To open long positions on GBPUSD, you need:

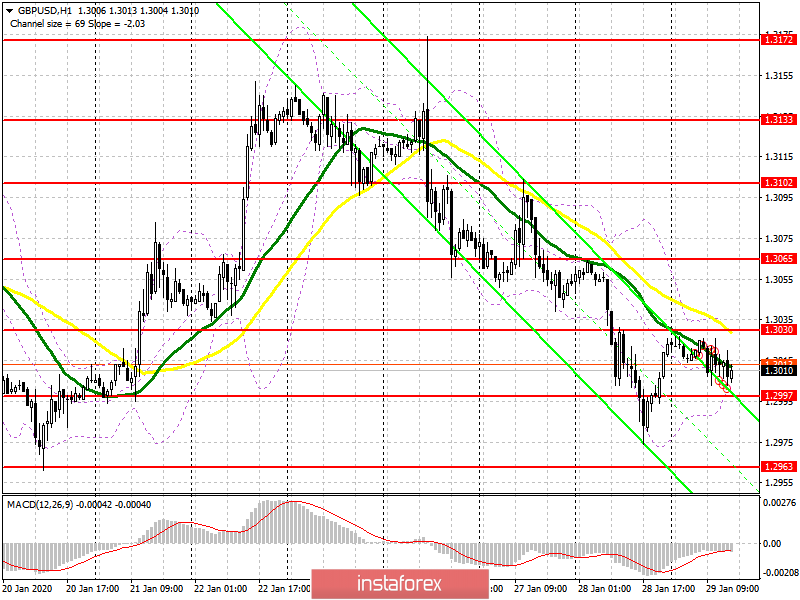

The technical situation in the GBP/USD pair has not changed in any way compared to the morning forecast, as traders do not have fresh guidelines regarding Brexit and the Bank of England's decision on interest rates, which will be announced tomorrow. The task of buyers today remains to hold the support range of 1.2997-90, where the formation of a false breakout will be the first signal to open long positions. The lower boundary of the upward channel can also be built in this area. An equally important point will be the breakout and consolidation above the resistance of 1.3030, which will lead to the demolition of sellers' stop orders and a larger upward correction to the area of the highs of 1.3065 and 1.3102, where I recommend fixing the profits. If the bulls do not have the strength to cope with the pressure of sellers in the area of 1.2997, then in this scenario, it is best to postpone purchases until the update of the lows of 1.2963 and 1.2939, which will mean the continuation of the bearish trend.

To open short positions on GBPUSD, you need:

While the bears do not let the pair go to the resistance area of 1.3030, where the formation of a false breakout will be a signal to sell GBP/USD, which will return the pound to the support area of 1.2997-90, near which the main struggle for further direction will unfold. Low volatility remains, and further movement will depend on the news on the US economy, as well as on the Federal Reserve's decision on interest rates. Fixing below the area of 1.2997 will quickly push the pair to the lows of 1.2963 and 1.2939, where I recommend fixing the profits. If there is no pressure from sellers in the resistance area of 1.3030 in the second half of the day, then it is best to postpone short positions until the test of the highs of 1.3065 and 1.3102.

Indicator signals:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates market uncertainty.

Bollinger Bands

In the scenario of an upward correction, the upper limit of the indicator around 1.3030 will act as a resistance. Breaking the lower border in the area of 1.2995 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA Period 12. Slow EMA Period 26. SMA Period 9.

- Bollinger Bands (Bollinger Bands). Period 20.