Asian exchanges supported large-scale sales on Monday morning, which does not give reason to expect a slowdown in risk aversion. On the other hand, Nikkei 225, Australian S & P / ASX 200 lost about 1% while the Shanghai Composite declined by more than 8% at once, throwing out a weekly accumulated lag due to the holidays.

Nevertheless, there are still no reasons to expect the completion of panic sales. Coronavirus spreads fast all over the planet, despite global quarantine measures. Commodity prices continue to decline, although demand for bonds and other protective instruments is high. The virus itself is hardly a "black swan", but it serves as a detonator for the accumulated negative processes in the global economy that have not disappeared after the 2008 crisis. Thus, we should expect a further fall in commodity prices and an increase in demand for gold and safe haven currencies based on the most probable development of events.

USD/CAD

The data on prices for industrial products published on Friday turned out to be positive. The prices rose by 0.1% (no changes were forecast), an annualized growth of 2.8% in December.

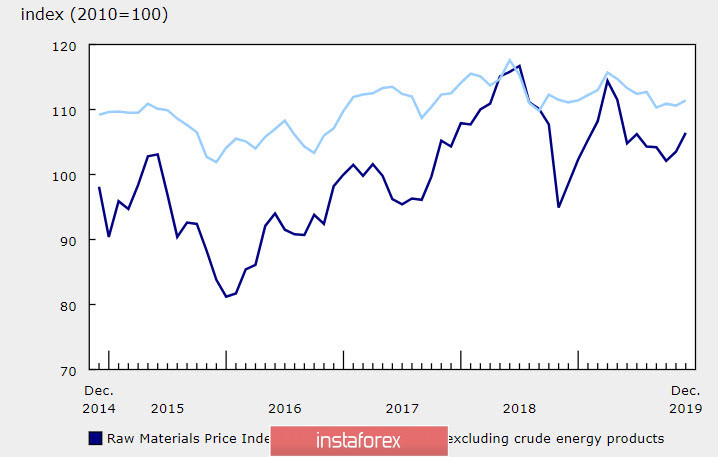

At the same time, we can't rely on the strengthening of the loonies yet. Oil traded in the red again on Monday morning, and price indices for December are outdated even before publication. Meanwhile, WTI crude oil declined 21% from the high of early January, while copper declined 12% in 12 consecutive days. Such strong movements led to overselling, which increases the chances of a pullback, but positive news is needed to implement this scenario, which is not there.

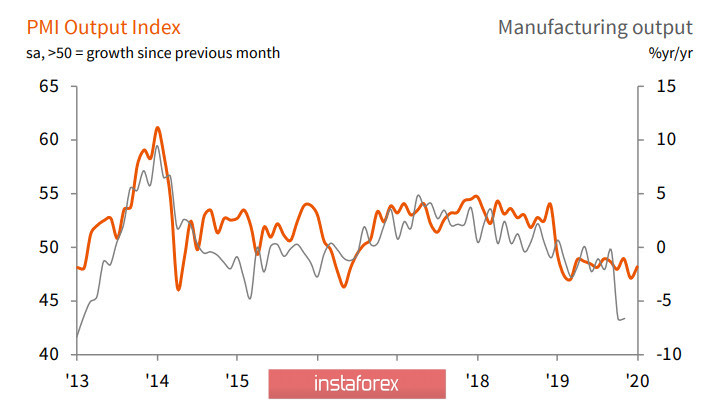

USD/CAD is likely to continue to grow, but the pace will slow down, and consolidation in a wide range of 1.3130 - 1.3327 is likely by the end of the week. Today, the PMI in the manufacturing sector will be published and it is expected to leave below the expansion zone to 49.6p. In addition, forecasts for the Friday employment report are negative, unemployment is expected to increase in December from 5.6% to 5.8%.

From the Bank of Canada, the Canadian dollar did not also receive any guidance. The speech of BoC representative Baudry last Friday looked moderately hawkish. Baudry said that the main goal of monetary policy is to control inflation, which, in fact, has long been known to everyone.

The short-term technical picture on USD/CAD remains bullish. The target is 1.3327, but first, you will need to break through the resistance 1.3270 / 80, where, perhaps, a short-term pullback will occur.

USD/JPY

Risk aversion leads to an increase in demand for defensive assets, which is why the yen is strengthening across the entire spectrum of the currency market. Macroeconomic data also does not contribute to the weakening of the yen, as it somehow supports the deflationary processes with which the monetary authorities of Japan have been unsuccessfully fighting for several decades.

Moreover, Tokyo's consumer price index rose in January by 0.6%, excluding food products - by 0.7%, both indicators are worse than forecasts and worse than December, given the slowdown in retail sales to -2.6% y / y. We can say that consumer activity has fallen and in the general case about declining demand.

The decline in industrial production in December slowed down to -3% YoY, but the January PMI Jibun Bank in industry declined from 49.3p to 48.8p again.

An amazing psychological phenomenon is noteworthy: despite the fact that new orders and production dropped to 7-year lows, which does not bode well for long-term economic prospects, business confidence has reached the highest level since August 2018.

USD/JPY cannot leave the trading range for 5 months already. Short-term bearish pressure remains pronounced, but if Europe opens with a pullback, the yen will try to stay above the resistance of 108.27 and roll back above the zone of 108.56 / 63. Any pullback should be regarded as an opportunity to sell - the chances of resuming growth remain low.