Crypto Industry News:

BIT Mining increases its investment in Ohio's Cryptocurrency Mining Data Center, which is being jointly developed with Viking Data Centers, to increase power.

The investment will be increased by $ 11 million, of which $ 9.8 million will be paid in cash and the remaining $ 1.2 million will be payable to Viking Data Centers in cash or as class A common stock.

The Ohio mine, scheduled for completion by March 2022, is expected to reach a total capacity of up to 150 megawatts, adding 65 MW to 85 MW for the original project, the company announced. The additional capacity will be developed in two phases, 25 MW in the first and 40 MW in the second. The parties expect to hit these milestones by February 15 next year and March 31, 2022 respectively.

After the successful implementation of the investment, BIT Mining's stake in Ohio Mining Site will increase to 55%, and Viking Data Centers will own the remaining 45%. The company has also completed the operation of a cryptocurrency mining data center in Texas, and will also limit the capacity of the cryptocurrency mining project in Kazakhstan to 40 MW.

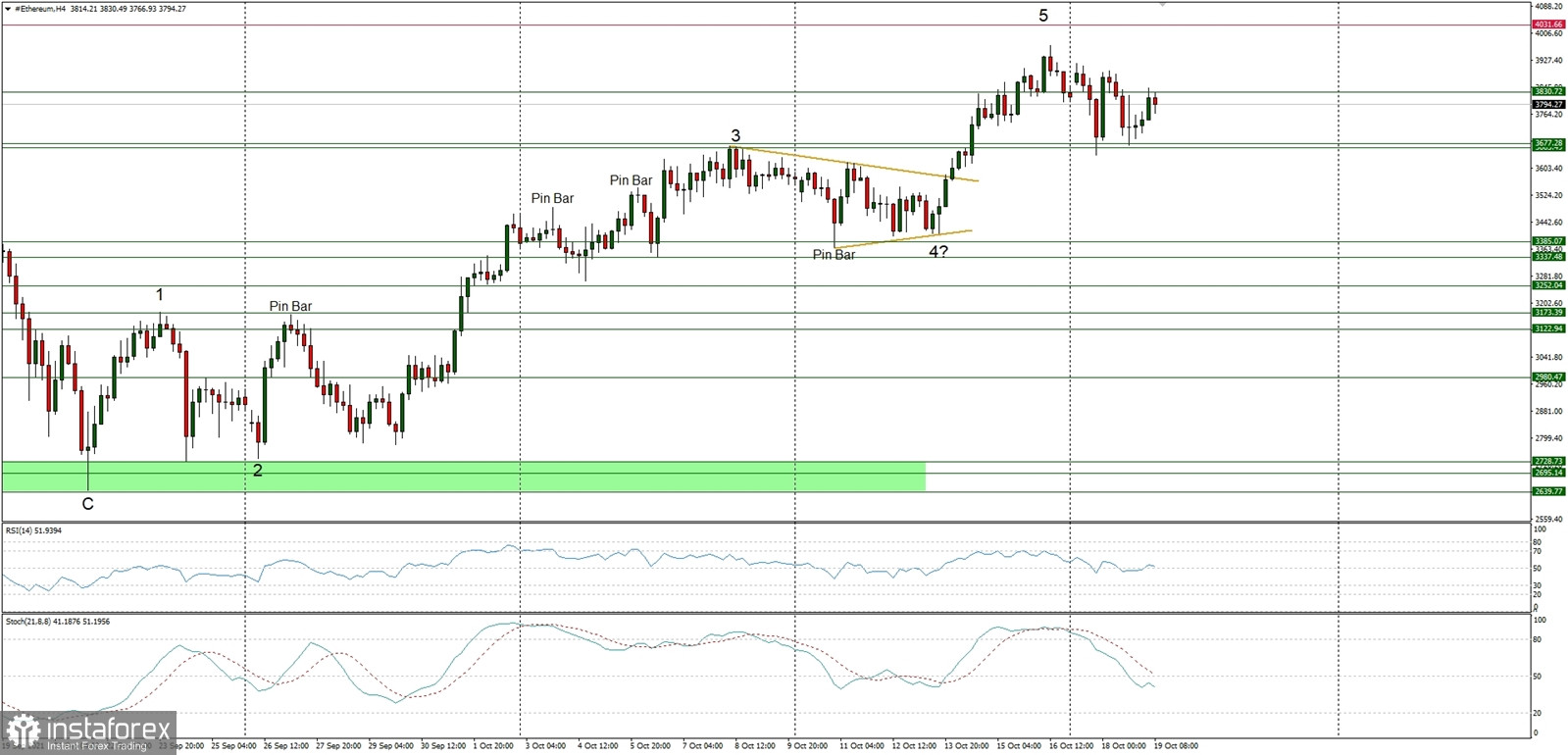

Technical Market Outlook:

The ETH/USD pair has been seen bouncing from the technical support located at the level of $3,677, but bulls are not that keen to head towards the level of $4,000 again. This might be the last wave in the impulsive cycle, the wave 5 of the overall wave progression, so a some kind of correction might be expected soon. The momentum is strong and positive, so the bulls might risk to push the prices towards the level of $4,000 before any meaningful correction will occur, but any breakout below $3,677 will be a negative in the short-term.

Weekly Pivot Points:

WR3 - $4,596

WR2 - $4,262

WR1 - $3,971

Weekly Pivot - $3,631

WS1 - $3,394

WS2 - $3,073

WS3 - $2,777

Trading Outlook:

Ethereum have started the next wave up and violated the long-term target at the level of $3,550. The next long-term target for ETH is seen at the level of $4,394. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls.