Good day, dear traders! I present to your attention the analysis of the GBPUSD pair in the framework of the "hunt for stops" method.

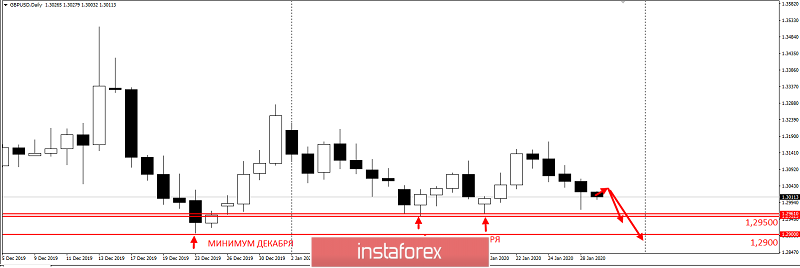

As we predicted, the pair fell to the round level of 1.3 and is now trading slightly higher at 1.302. But few people see that the Briton has a very strong stop zone at 1.29500. Let's look at it in more detail.

D1

Everyone who is currently buying a pair on D1 will choose 1.29500 - the double bottom of January as a benchmark for setting stop orders. And this is normal within the framework of classical technical analysis. Others will hide risks for the December minimum, which is only 500 points from the previous level. Thus, the so-called "trap" of buyers is formed, on which I propose to make money.

Let us now turn to the smaller TF.

H1

Here, I want to draw your attention to the so-called "local platform" with sellers' stops, where you can work with a small one-hour auction for a false breakout of 1.30300 and then count on a decline with good potential to 1.29500.

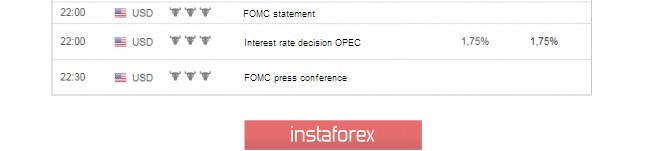

I remind you that today is important news on the US dollar, which is part of the GBPUSD pair:

Be careful at this time. Good luck with trading and control your risks!