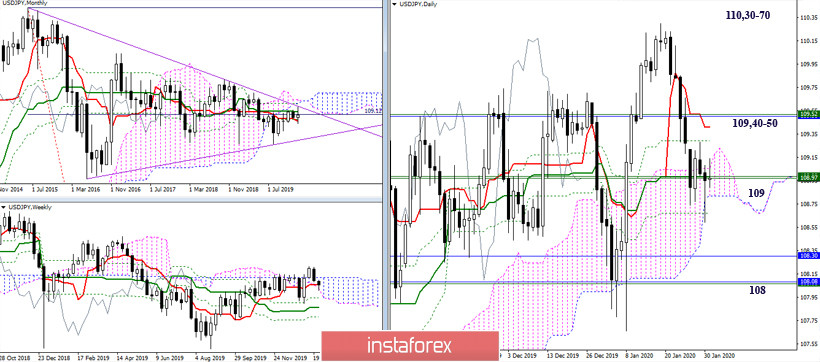

USD / JPY

The attempt of the players to increase initiated at the beginning of the year was unsuccessful. In January, they failed to rise above the final boundaries of the monthly Ichimoku cross (109.59 - 110.83), and also gain a foothold in the bull zone relative to the weekly cloud. Players on the rise were forced to retreat, so far they have questioned the preservation of the daily golden cross and the presence, albeit not higher, but at least in the cloud zone in the daily and weekly times.

Therefore, based on the situation, it can be noted that in February the couple will spend in the struggle for possession of area 109 (daily cloud + final boundaries of the daily cross + weekly short-term trend + lower boundary of the weekly cloud), followed by strengthening of the players to lower. The confrontation at the lines 109 can lead to a retest of the levels completed on the eve and a new testing of zone 109, 40-50 (daily Tenkan + weekly Senkou Span B + monthly Kijun). The nearest support zone, which will also try to defend bullish interests in the future, is located in the region of influence and attraction at level 108 (monthly and weekly cross levels) in February.

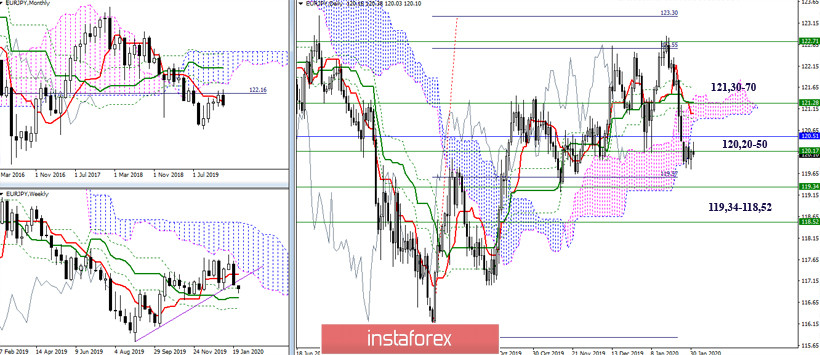

EUR / JPY

In January, the upward players retested the previously reached milestones in the region of 122.70-50 (the first target of the daily target for breakdown of the cloud + lower boundary of the weekly cloud), but after that, they passed the initiative to the opponent, who, it should be noted, managed to achieve good results. Due to which, it almost designated a rebound from a monthly short-term trend. As a result, if the fundamental component does not intervene, the main prospect for February may be the further strengthening of the bearish sentiment and the development of the started decline.

The interests of the lowering players will be aimed at eliminating the weekly golden cross (119.34 - 118.52) and fulfilling the daily bearish target for the breakdown of the cloud. The main influence and attraction now have an area of 120.20-50 (weekly Fibo Kijun + monthly Tenkan), Furthermore, in the case of a retest, the area 121.30-50 (daily cloud + daily cross + weekly Tenkan and Senkou Span A) will be important. A reliable fixation above can level the January achievements of the bears, which will require a new assessment of the situation.

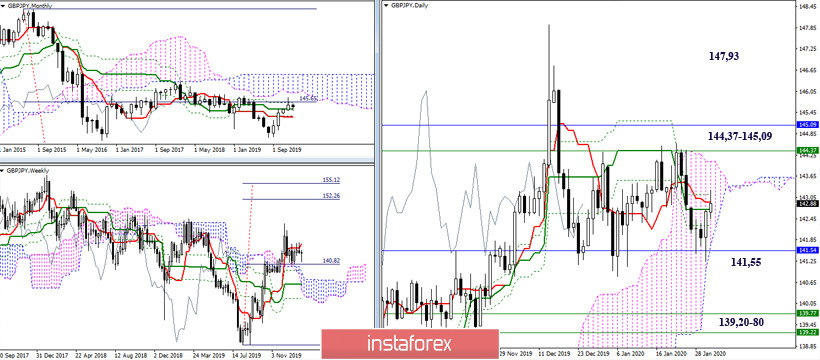

GBP / JPY

The pair failed to achieve great certainty in January and the whole month passed in consolidation and uncertainty. The support was the monthly medium-term trend (141.55), while the weekly Tenkan and the monthly Fibo Kijun (144.37 - 145.09) organized the upper limit for the movement. Therefore, in February, the reliable overcoming of these lines will be of paramount importance. The following significant landmarks are now located for players to increase in the region of 147.93 (maximum extreme), and for players to decrease by 139.20-80 (weekly Fibo Kijun and the cloud).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)