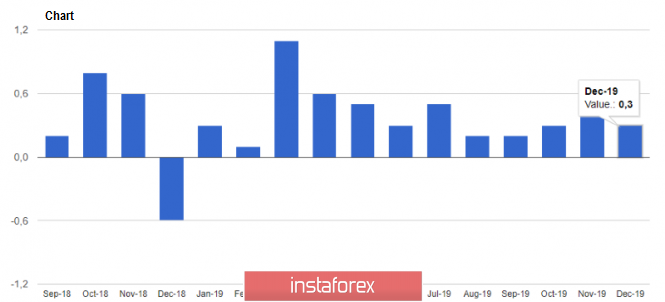

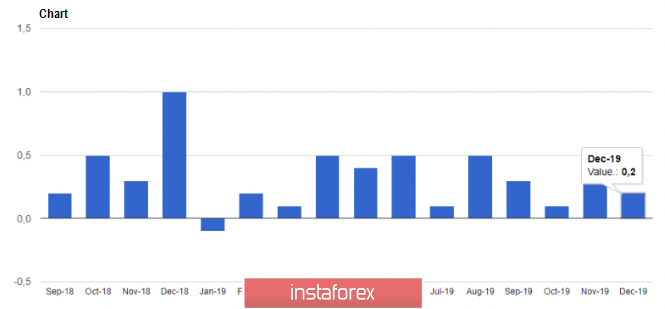

The US dollar ignored the fact that a good growth in spending and wages of Americans will support the economy in the medium term. On Friday, a report from the US Department of Commerce was released, stating that at the end of last year, personal spending by Americans increased by 0.3% compared to the previous month. There was also good income growth, where the index increased by 0.2%, while economists had expected a growth of 0.3%.

The Ministry noted a rather sluggish holiday shopping season, but this did not significantly affect the indicator. A slight decrease was observed for durable goods, while at the same time, expenses on services increased by 0.3%. As for the overall figure for the year, household spending increased by 0.4% n 2019, as compared to 2018.

The data on the index of labor costs did not please traders. The US Department of Commerce noted a fairly modest increase in costs in the 4th quarter of 2019. Thus, the index of expenditures from October to December increased by 0.7% compared to the previous quarter, which fully coincided with the forecasts of economists. Compared to the same period of the previous year, labor costs increased by 2.7%, which is slightly slower than the 2.8% growth that was observed in the 3rd quarter.

The US dollar ignored the good report on the American's assessment of the economy's prospects. According to the data from the University of Michigan, the final consumer sentiment index came close to 100 points, amounting to 99.8 points against its former 99.3 points. This is in contrast to economists' expectation of a decline to 99.1 points. The decline was observed only in the index of current conditions, which fell to 114.4 points against 115.5 points at the end of December. Low unemployment, interest rates, and a gradual increase in household wealth have a positive effect on consumer opinion.

On Friday, a report on the Chicago purchasing managers' index (PMI) was also released, a leading indicator of economic activity. According to the data, the Chicago PMI in January of this year fell to 42.9 points, compared to 48.2 points in December. Let me remind you that the value below 50 indicates a decrease in activity. Economists had expected the figure to be just 48.5 points. The decline was mainly due to a sharp drop in the sub-index of outstanding orders. There was also a decline in the sub-indices of the commodity-material stocks.

The speech by Fed Vice Chairman Richard Clarida was also ignored by traders. Clarida once again stressed the relevance of the current interest rate policy, which will contribute to further growth of the economy. He also drew attention to the good performance of the labor market, which, in his opinion, has not yet reached the level of full employment.

As for the technical picture of EUR / USD, the correction scenario will be supported by the area of 1.1060, but larger buyers of risky assets can release the market to the lows of 1.1035, where most likely, a new lower border of the current upward channel will form. The bulls' return to the resistance level of 1.1090 will open a direct path for the pair's growth to the area of the highs of 1.1115 and 1.1140.