Economic calendar (Universal time)

There are no important indicators in today's economic calendar.

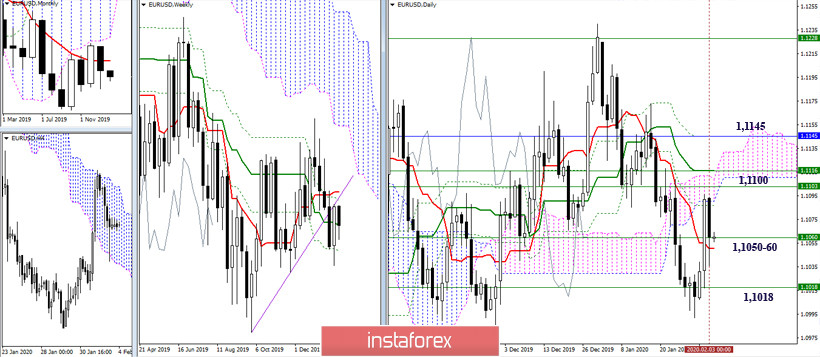

EUR / USD

Yesterday, the euro showed a fairly deep decline. Perhaps, the players on the downside will be able to prove that the rise was only a retest of the passed levels and that the situation is not able to lead to a change in mood over a long period of time. At the moment, support and attraction is provided by the area 1.1060-50 (weekly Kijun + day Tenkan), then the level 1.1018 (weekly Fibo Kijun) plays an important role among the supports. Today, resistances remain still concentrated within 1.1100-45 (daily cloud + final borders of the daily dead cross + weekly Tenkan + monthly Tenkan).

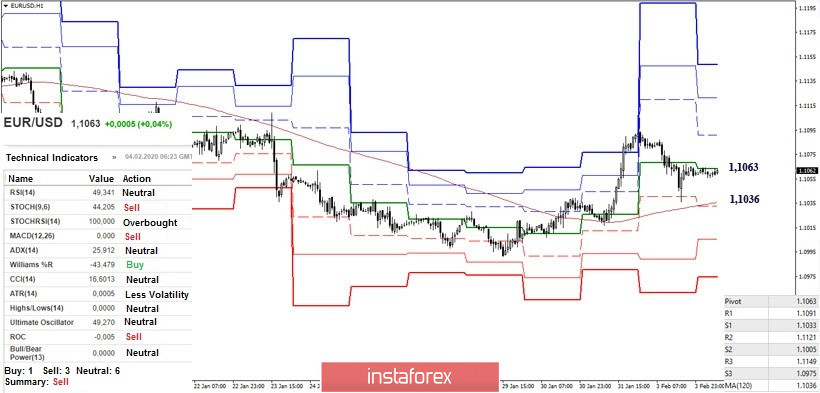

In the lower halves, the pair is between the key levels - 1.1063 (central Pivot-level of the day) and 1.1036 (weekly long-term trend). These levels determine your current preferences. Now, the initial advantage is on the side of the bears, while there is a reliable consolidation below 1.1036 and a reversal of moves will allow them to significantly strengthen their positions. Further support is located today at 1.1005 (S2) - 1.0975 (S3). In this situation, it is important for the players to increase not only to regain the central Pivot (1.1063), but also to leave the zone of downward correction (1.1096 maximum extremum).

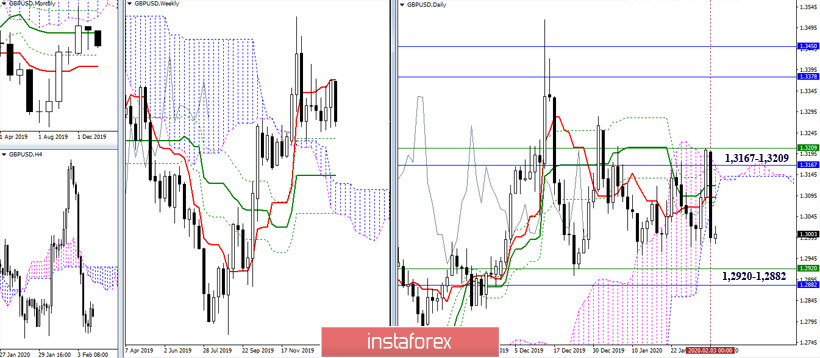

GBP / USD

It seems that the optimistic uplift of the players was only based on the desire of some to successfully close the week and month. Due to the weakness of the bulls in the long run, players on the downside not only maintained their position in the consolidation zone, but also returned the situation to its lower borders. Now, perhaps, the consolidation will continue for some time. To change the current situation and the emergence of new prospects, it is still important to leave the zone of prolonged confrontation and uncertainty, having firmly established itself behind its borders, which can be designated as 1.3167 - 1.3209 (monthly Kijun + weekly Tenkan + daily cloud) and 1.2920 - 1.2882 (weekly and monthly Fibo Kijun).

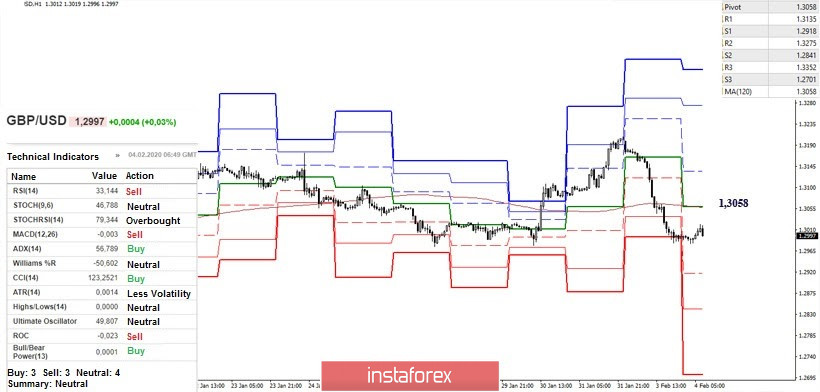

The benefits are currently on the downside. The continuation of decline and restoration of the downward trend will return relevance to the support of the classic Pivot levels, which are located at 1.2918 - 1.2841 - 1.2701 today. On the other hand, the lower key resistance today joined forces at 1.3058. Consolidation above can change the current balance of forces and delay the development of the situation.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)