The key decision of the Bank of England today was to maintain interest rates at the same level, which instantly supported pound buyers who were somewhat afraid of a real easing of monetary policy at the beginning of this year. However, the technical breakthrough of resistance of 1.3030, which I mentioned in detail in the morning review, led to the demolition of a number of stop orders and a larger growth wave.

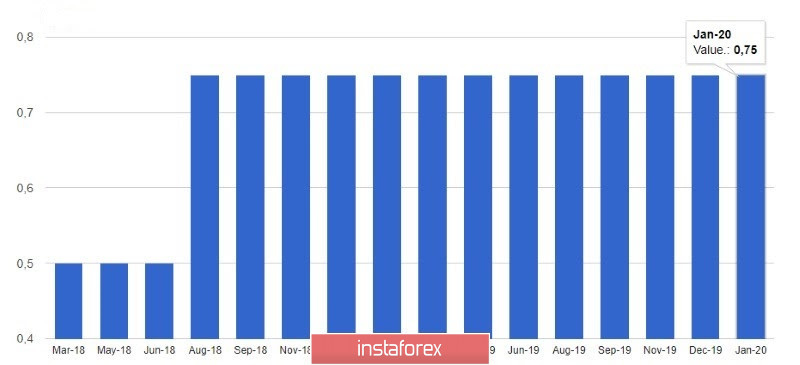

As I noted above, the BoE left the key interest rate at 0.75%. This decision was made with a vote ratio of 7-2. The number of votes cast to keep the key rate unchanged was 7, and the number of votes cast to increase the key rate was 0.

As for those who voted for a lower rate, and these are two members of the board - Jonathan Haskel and Michael Saunders, their motives were clear at the end of last year. Those who disagree with the majority decision cited weak growth amid Brexit, inflation and global uncertainty, which has now intensified due to the spread of coronavirus.

However, the majority noted positive trading news, a reduction in uncertainty around Brexit, and last but not least, the upcoming fiscal stimulus, which I also mentioned in detail in my morning review. The BoE noted that lowering the rate may be required only if signs of a global economic recovery turn out to be unstable, and talking about raising the rate is possible only if the UK economy grows in accordance with expectations.

It is also worth paying attention to the revision of the forecast for UK GDP growth from 1.25% to 0.75% for 2020. It is expected that GDP in the fourth quarter of 2019 will remain unchanged at 1.25% based on last year's results. Inflation will continue to be below the target level of 2% in 2020 and 2021, which makes it easier to maneuver with interest rates if necessary.

The central bank noted that they are awaiting the conclusion of a deep free trade deal with the EU since 2021, but they also do not build hopes that the negotiations will go very smoothly, since a number of requirements need special coordination. The BoE is also ready for a sharp drop in UK exports in 2021 after the entry into force of a new trade deal with the EU, but it is still too early to talk about it.

As for the technical picture of the GBPUSD pair, a breakthrough of the technical support level of 1.3030 led to a sharp increase in the pound. However, if you look at the daily chart, you will see how the British pound walked "along the edge of the knife," since it was near the level of 1.2290 that the lower boundary of the triangle formed on December 23, 2019 passed, the break of which caused the pound to sharply fall in the beginning of this year. Now the task of the bulls is to break through the upper boundary of this triangle, which is visible in the area of 1.3133. Consolidation on this range will quickly return the pound to the highs of 1.3265 and 1.3316. We can expect a return to 1.3400 and 1.3520 in the longer term.

EURUSD

The euro continued to trade in a narrow side channel against the US dollar after the release of reports on the eurozone labor market. Weak activity was directly related to low demand for risky assets.

According to the data, the number of applications for unemployment benefits in Germany fell in January, which was good news for an economy that is going through hard times. Labor market growth will support the gradual recovery of the country's GDP. According to the report, the number of applications fell by 2,000 in January after an increase of 8,000 in December, while economists had expected that the number of applications would increase by 5,000 in January. The unemployment rate was 5.0% in January and the number of vacancies was 668,000.

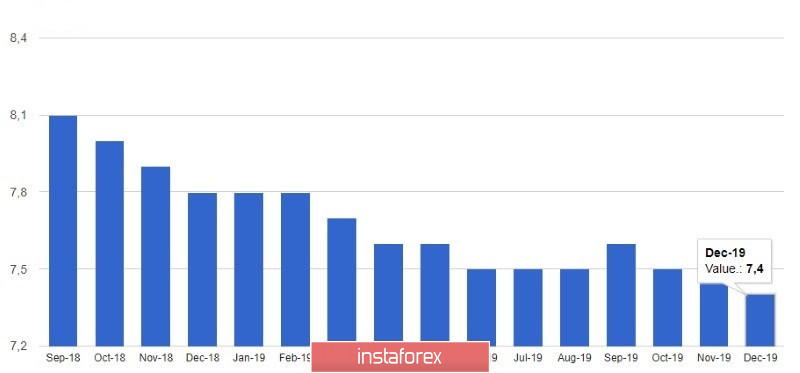

As for Italy, the number of unemployed slightly grew in December. According to statistics agency Istat, the number of applications for unemployment benefits rose by 2000, and the unemployment rate was 9.8%. More than 30% of the unemployed are young people aged 15 to 24 years. Employment increased by 0.6% compared to December 2018. In general, in the eurozone, the unemployment rate decreased to 7.4% in December 2019 compared to 7.5% in November, but this did not impress traders. Unemployment in the eurozone in December was projected at 7.5%.

Consumer confidence also did not improve earlier this year, and there are a number of reasons for this. The report said that the consumer confidence index in the eurozone remained unchanged in January compared to December and amounted to -8.1 points, which fully coincided with the forecasts of economists. The growth of the confidence index in the eurozone industry to -7.3 points in January, against -9.3 points in December, was partially offset by a decrease in the confidence index in the sphere for services of the eurozone to 11.0 points against 11.3 points.