Hello dear traders!

Today at 03:30 UTC, the Reserve Bank of Australia (RBA) announced its decision on the basic interest rate, and also issued an Accompanying Statement.

As expected, the RBA did not change the parameters of its monetary policy, and the discount rate remained at the same level of 0.75%.

As for the Accompanying statement, the Bank noted that it is ready to ease monetary policy if necessary. The RBA also said that current rates are appropriate for this time period and will remain so for a specific time only.

This year, Australia's economy is expected to reach 2.75% and around 3% by 2021. In terms of this year's inflation as well as the next, the RBA hopes it to be close to 2%.

The bank intends to continue to monitor changes in the country's labor market, and the current level of unemployment as the bank's economists assume that it will remain in a certain amount of time.

The Australian Central Bank noted the negative impact of low-interest rates on the rate of its national currency, and forest fires and coronavirus were identified as the main risks. The trade war between the US and China is a major uncertainty for the global economy.

These are so far all the main points of the Australian Central Bank, and now we move on to analyzing the price charts for the AUD / USD currency pair.

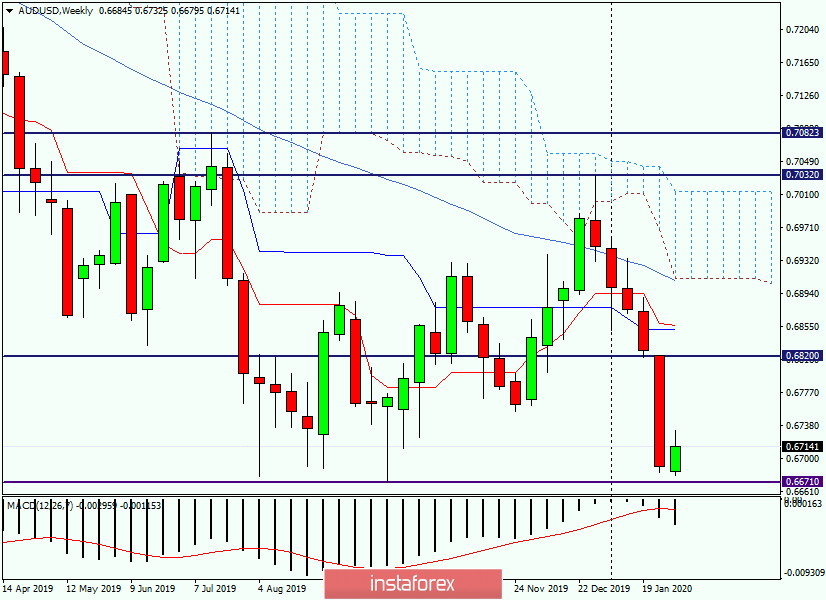

Weekly:

As can be clearly seen on the weekly timeframe, the pair completed the last five-day trading with a rather impressive decline. The course was close to reaching a key support level near 0.6670 but still failed to test its strength. From 0.6679, the Australian dollar began a recovery that continues at the time of this writing.

Given the strong decline last week, the immediate target of the Aussie bulls will be the January 27–31 highs at 0.6820. A further target of possible growth will be the price area of 0.6852-0.6856, where the Tenkan and Kijun lines of the Ichimoku indicator are located.

A break in the support level of 0.6670 and consolidation below this level will signal the persistence of bearish moods in the pair.

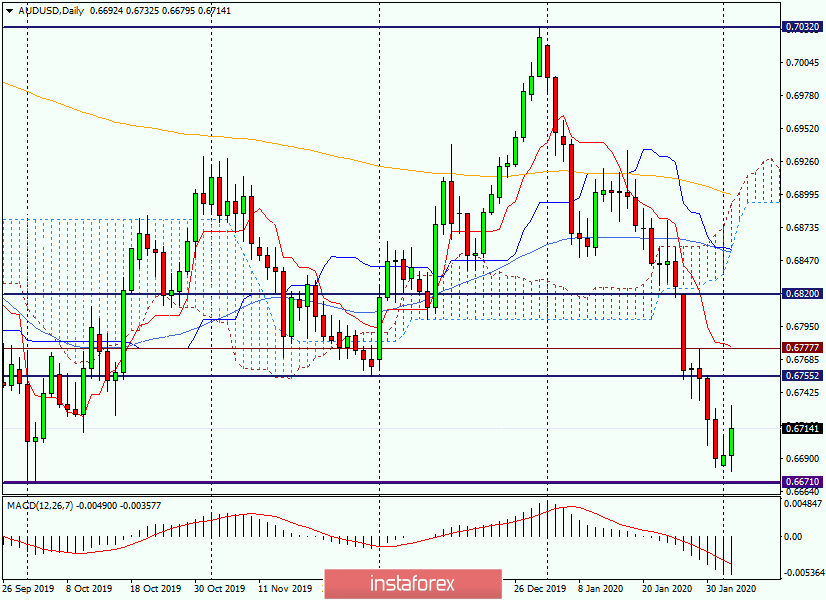

Daily:

After yesterday's "Hammer" candle with a bull's body, which is a reversal model of candlestick analysis, the pair's growth is really observed today and it's pretty good. In many ways, this is the reaction of market participants to the decision of the Reserve Bank of Australia at the interest rate and the Accompanying Statement.

However, in my opinion, there was no significant bullish rhetoric in the comments of the RBA, but the market counted as it counted. It seems that the technical factors influenced the strengthening of the pair to a greater extent as the previous rather protracted downward dynamics, as well as the proximity of the strong support level of 0.6670. As you can see, after reaching today's highs at 0.6732, the quotes slightly decreased, and at the time the review is completed, trading takes place near 0.6717 / 15.

In an upward scenario, the nearest targets will be the levels of 0.6755, 0.6777 and, possibly, 0.6820. If the market for the AUD / USD pair is again under the control of the bears, we should expect a decline towards the support level of 0.6670. Perhaps this significant mark will be tested for a breakdown. Important American statistics are not expected today, except for production orders, so trading is likely to be influenced by market sentiment, technical factors and reports on the situation with the coronavirus.

For trading ideas, I can offer purchases from current prices (0.6715), but I note that, despite some euphoria from the decision and comments of the RBA, a bearish trend continues in the pair.

Based on this, I consider the most relevant sales after the pair rises to the levels of 0.6755, 0.6777, 0.6800, 0.6820 and 0.6830.

Successful and profitable trading!