As expected, the end of the "holiday" of the Chinese New Year resulted in a collapse of the main stock indices for the local financial market, which fell by more than 8% at the moment.

Coronavirus continues to hang over financial markets, providing a direct and immediate impact on investor sentiment. It can be recalled that it is precisely the decline in business and production activity, primarily in China, that makes market participants worry about the prospects for demand for commodity and raw material assets, as well as company stocks.

We believe that while this topic remains in the top of the news, we should not expect a full recovery in demand for risky assets until the peak of this contagious disease passes.

Everything is still pretty predictable in the currency market. The exchange rate of the British currency, as well as the euro, rose significantly over the week. The main driver was the fact that Britain officially left the European Union on January 31. The political part of this three and a half years of the epic within the country has ended, and now, the long-term process of resolving trade and political contradictions begins, which will make itself felt more than once.

The question arises: should we expect continuation of growth of the euro and pound rates following Brexit's wave of certainty?

Of course, the points that have appeared over the political fact of Britain's exit from the EU may provide local support for both the euro and the pound, but they do not solve the complexity of old and new economic problems. Therefore, everything will fully depend on the situation in the economies of Britain and the eurozone, as well as in China and the United States as the leading countries of the world economy.

Today, important data will be published on business activity indices in the manufacturing sector of the eurozone, Germany, Britain and the USA. The Chinese indicator for the month of January declined more than expected to 51.1 points from 51.5 points. Thus, it can be assumed that if the data of this indicator also turn out to be negative in the countries listed above, this may stimulate the resumption of demand for gold, as well as shelter currencies, including the US dollar and government bonds of economically developed countries.

Forecast of the day:

The USD/JPY pair is trading below the level of 108.55. We expect the continuation of a prospective reduction in prices to 107.95 in the wake of the continuing negative impact on the markets of the coronavirus situation.

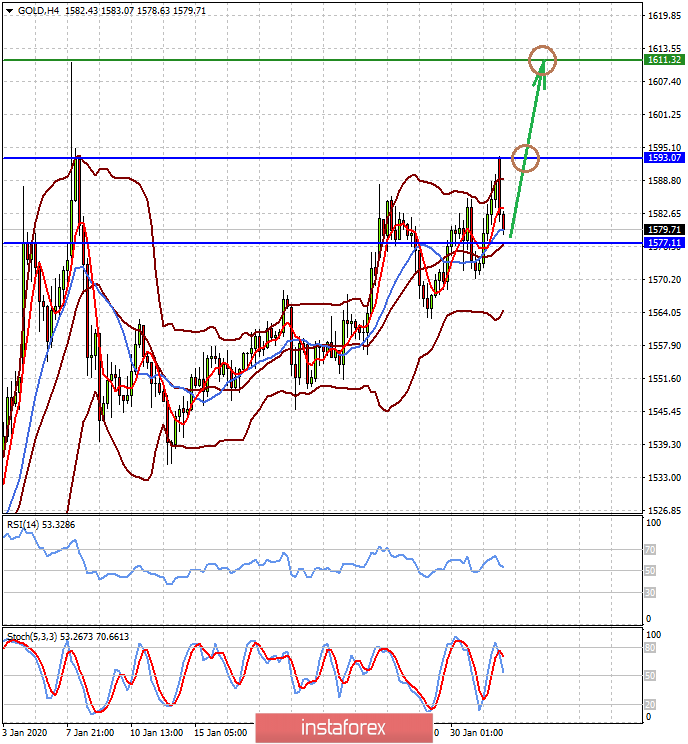

Gold on the general wave of positivity has the potential to resume growth if, from a technical point of view, holds above the level of 1577.10. In this case, we should expect the resumption of price growth, first to 1593.00, and then to the recent maximum of 1611.00.