Yesterday was incredibly exciting and eventful. Here, you have macroeconomic statistics and a review of candidates for the presidency of the United States from the Democratic Party. In short, I did not have to get bored. However, everyone had their own result. The pound was able to strengthen its position, but there is no single European currency. And no matter how ridiculous it may sound, this result fully fits into the logic of published macroeconomic data. But first things first.

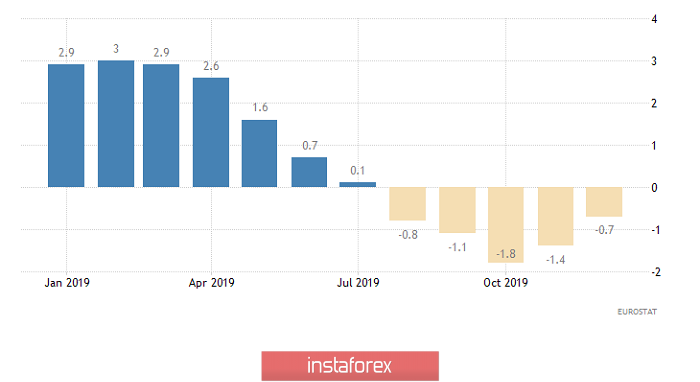

The weakening of the dollar began even before the index of business activity in the UK construction sector was published, as forecasts for European statistics were purely positive. But in fact, everything turned out to be even better, as the index of business activity in the construction sector increased from 44.4 to 48.4, and not to 45.1. The index itself is directly related to the real estate market, which is the main criterion for determining the investment attractiveness of the United Kingdom. Thus, the improvement of sentiment in this industry directly suggests that they will build more, which means there is a demand for housing. Consequently, housing prices will rise. Including previously acquired investment property and so, the optimism of the pound is understandable.

Construction sector business activity index (UK):

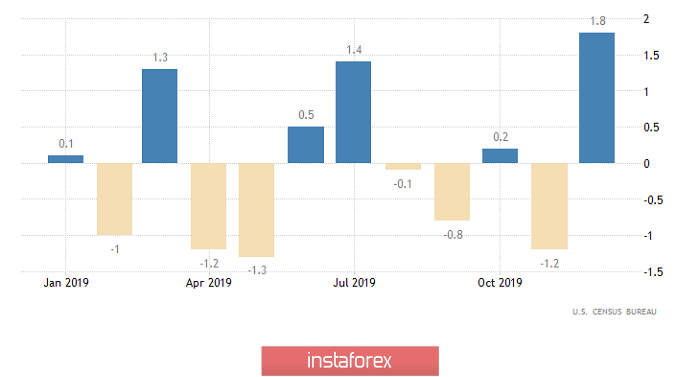

The single European currency did not increase so actively, although the pace of decline in producer prices slowed down from -1.4% to -0.7% which coincided with the forecasts. Although the pace of decline has slowed, indicating the prospects for further inflation, this is still a decline in prices. This has been going on for several months. On the other hand, such dynamics clearly indicate that the European Central Bank will clearly not reduce the refinancing rate. Rather, on the contrary, it's time to think about the prospects for raising interest rates. This is what the representatives of the European Central Bank tell us. Nevertheless, the decline in producer prices has been ongoing for five months.

Producer Price Index (Europe):

At the same time, there was a small scandal associated with the start of the election of a candidate for the presidency from the Democratic Party before the American statistics were published in the United States, and throughout the world. The development of this story also perfectly coincides with the dynamics of the dollar. As soon as it became known that Bernie Sanders defeated the primaries in Iowa, it was time to turn him down. The prospect that a democrat will claim the presidency as a communist, and that is how they perceive him in the United States, can lead to a stroke of every honest American billionaire. So the weakening of the dollar is understandable from this point of view. But then the whole story turned into a scandal or a drama. Suddenly, it turned out that the mobile application for voting allegedly crashed and the results are unreliable, so it's necessary to carry out a manual recount. According to the results of which, the former mayor of such a world famous city as South Bend won. Everyone knows this is a beautiful metropolis, lost in the vast Indiana. Well, and most importantly, from the point of view of big capital, Pete Buttigieg is a much more acceptable figure, since at least he is not scattered with slogans in the style of Comrade Trotsky. Thus, a manual recount reassured the worried Fat Cats from Wall Street. After all, Pete Buttigieg clearly adheres to extremely liberal views, which impresses large financial capital. And of course, the company, the developer of the mobile application, immediately apologized, adding that the incident was a real disgrace.

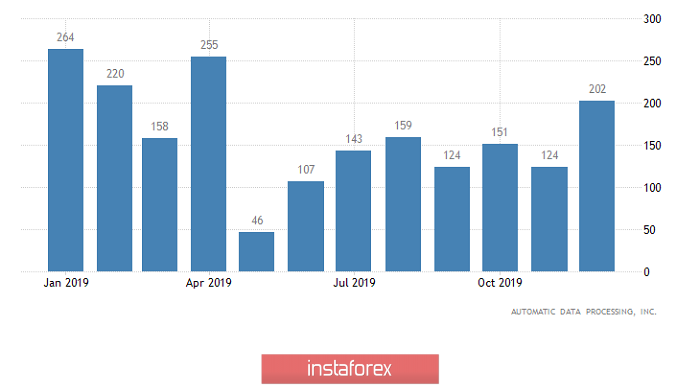

However, if you look at the data on factory orders, which grew by 1.8% against the forecast of 0.9%, it becomes clear that the dollar should have grown even without the scandals. At least in the afternoon. Which is what happened. Indeed, the growth of orders inspires hope that the decline in industrial production will cease soon and we will see growth in production again. At the same time, the pound could still close the day in positive territory due to excellent data on the index of business activity in the construction sector. But there was nothing to brag about the single European currency, so it closed the day in the red.

Factory Orders (United States):

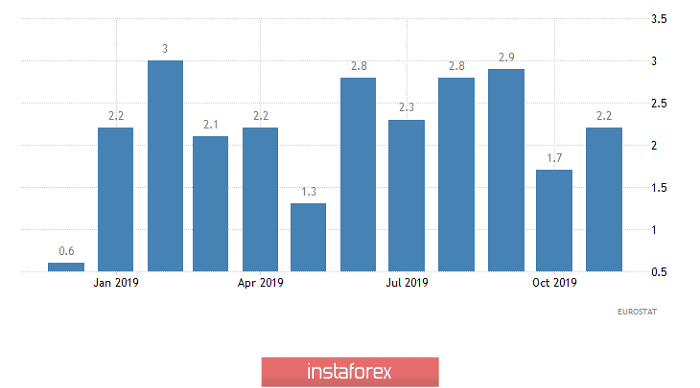

Today's scenario is likely to be somewhat more one-sided, as the general nature of the published data clearly does not favor the growth of the dollar. Of course, we can say that weak data on business activity indices are expected in Europe, which will be true. The fact is that the index of business activity in the services sector should decrease from 52.8 to 52.2. However, the composite business activity index will remain unchanged due to the growth of the production index, which was published on Monday. In addition, retail sales growth may accelerate from 2.2% to 2.5%. Well, the growth of consumer activity contributes to inflation, which means that the European Central Bank has more and more reasons to think about raising interest rates. As a result, the single European currency will increase.

Retail Sales (Europe):

The data on business activity indices will push the pound up. In particular, the index of business activity in the services sector should increase from 50.0 to 52.9, and a composite index from 49.3 to 52.4. It is extremely important here that the indices should grow above the level of 50.0 points, which separates stagnation from economic growth. Consequently, the pound has good reasons for growth.

Composite Business Activity Index (UK):

It should be noted that business activity indices are also expected in the United States, which is unlikely to help the dollar. Yes, the index of business activity in the services sector should increase from 52.8 to 53.2, while the composite index from 52.7 to 53.1. However, a report by the United States Department of Labor is published on Friday, and any labor market data is crucial. This is just about ADP data on employment, which should show its growth by 142 thousand, but the fact is that in the previous month employment increased by 202 thousand. Well, a slowdown in employment growth is an extremely bad signal in anticipation of the publication of a report on labor market conditions. This is what will have a negative impact on the dollar.

ADP Employment Growth (United States):

The single European currency is expected to gradually return to around the level of 1.1075.

The pound will try to reach the level of 1.3100.