Hello, dear colleagues!

Monday's trading session was marked by the US dollar. It rose against all major currencies except the Australian dollar.

Against the background of improving risk sentiment, the safe-haven currencies, the Japanese yen and the Swiss franc in particular, have lost their appeal to investors. Meanwhile, Chinese authorities are doing everything possible, and sometimes impossible, to stop the coronavirus epidemic. Such actions have a positive effect on the mood of market participants. At the moment, 305 people have already died from this terrible epidemic, and it seems that this is still far from the limit. Unfortunately.

If we turn to yesterday's statistics, the data on the production index of the Institute of Supply Management (ISM) in the United States exceeded the experts' expectations of 48.5. The indicator came out at the level of 50.9.

Today, at 11:00 London time, data on producer prices in the Eurozone will be published, while production orders in the United States will come out at 16:00 London time. Let me remind you that the main event of the current trading week will be the data on the US labor market, which will be published on Friday at 14:30 London time.

In the meantime, let's move on to the charts of the EUR / USD pair and start with the daily timeframe.

Daily

No matter how hard the euro's bears tried yesterday, they still failed to gain a foothold above the green support line of 1.0879-1.0981. I believe that in addition to the specified line, the exponential moving average and the lower limit of the daily cloud of the Ichimoku indicator also played an important role as resistance.

Thus, yesterday's recommendation to consider EUR / USD sales from the 1.1095 area was correct.

The current support for the EUR / USD pair is provided by the Tenkan line of the Ichimoku indicator, where a fairly good rebound occurred yesterday. If today, the quote falls below this line and the trades close below it, it is time to expect a further decline to the support line of 1.0992, where the breakdown of which will finally determine the bearish direction of the pair.

In case of an upward scenario, another attempt will follow, to return above the green support line. There will be a breakout of the 89 EMA, and a close of trading within the Ichimoku cloud. Successful implementation of this plan will make the Kijun line, which is located at 1.1115, the next goal for players to increase the rate. However, it is too early to talk about further goals.

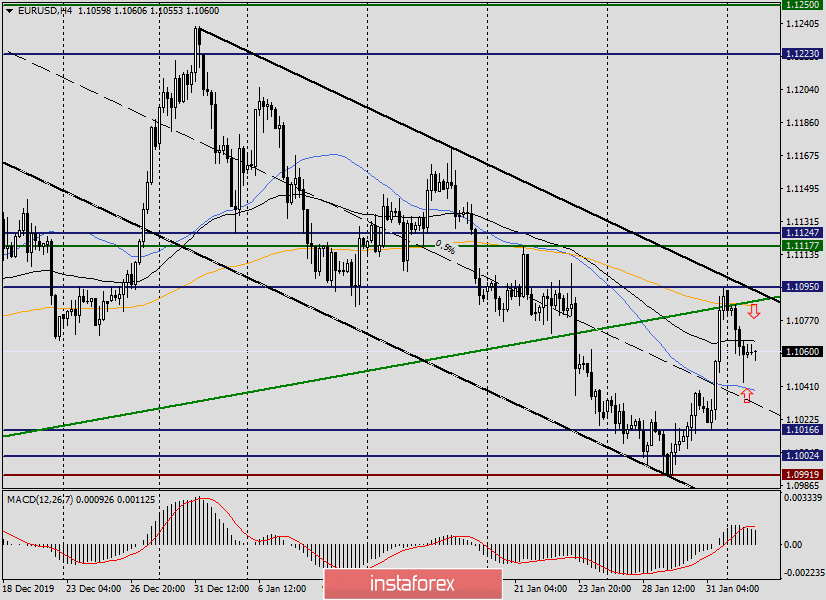

H4

On this timeframe, the pair is trading in a downward channel, with the parameters: 1.1237-1.1172 (resistance line) and 1.0992 (support line). The arrows mark the options for opening positions. Since the situation for the pair is unclear, you can consider both purchases and sales. Purchases look good when falling to the middle line of the channel (dotted), where there is also a 50 simple moving average, which can provide good support. The support levels 1.1016 and 1.0992 can be further options for opening long positions on the EUR/USD. However, I believe that these are more risky options for purchases.

For sales, in my opinion, the best option for opening short positions is to raise the rate to the area of 1.1085-1.1095. As we can clearly see on the chart, the same green support line is still there, and the breakdown of which is still in question. Moreover, the upper border of the descending channel, the 200 exponential moving average, and the resistance level of 1.1095 are still there as well. I believe that all of the above can provide strong resistance and turn the quote downwards.

At the moment, sales from the area of 1.1085-1.1095 seem to be the most relevant option. As I expected yesterday, the EUR/USD pair has a better chance of strengthening at the end of this week. However, a lot will depend on Friday's data on the US labor market.

Good luck!