Economic calendar (Universal time)

Today's economic calendar is filled with a variety of statistics, no matter how close the week and first month of 2020. It should be noted that the closing of the week and month today will be the main factor affecting the movement of the market, since there are practically no important indicators in the statistics. Separately, only the Eurozone consumer price index (10:00) can be distinguished.

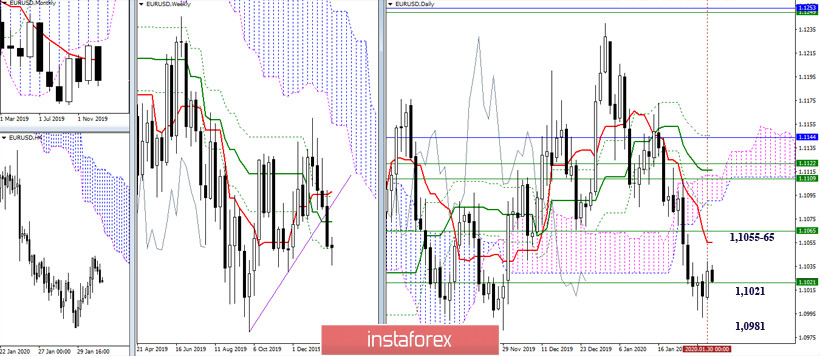

EUR / USD

The pair spent the whole week in collaboration with the important support they met 1.1021 (the final milestone of the weekly golden cross). The main question for today is whether players will be able to declare themselves to increase and reach the closure of the week and month above the level of 1.1021. Success in this direction can help restrain the further bearish offensive, maintain uncertainty and inhibition, and even completely lead to the subsequent restoration of the players' positions to increase. Today, the nearest benchmarks remain in place, for bears - 1.0981 (minimum extreme), for bulls - 1.1055-65 (daily Tenkan + weekly Kijun).

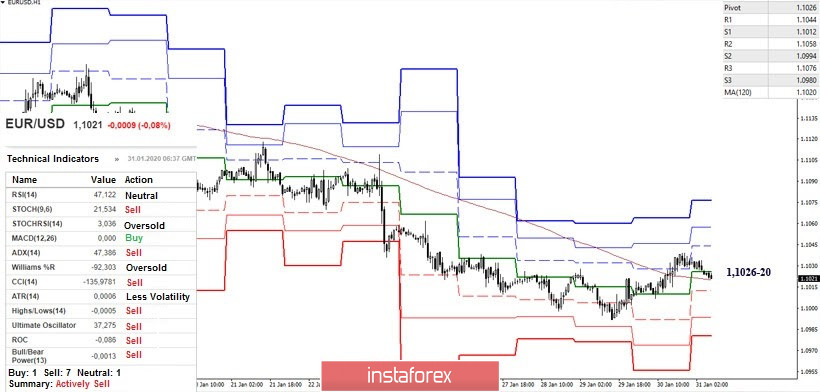

Currently, market players are busy fighting for the key frontiers of the lower halves. Under the current conditions, the weekly long-term trend and the central Pivot level of the day are joining forces in the area of 1.1026-20. In this regard, developing above these levels will strengthen players to increase. In turn, returns and consolidation below will increase the bearish chances. The strength and significance of these milestones are given by the level of met support for the higher halves (1.1021). Today, other intraday supports are located at 1.1012 (S1) - 1.0994 (S2) - 1,0980 (S3), while the resistances of the classic Pivot levels are now at 1.1044 (R1) - 1.1058 (R2) - 1.1076 (R3).

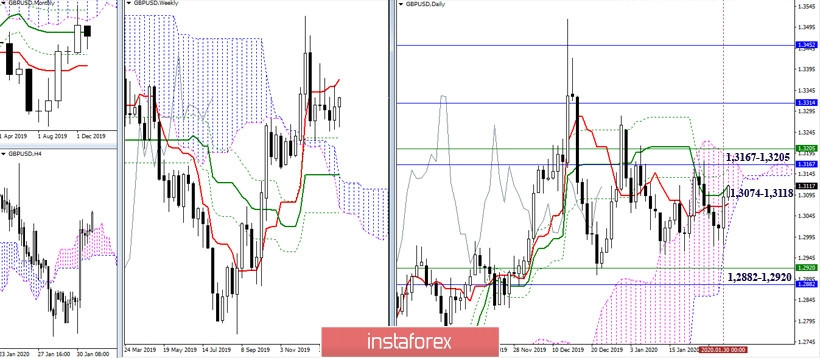

GBP / USD

The pair continues to work towards the zone of former consolidation. Closing of the week and month is approaching, and thus, the result will be important. It should be noted that the players on the upside are now actively busy strengthening their positions, but remaining in the consolidation zone is difficult to achieve a significant result. To begin with, the players need a way out and a reliable consolidation over the significant resistance of this area, which have combined their efforts in the region of 1.3167 - 1.3205 (the upper border of the daily cloud + weekly Tenkan + monthly Kijun).

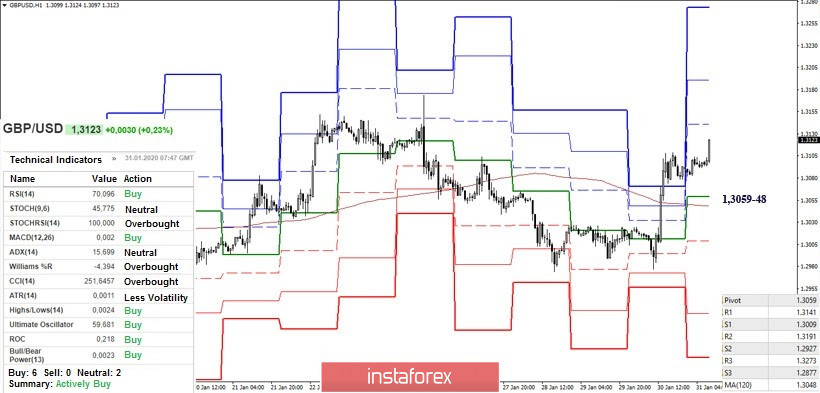

The players on the upside managed to break through the key resistance and are now using their advantage. At H1, we observe an upward trend in its active phase. The upward reference points within the day are now the resistance of the classic Pivot levels, which are located at 1.3141 (R1) - 1.3191 (R2) - 1.3273 (R3). On the other hand, the levels determining the presence of preferences and advantages combine their efforts in the region of 1.3059-48 (weekly long-term trend + central Pivot level) today. Consolidation below will affect the current balance of power and create prospects for a decline to bearish guidelines. Meanwhile, the downward benchmarks for the lower halves in the form of supports of the classic Pivot levels in this situation can be noted at 1.3009 (S1) - 1.2927 (S2) - 1.2877 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)