It seems that the assurances of the Chinese authorities, as well as the prevalence of coronavirus both China and the world, as well as the percentage of deaths to the number of infected people, had a positive impact on the mood of investors.

The current situation with the coronavirus is likely to remain under the control of the Chinese authorities and not gain significant distribution in the world, which can lead to a change in sentiment in the financial markets and facilitate energetic purchases of risky assets, primarily shares of companies. In addition, the economic statistics in the US and Europe presented on Monday are encouraging.

If the published values of the business activity index in the manufacturing sector (PMI) from Caixin of China showed a slowdown to 51.1 points from 51.5 points, which raised concerns about the prospects for deepening negative trends in the Chinese economy, then the same indicators for a number of economically strong countries in Europe and, of course, in general, they were above forecasts in the eurozone and in the United States. They led to increased optimism in the financial markets and increased demand for risky assets.

We believe that if the situation around the coronavirus begins to smoothly "deflate", then we will most likely see continued active purchases of previously cheaper shares of companies. At the same time, quotes of crude oil may remain at current values or even "fail" even lower due to the expectation of a slowdown in the Chinese economy from the effects of coronavirus, since China is the largest consumer of oil and petroleum products in the world.

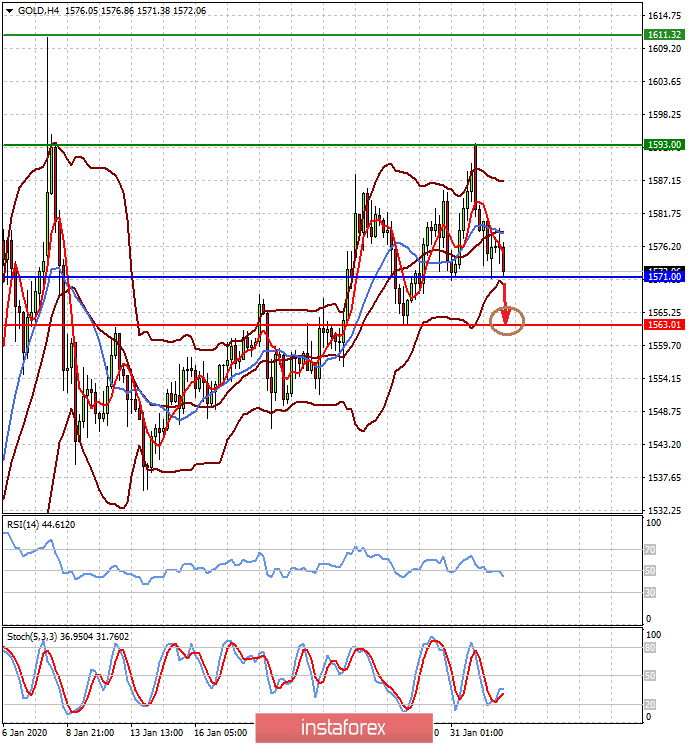

Therefore, stabilization of the situation in the financial markets may become the basis for further local reduction in gold prices. At the same time, commodity and commodity currencies, in the wake of maintaining the exchange rates of monetary policies of the RBA, RBNZ, and also, probably, the Central Bank of the Russian Federation, can receive support and resume the upward trend after significant decreases earlier. On the contrary, the Canadian dollar may suffer even more if oil quotes continue to decline.

With regard to eurocurrency and pound, it can be noted that the market has completely worn out the Brexit topic and will now closely monitor the situation in the economies of the eurozone and Britain, and since there are many potential pitfalls, we expect that the period of consolidation of these currencies in pairs with US dollar will remain in the short term.

Forecast of the day:

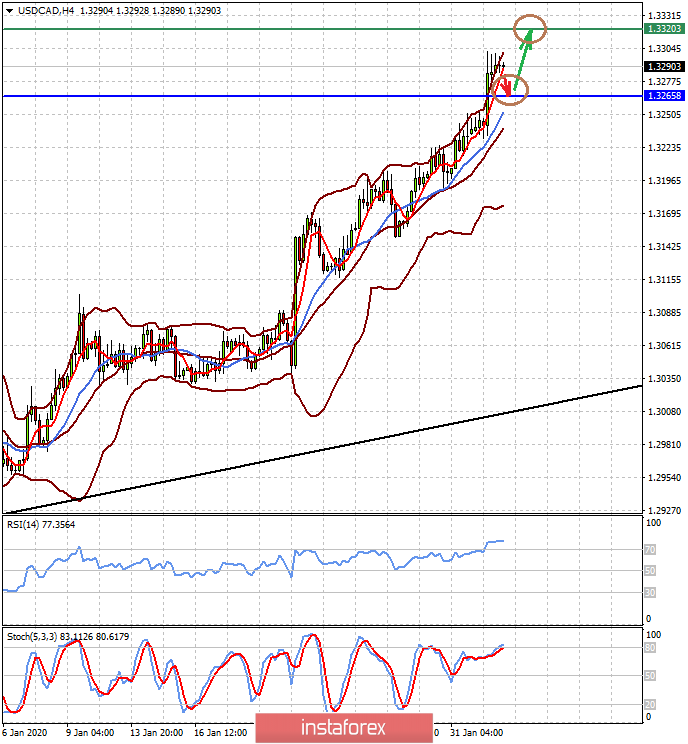

The USD/CAD pair remains in a short-term upward trend in the wake of a prospective decline in crude oil prices. Moreover, maintaining the current state of affairs may force the pair to continue growth to the level of 1.3320 after some correction to 1.3250-65.

Gold is trading above the level of 1571.00. Prices may continue to decline to 1563.00 if positive market sentiment continues. If the mood worsens again, then gold will move quickly around 1593.00 again.