Hello, dear colleagues!

Today's article will start with yesterday's most important events that were eagerly anticipated by participants of the Forex currency market.

At the end of its two-day meeting, the Open Market Committee of the US Federal Reserve kept the main interest rate in the range of 1.5% -1.75%.

As expected, the main reaction of investors was focused on the accompanying FOMC statement and the press conference of the Chairman of the Federal Reserve System (FRS), Jerome Powell.

As already noted, federal funds rates remained in the range of 1.5%-1.75%. All ten members of the FOMC unanimously voted for this decision, however, there were no abstentions and there was no such verdict.

In turn, the discount rate did not change and remained at the level of 2.25%. But the rate on reverse repo operations was raised from 1.45% to 1.5%. At the same time, overnight repo operations will continue until April of this year.

The same thing happened with the excess reserve rate (IOER), which increased from 1.55% to 1.6%. Purchases of Treasury bonds will also continue through the second quarter of 2020.

The accompanying statement noted a decent increase in new jobs, but inflation still does not reach the target level of 2%. Household spending is also gradually increasing, while investment in fixed assets and the export component remains weak.

As usual, the Open Market Committee announced its intention to monitor incoming macroeconomic data, especially regarding inflation.

In general, the current monetary policy is considered appropriate in the current conditions.

Now about the main points that Fed Chairman Jerome Powell made in his speech.

Cons: weak exports; coronavirus carries uncertainties; if there are reasons to change forecasts, it will respond accordingly.

Pros: moderate household growth; US citizens with low incomes are looking for employment opportunities; the role of the active repo is becoming less important; the situation and conditions in the markets are still being closely monitored, and adjustments will be made if necessary. Fed Chairman Jerome Powell said roughly the same thing during his press conference.

In principle, that's all. These are all the main points. As you can see, almost no new and fundamental changes in the policy of the Federal Reserve System have occurred, which is to be expected.

Now let's see what data is expected today for the EUR/USD currency pair.

Germany: at 09:55 (London time) - a change in the number of unemployed and the unemployment rate, seasonally adjusted.

Eurozone: at 11:00 (London time) - a whole block of statistics is scheduled. This is the index of business optimism in industry sentiment index in the business community, business confidence in industry sentiment index in the economy, consumer confidence, and, perhaps, the most important report on the unemployment rate.

In continuation of the European statistics, data on the consumer price index in Germany will be released at 14:00 (London time).

USA: at 14:30 (London time) - weekly data on initial claims for unemployment benefits, price deflator, and preliminary GDP data for the fourth quarter.

That's probably all. It's time to move on to price charts.

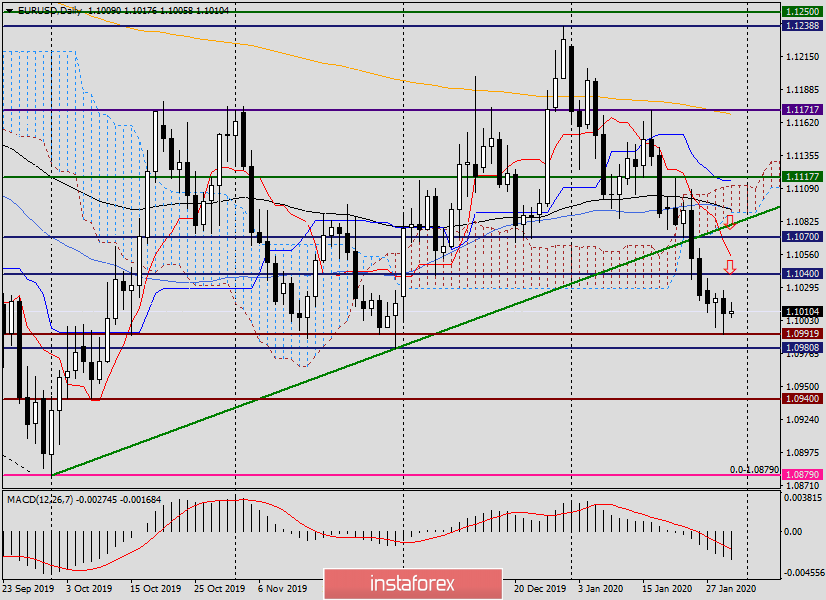

Daily

During yesterday's trading, the pair fell to the level of 1.0992, where it received support and began a slow recovery. At the time of writing, the rate is trading near 1.1009. Please note that the candle from January 28, which could be considered a reversal, was followed yesterday by a candle with a long lower shadow, which indicates the market's reluctance to trade on EUR/USD at lower values. Yes, even if the minimum trading values were updated on January 28, but the long tail at the bottom and the closing price on January 29 at 1.1008 suggest a long-awaited adjustment of the euro-dollar exchange rate for many.

If this happens, we are waiting for the pair near the levels of 1.1027, 1.1040, and, possibly, around 1.1060. In the case of a bearish scenario, I expect a breakdown of the support of 1.0992, after which the decline will continue to the level of 1.0980, in the case of a breakdown of which the quote will go to the price zone of 1.0940.

As for the trading plan, it remains the same at the moment. Given the probability of correction (a position against the current downtrend), you can try to buy with the nearest targets of 1.1027, 11040, and 1.1060. From each of these possible growth goals, you should look closely at sales, which will be signaled by bearish patterns of Japanese candlesticks on the 4-hour and hourly charts.

Good luck!