There was truly a trillion swing, but they won't give a broken cent for the blow. For more than a day, the market was preparing for a meeting of the Federal Committee for Open Market Operations, and we were forced to contemplate first the filigree withdrawal of the single European currency and the pound to the starting positions, and then the dull and long horizontal movement of the charts, as if on a ruler. Moreover, the tension was such that none of the market participants looked at what was happening around. However, the Federal Reserve System in the best bureaucratic traditions has so emasculated the content of comments on monetary policy that it is impossible to understand anything at all. It can be said that this is the best example of a "nomenclature lexicon". The only thing that can be understood is that the refinancing rate was left unchanged. Thank you for at least expressing this clearly on this issue. But for all the rest, we can only throw up our hands since it is completely incomprehensible what and how the Federal Reserve System will do in the near future. There is no clarity so think what you want. They can reduce, but they can also increase. The language is so streamlined that both are possible and there is no clarity with the timing of any gestures on the issue of monetary policy parameters. Therefore, there are no guarantees that the refinancing rate will continue to be at current levels. That left a single European currency with the pound, as they stand still, not understanding what they should do next.

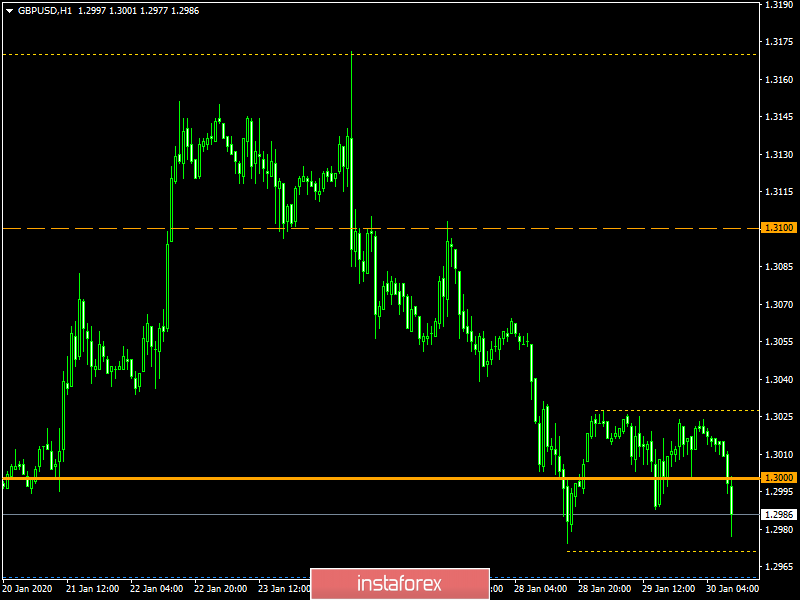

Meanwhile, Nationwide data on housing prices, which showed an acceleration of growth from 1.4% to 1.9%, remained unattended. But it turned out to be much better than the forecasts of 1.6% and this is extremely positive news, as the state of the real estate market, especially prices, is one of the main criteria for determining the investment attractiveness of the United Kingdom.

Nationwide Housing Price Index (UK):

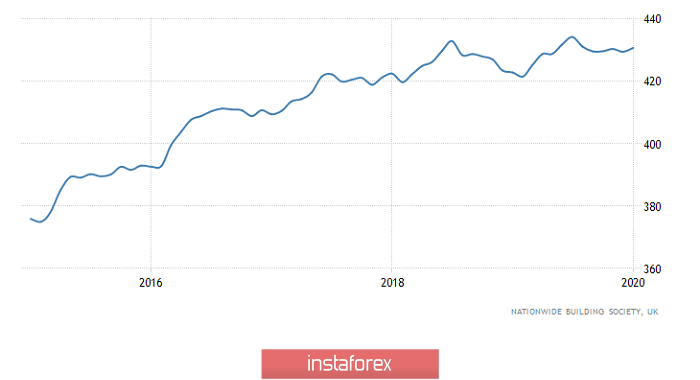

Similarly, data on lending in Europe, where the growth rate of consumer lending unexpectedly accelerated from 3.5% to 3.7%, were ignored. The surprise is that a slowdown of up to 3.4% was predicted. At the same time, data on lending to the corporate sector more or less coincided with forecasts, as their growth rates, as expected, slowed down but not from 3.4% to 3.3%, but to 3.2%. However, the growth in consumer lending is clearly offset by this.

Consumer lending (Europe):

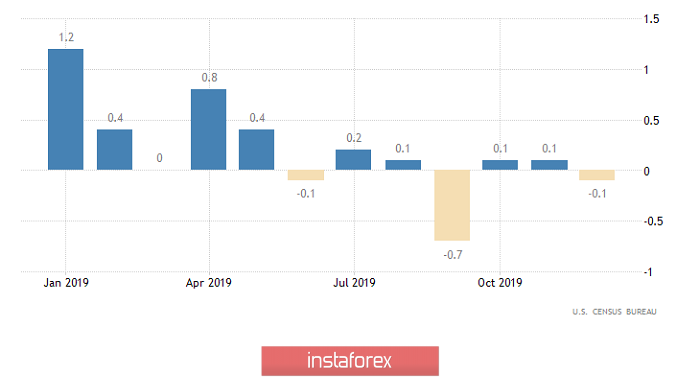

In addition, there is nothing surprising in the fact that no one was impressed by American statistics either. But wholesale inventories decreased by 0.1%, which indicates the possibility of industrial production growth, which is still decreasing. On the other hand, the growth rate of pending home sales has not slowed as much as expected - from 7.4% to 4.6% instead of 4.4%.

Wholesale Stocks (United States):

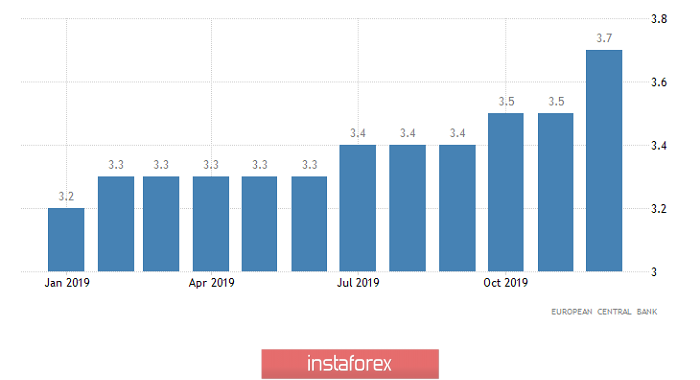

It is clear that the central event for today will be the meeting of the Board of the Bank of England. After yesterday's failure, and investors were preparing for a serious race, market participants are demanding satisfaction and compensation for moral damage. And according only from the tension hanging in the air, it becomes clear that the Bank of England will not be able to get away with it. This Federal Reserve has room for maneuver and the ability to delay the moment. However, the Bank of England is on the edge of the abyss, and the only question is when exactly will the refinancing rate be reduced. Nevertheless, the majority tend to think that this will happen only in the summer. However, the possibility of lowering the refinancing rate today is also being actively discussed. Moreover, it will look beautiful. After all, today's meeting for Mark Carney is the last as the head of the Bank of England. You never know, he wants, so to speak, to leave in English. There are simply no other options. At the same time, given the incredible tension, the market needs only a reason for a breakthrough. And if the Bank of England still postpones the reduction of the refinancing rate by the middle of the year, then it is worth waiting for the pound to grow. And then the single European currency. However, due to the fact that the decline will continue, just later, the growth potential is still somewhat limited. In contrast to the possible reduction that will occur if the refinancing rate is reduced, for example, to 0.5%, there will be a lot to roam around, as they say. But in any case, it is better not to make hasty steps and action on the situation.

Refinancing Rate (UK):

Moreover, as yesterday, all other news will no longer have any meaning. So the data on the unemployment rate in Europe will be ignored. However, there is nothing to look at, since no changes are expected.

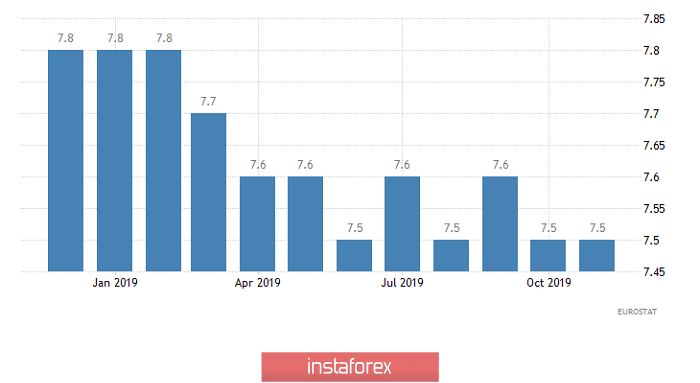

Unemployment Rate (Europe):

Unemployment claims in the United States will also be ignored. But here, the overall balance should remain unchanged. The number of initial applications for unemployment benefits should increase by 6 thousand, while the number of repeated ones should be reduced by exactly the same number.

Repeated Unemployment Insurance Claims (United States):

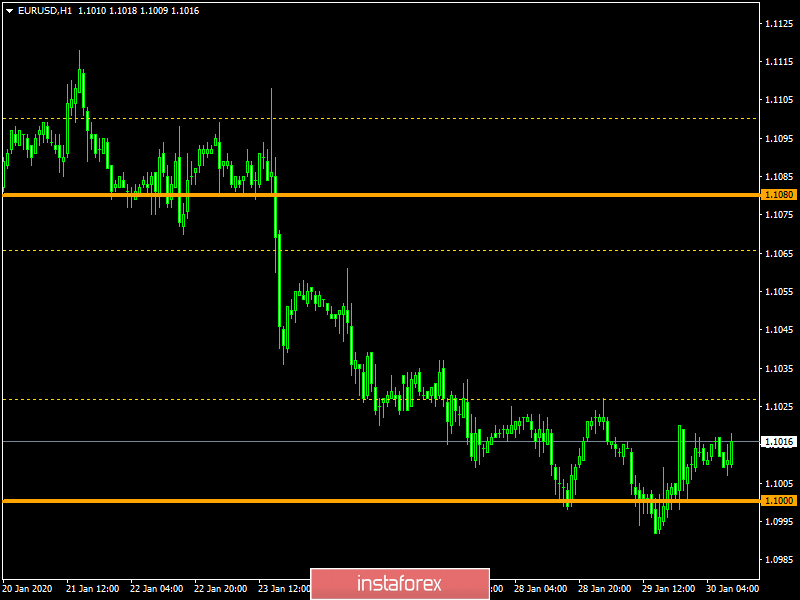

The euro / dollar currency pair keeps the concentration within the control level of 1.1000, where an attempt to break it was, but failed. In fact, we were faced with a characteristic uncertainty, where volatility subsided several times, and the probability of acceleration increased significantly. It is likely to assume that the accumulation within 1.0990 / 1.1030 will not last long. Thus, the best tactic is to pause where the work will be on the breakdown of the specified boundaries.

The pound / dollar currency pair managed to slow down the movement even more, where the focus was on the psychological level of 1.3000, relative to which the accumulation process is taking place. It is likely to assume that stagnation will very soon subside and acceleration, expressed in an impulse jump, will come in its place. Trading tactics was selected by the method of analyzing price fixing points relative to the values of 1.2965 - sale and 1.3040 - purchase.