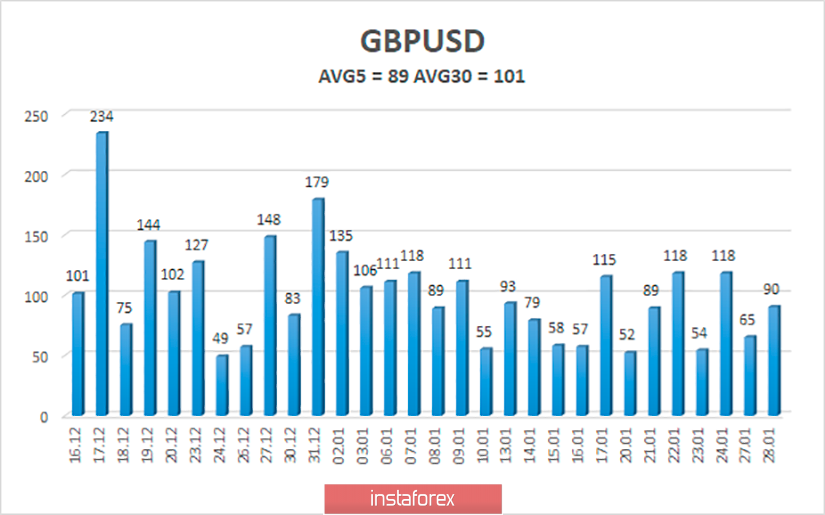

The average volatility of the pound-dollar pair over the past 5 days is 89 points. According to the current volatility level, the working channel on January 29 is limited to the levels of 1.2935 and 1.3113. Judging by the general trend, the pair will again move to the lower border of the channel, and the reversal of the Heiken Ashi indicator down will indicate the end of the upward correction.

Nearest support levels:

S1 - 1.3000

S2 - 1.2970

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3031

R2 - 1.3062

R3 - 1.3092

Trading recommendations:

The GBP/USD pair is still maintaining a downward trend but has started to adjust. Thus, traders are now recommended to sell the pound with the targets of 1.2970 and 1.2939 after the Heiken Ashi indicator turns down. It will be possible to buy the British currency again after the pair's reverse consolidation above the moving average line with the first targets of 1.3092 and 1.3123.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.