Indeed, this already ceases to be ridiculous, and it even came to a direct accusations from Beijing against Washington that the United States deliberately creates a panic through the American media. China directly called out the way the information related to the coronavirus and information attack is covered and presented. At the same time, it cannot be denied that this is really about hysteria and panic, and can be observed in the status of the financial markets, which are still performing very poorly and we are witnessing an almost stampede. Frightened to hell investors are in emergency mode to close their positions around the world. Most of them are actively in Asia. They want to transfer funds where, in their opinion,is the most secure. And this, oddly enough, is the United States. This was the same case during the Second World war, thus, the sharply increased demand for the dollar led to its significant growth.

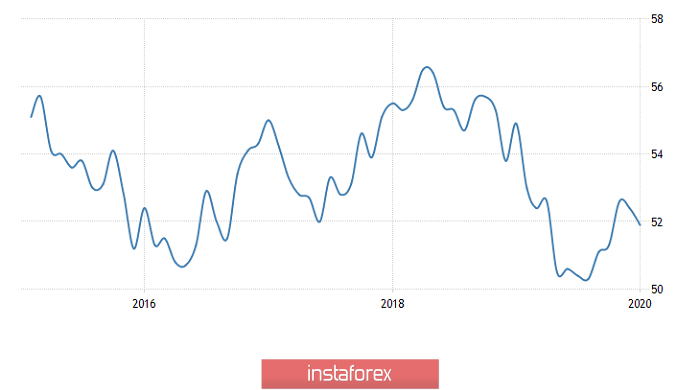

It should be noted that it was informational noise that became the reason for the strengthening of the dollar, since fundamental economic factors indicated rather a different development of events. Thus, the index of business activity in the manufacturing sector of the euro area rose from 46.3 to 47.9. They were waiting for growth, but only to 47.8.

Manufacturing PMI (Europe):

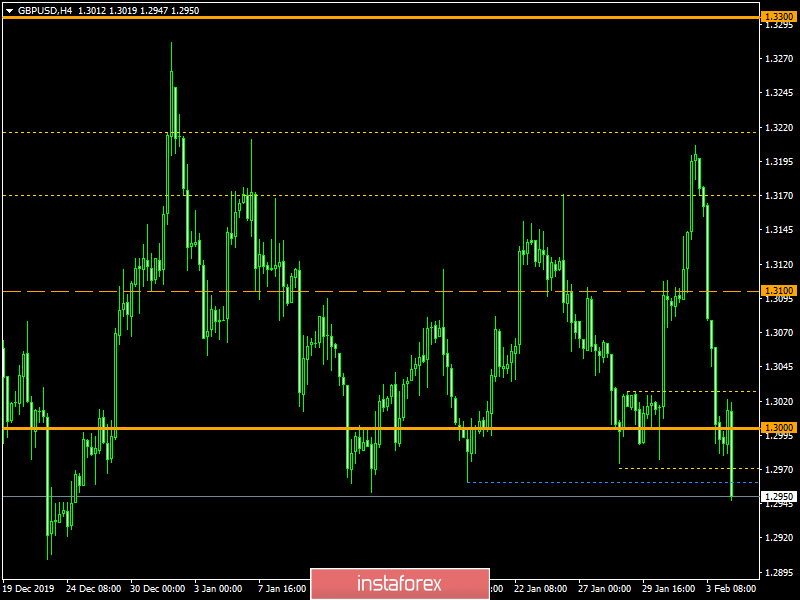

The situation is similar with the pound, as the index of business activity in the UK manufacturing sector rose from 47.5 to 50.0 instead of 49.8. However, yesterday, the pound set a record for the scale of weakening against the dollar.

Manufacturing PMI (UK):

For such achievements, the pound should only thank Boris Johnson, who decided to declare that the trade part of the agreement with the European Union should be written in London, and Brussels is simply obliged to accept it. He argued with such a bold statement that, supposedly, the British standards of quality of goods and services, as well as the centuries-old traditions of liberalism, bring the British economy to such a high level that other countries must still grow and grow. Simply put this way, Boris Johnson wants trade relations to be regulated precisely by British standards, especially in terms of certification and licensing.

Naturally, all these certificates and licenses will be issued by purely British services, both public and private. This simply means that the UK can use this tool to regulate imports, as well as European companies access to the British market. British companies themselves will not have any barriers to their activities in the European market. It is clear that such greyhound statements did not go unnoticed by Brussels, and the chief negotiator from the European Union gave a rather tough answer. Michel Barnier said that he did not understand what Boris Johnson was talking about, and generally advised him to buy a lip-rolling machine. Of course, the wording was a little different, but the essence is understood. The European Union does not intend to make any concessions and will impose on London such a trade agreement that suits Brussels specifically.

Moreover, Brussels's position is much better, only for the reason that the European Union has a much larger economy and domestic market size. If European companies lose the British market, they will be able to compensate for this with the place that will free up capital from the United Kingdom on the continent. And again, due to the size of the markets, it is British capital that is losing the most.

Time plays on the side of Brussels, since it is necessary to have time before the end of this year. If until this time London does not knock out at least some goodies, then British companies will find themselves in the position of entrepreneurs from Africa and access to the European market will be practically closed for them. Voicing the position of Brussels, as well as the wishes of London, and became the reason for the strong weakening of the pound. And oddly enough, this situation perfectly illustrates why for three and a half years, the parties have not been able to get off the ground in matters of trade. And one gets the feeling that they will not move.

However, even if we do not take into account European statistics, the dollar really had no reason for growth. The index of business activity in the manufacturing sector decreased from 52.4 to 51.9. In fairness, it should be noted that they expected a slightly larger decline, to 51.7. Nevertheless, the picture doesn't change much from this, since it is still a decrease, while in Europe the index is growing.

Manufacturing Business Activity Index (United States):

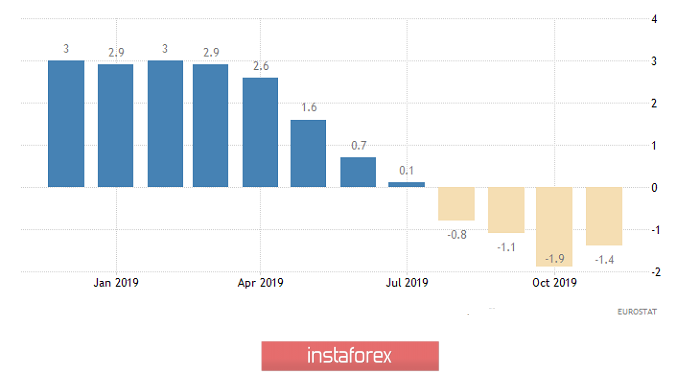

It is clear that at the moment it is the media, or rather how they cover the situation with the coronavirus, that are decisive for the markets. And this whole situation clearly demonstrates that it is time to rename them all into mass media and disinformation. Nevertheless, a rebound has clearly matured in the market, and if the mass media of agitation and misinformation do not intensify the passions, then there will be many reasons for this rebound. Thus, in Europe, a slowdown in the decline in producer prices is expected from -1.4% to -0.5%, which increases the likelihood of further inflation growth.

Producer Prices (Europe):

Great Britain also expects good news in the form of growth from 44.4 to 45.1 index of business activity in the construction sector. Given that it is directly related to the real estate market, which is the main criterion for determining the investment attractiveness of the United Kingdom, then this is definitely a positive factor.

Construction sector business activity index (UK):

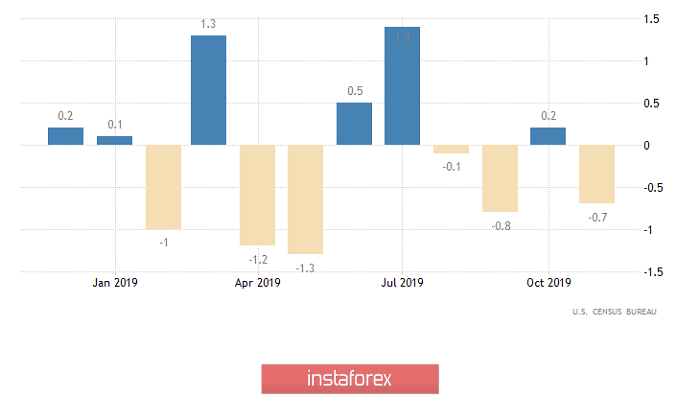

Meanwhile, in the United States, not everything is so bad since factory orders can increase by 0.9%. However, this is not such a significant indicator, and it will be published quite late. So even without information hysteria, this indicator could not have any impact on the market.

Factory Orders (United States):

The EUR / USD currency pair once again found a resistance point in the region of the level of 1.1080, where after a short deceleration, the downward movement resumed. It is likely to assume a temporary fluctuation in the direction of 1.1040-1.1050, where in the case of confirmation of a positive news background, a reverse move to 1.1060-1.1070 may occur. Otherwise, downward interest will continue.

The GBP / USD currency pair showed extremely high volatility, where, against the background of the inertia, the quotes managed to go down to the psychological level of 1.3000. It is likely to assume that overselling is already on the market, but if the price is fixed lower than 1.2950, the inertial stroke may persist. An alternative scenario is considered in terms of temporary impulses with a return price return above the control level of 1.3000.