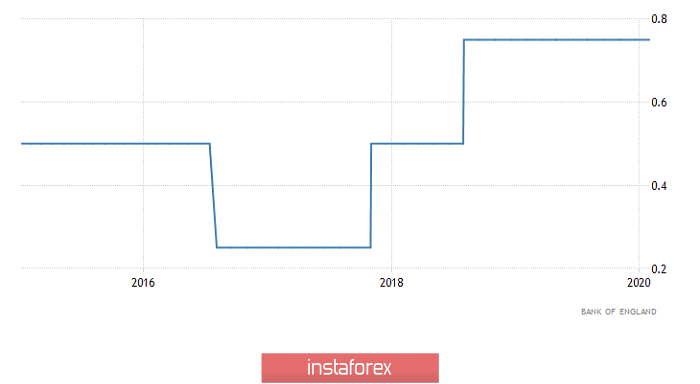

Mark Carney decided not to mourn on the occasion of his resignation as head of the Bank of England and instead organized a fireworks display in the form of a rapid pound rise. To do this, it was enough to just keep the refinancing rate at 0.75%. The joy of investors knew no bounds.

But how diligently a number of mass agitation and misinformation media have escalated the situation. There was so much discussion about the fact that the Bank of England will lower the refinancing rate now. Well, if it doesn't, then at least three out of nine board members will vote for such a move. Yes, there are three but generally, there are four. Come on more. But in the end, not only the refinancing rate was left untouched, but, just like last time, there were only two daredevils who spoke in favor of easing monetary policy. It was this injection that caused the pound to increase, as the worst nightmares were not confirmed. However, nothing has changed essentially, and the Bank of England will still lower the refinancing rate, although this will happen only in the summer. Of particular note is the content of the commentary on the monetary policy of the Bank of England, which just oozes endless optimism. Here you have Boris Johnson, whose election has increased confidence in the prospects for the British economy, and the confidence that London and Brussels are about to sign a free trade agreement. In short, the continuous feeding of pink unicorns with a rainbow. However, the problems associated with Brexit do not disappear. As a result, the growth of the pound is rather just an elementary emotional outburst. So to say, the public needed to be at least something to enjoy.

Refinancing Rate (UK):

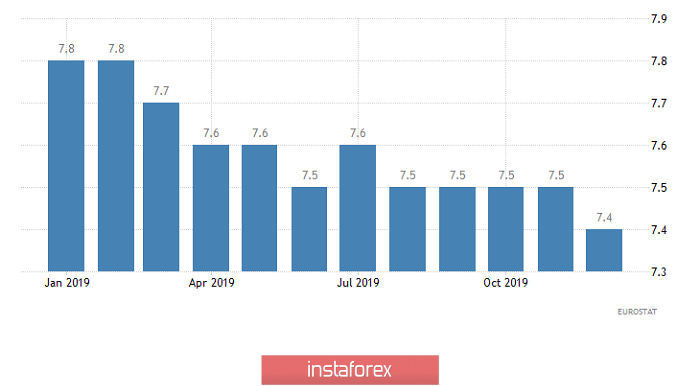

It is clear that the results of the meeting of the Bank of England board is so attractive for the attention of all those involved and not involved that no one really paid attention to the decrease in unemployment on the other side of the English Channel. Yes, that's right, the unemployment rate in Europe declined from 7.5% to 7.4%, which, of course, cannot but rejoice, as it speaks of a continuing improvement in the situation on the labor market in the euro area. This, by the way, also suggests that the probability of a further reduction in the refinancing rate of the European Central Bank is somewhat reduced.

Unemployment Rate (Europe):

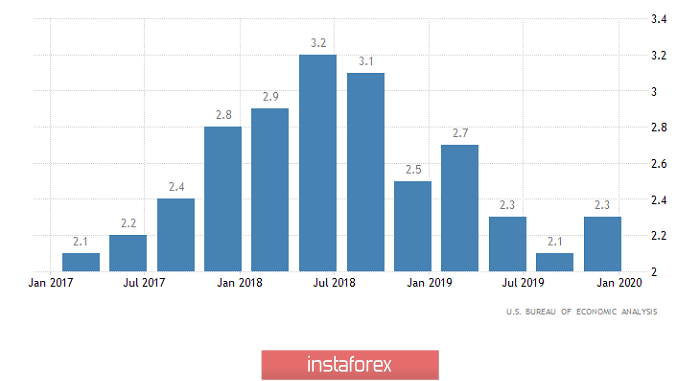

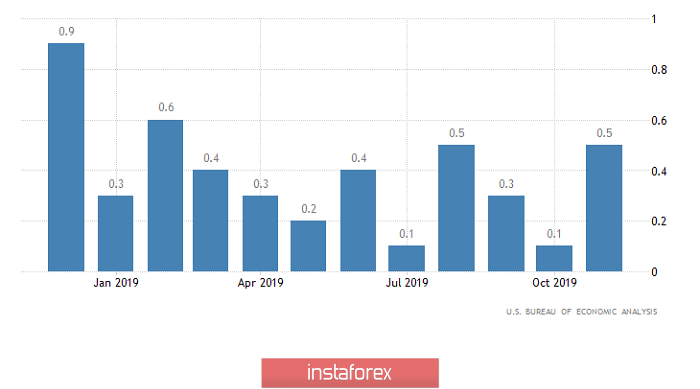

At the same time, the lack of reaction to the reduction in unemployment in Europe is quite justified. However, confirmation of the fidelity of such behavior came only a few hours later. The fact is that American statistics can be called delightful. Most importantly, the first estimate of United States GDP for the fourth quarter showed an acceleration in economic growth from 2.1% to 2.3% and this is quite an excellent result. It remains only to be confirmed by subsequent estimates, as well as the final data. In addition, the total number of applications for unemployment benefits declined by 51 thousand when it should have decreased by 1 thousand. But here, the revision of previous data intervened as always. But unfortunately, for the worse. So, the number of initial applications was revised from 211 thousand to 223 thousand. Meanwhile, the number of repeated applications increased from 1,731 thousand to 1,747 thousand.

GDP growth rate (United States):

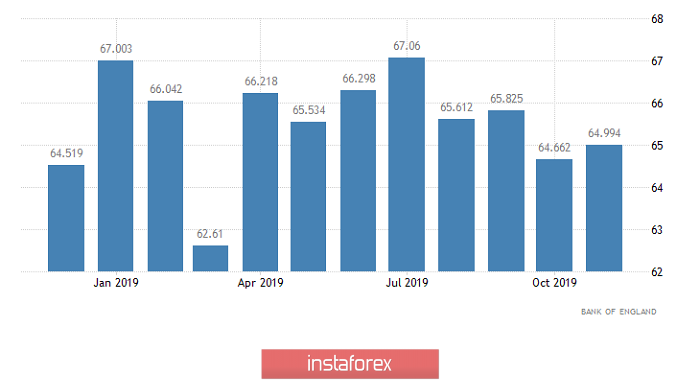

It is clear that the main event of today will be the publication of preliminary data on inflation in Europe. But before that, it is worth paying attention to data on lending in the UK. Thus, net consumer lending could decline from 4.5 billion pounds to 4.4 billion pounds. At the same time, the volume of mortgage lending should decrease from 4.1 billion pounds to 3.8 billion pounds. However, the obligation to brighten up such a dull picture was assigned to mortgage loans, since the number of approvals for them should increase from 65.0 thousand to 66.8 thousand. This indicates that the volume of mortgage lending will at least increase. So, according to forecasts, lending data will be neutral, with a promise of improvement in the future.

Mortgages Approved (UK):

Now, we can talk about inflation in Europe, especially since its growth is expected from 1.3% to 1.4%. This will finally remove all questions regarding the possibility of lowering interest rates of the European Central Bank in combination with a decrease in unemployment. But perhaps it will not be. Moreover, the continuation of the upward trend in inflation inspires hope that they will seriously talk about the possibility of a transition to a systematic tightening of monetary policy by the end of this year. Thus, if these forecasts are confirmed, then the single European currency, of course, will jump up. However, you should not think that it will repeat yesterday's pound rise, as it will be restrained by the first estimate of European GDP for the fourth quarter, which should show a slowdown in economic growth from 1.2% to 1.0%. Of course, amid the acceleration of the American economy, the European currency looks extremely weak. In addition, one should not exclude the possibility of reducing inflation, or its stability, which, given the increased tension of market participants who have long been prepared for a breakthrough, will lead to a sharp decline in the single European currency.

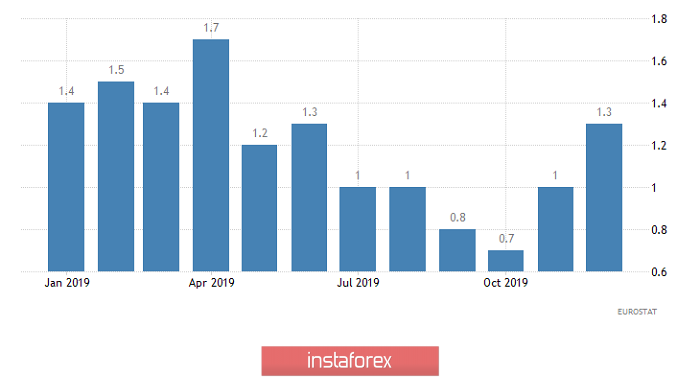

Inflation (Europe):

There is no point in looking at American statistics today, unless for the love of art only . The data on personal income and expenses will only be published, which can no way affect the mood of investors. Thus, revenues should increase by 0.4%, and expenses by 0.5%. Nevertheless, exceeding growth in expenses indicates a high potential for growth in consumer activity and retail sales. But the market will only rejoice at this when regular sales data will be published.

Personal Income (United States):

If all forecasts are confirmed, then the single European currency can increase to the level of 1.1075. If inflation data disappoint, then it will return to the level of 1.1000 with a possible decrease to 1.0975.

The pound continues its ascent, but not with the same agility as yesterday. Positive European data can help it increase to the level of 1.3150 - 1.3175. However, it is worth waiting for its gradual return to 1.3025 in the medium term.