The growth of stock indices shows signs of correction after a major failure at the beginning of the week. Thus, the probability of a new wave of collapse remains high. In turn, positive reports of the production ISM added positivity, preparations for the OPEC and meeting are pushing up oil prices, but at the same time, demand for government bonds remains high while gold futures resumed growth, failing to get to support 1546.

Today, key reports that could affect expectations for the US labor market will be published - ISM in the services sector in January and ADP in private employment. ISM is projected at 55p.Meanwhile, significant growth in new orders is expected. This rather optimistic position will support the dollar if confirmed, as it will increase the chances of a strong employment report on Friday.

NZD/USD

The RBNZ will hold a regular meeting on monetary policy in a week. The markets assume that the rate will remain at the current level of 1%, because the New Zealand economy looks confident in a number of key parameters.

In particular, the housing market is recovering steadily against the background of eased financial conditions, the ore market and inflation which have positive dynamics. Moreover, RBNZ has the opportunity to remain in the observer position in the current conditions. In general, the situation looks like that RBNZ will be able to revise its forecasts in the direction of improvement and the market can formulate its expectations in the form of an increase in demand for kiwi in the coming week.

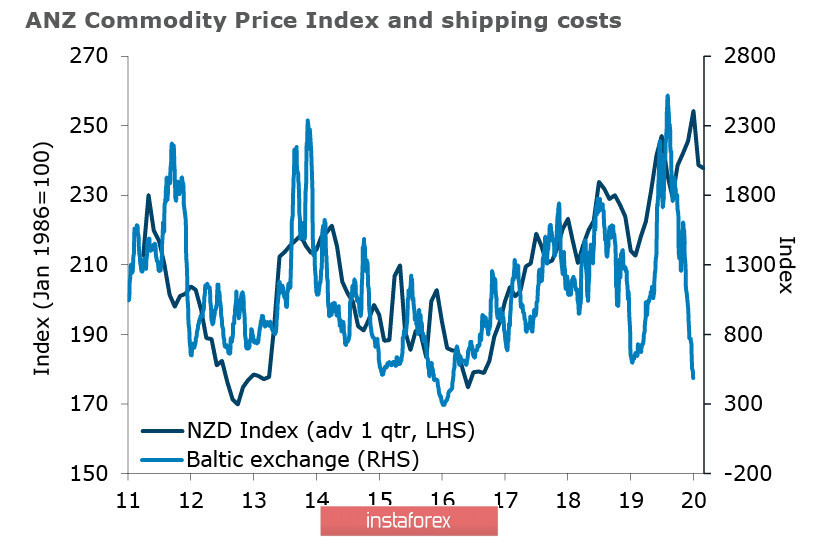

These considerations apply only to the internal situation. External factors are negative, primarily the threat of a deterioration in the trade balance due to falling demand from China, which is actively fighting the epidemic of coronavirus. Dairy prices declined 4.7% at the last auction, the Baltic Dry Index, reflecting global demand, also declined by 55% in January, which directly indicates a strong slowdown in world trade.

Positive news will facilitate the transition of NZD/USD trade to the sideways range. The negativity will allow resuming the decline, so we are not talking about the conditions for growth. At the same time, the resistance is at 0.65, but its passage is unlikely. Therefore, the kiwi is likely to return to the recent low of 0.6451 and make an attempt to go lower with the target of 0.6318.

AUD/USD

Following the meeting on February 4, the RBA left the rate unchanged again at 0.75%. The RBA maintains an optimistic outlook on the Australian economy despite large-scale forest fires and the growing threat of the coronavirus epidemic. According to the Bank, this year GDP will grow by 2.75%, and by 3% next year. The employment situation will improve, and inflation will return to the target range of 2 - 3%.

In addition, RBA also commented on the current situation, emphasizing that monetary policy is already stimulating, and given the inertia of the economy's response to monetary incentives, one just needs to be patient.

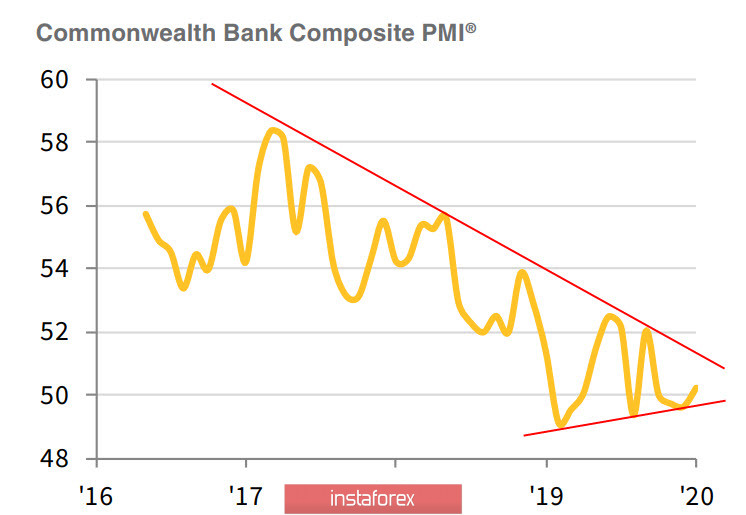

It would seem that the recent data confirm the validity of the position of the RBA. The Commonwealth Bank PMI index increased above 50p in January, and perhaps, the bottom has already been found. At the same time, the long-term downward trend, which began in 2017, is not in doubt.

The RBA position is not shared by all banks that are active in Australia. For example, NAB Bank believes that the state of the economy will be significantly worse than the RBA forecasts and the main reason is the weak demand, which, in turn, is a consequence of low incomes. Moreover, NAB believes that this weakness will become apparent in the very near future, which will force the RBA to lower the rate at the next expanded meeting in April.

Today, RBA head Lowe will give a speech on the current economic situation on Thursday. The December reports on the trade balance and retail trade will be in focus, while on Friday, AiG will present its own data on PMI. RBA commentary on the current monetary policy will also be published.

AUD/USD won back part of the losses on the last day, but the growth is unstable and may end at any time. The resistance is at 0.6753. In case of attempts to grow, it is possible to sell with the target of 06669, and an attempt to break through which with a high probability will be made in the near future. As a result, there are no reasons to rely on the fact that the wave of panic has already subsided.