To open long positions on GBP / USD, you need:

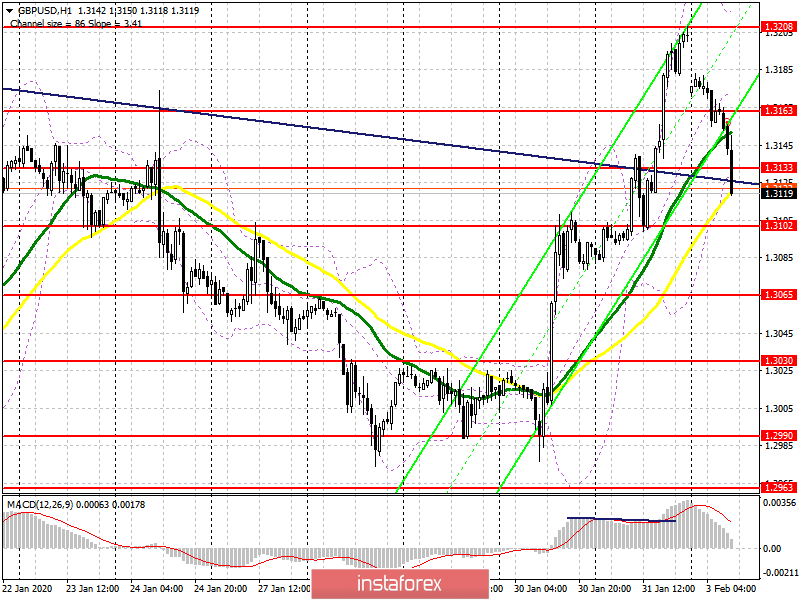

Britain's exit from the EU was marked by strong bullish growth and a breakthrough in the upper boundary of the medium-term triangle, which will help the bulls in the future to build a new wave of growth. Currently, buyers are required to maintain the level of 1.3102, a test of which will happen in the near future. The formation of a false breakdown at this level can return to the market players who are betting on further growth, but if there is no activity in this range, it is likely that the pair will fall even lower to area 1.3065, where I recommend opening long positions immediately for a rebound. An equally important goal of buyers will also be the resistance level of 1.3133, consolidation on which will push GBP / USD to a maximum of 1.3163 and allow counting on a quick return of the pair to 1.3208, where I recommend taking a profit.

To open short positions on GBP / USD, you need:

Fast profit-taking after Friday growth so far plays on the side of pound sellers, since Britain's exit from the EU itself is only part of the main problem. Now the bears are focused on the support area of 1.3102, where they can meet active resistance from buyers. Fixation below this level will quickly push GBP / USD down to the support area of 1.3065, where I recommend taking profits. Under the pound growth scenario in the morning, the area 1.3133 will become a good level for protecting its short positions, from where I recommend opening short positions only if a false breakdown is formed. Selling the pound today immediately on the rebound is best from a maximum of 1.3163.

Indicator signals:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, and so far they have not actively supported the pound.

Bollinger bands

Growth will be limited by the upper level of the indicator at 1.3170. A break of the lower border of the indicator in the region of 1.3133 has already led to an instant sale, which puts additional pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20