USD / JPY

Due to the general pressure of the dollar and the growth of the stock market, the USD / JPY pair jumped 81 points yesterday. The dollar index, on the other hand, gained 0.12%, and an additional 1.50% on the S&P 500. Today, Nikkei225 is growing at 1.35%, and even the Chinese Shanghai Composite Index is gaining 0.45%.

We believe that optimism on the Asia-Pacific stock markets is temporary. The coronavirus itself is not so terrible as the consequences for the Chinese economy after unreasonably harsh measures to overcome its spread. According to pessimistic estimates, 2/3 of the Chinese economy is paralyzed, and the volume of bad loans is expected to increase to 6.3%. Of course, China can gloss over the following statistics, but this will not change its overall negative picture. So the January Manufacturing PMI has already shown a decrease from 51.5 to 51.1. Services PMI has worsened from 52.5 to 51.8, and on Friday the most important data on the trade balance for January will come out where the forecast for Trade Balance is 36.8 billion dollars against 46.8 billion in December.

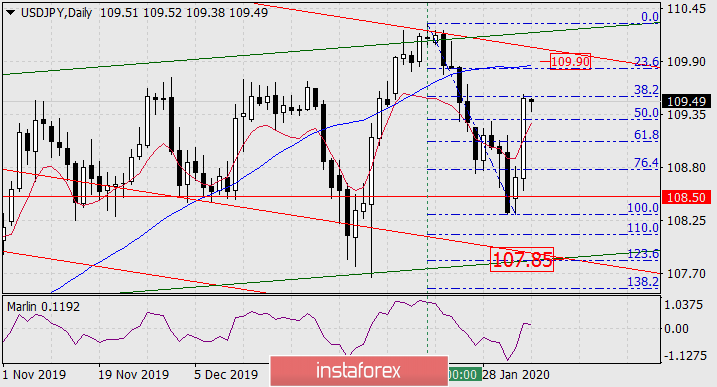

Thus, this makes the situation on the yen look shaky. The price increase up to the peak of January 17 (110.30) is corrective in nature, even if it is part of the trend movement from last August.

It is observed on the daily chart that the correctional price increase was 61.8% (in the figure, due to the overturn of the grid 38.2%). Perhaps this is where the price will unfold. But higher are the stronger resistances with the correctional level of 76.4% which is equivalent to 23.6% in the figure and at 109.90 in the MACD line. Turning the price down will once again direct the price to the area of attraction of the price channel lines and the Fibonacci reaction level of 123.6% at 107.85.

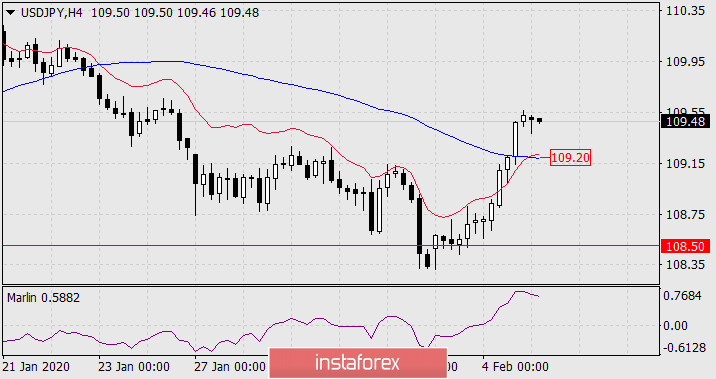

Price-fixing below the MACD line of 109.20 on the four-hour chart, will be a sign of the development and strengthening of the falling scenario. At the moment, the situation is neutral.