Economic calendar (London time)

In today's economic calendar, you need to pay attention to the following events:

10:30 - composite index and data on business activity in the service sector (UK);

13:15 - the ECB President will make a speech;

14:15 - change in the number of people employed in the non-agricultural sector (USA);

16:00 - composite index of non-manufacturing sector (USA);

16:30 - crude oil reserves.

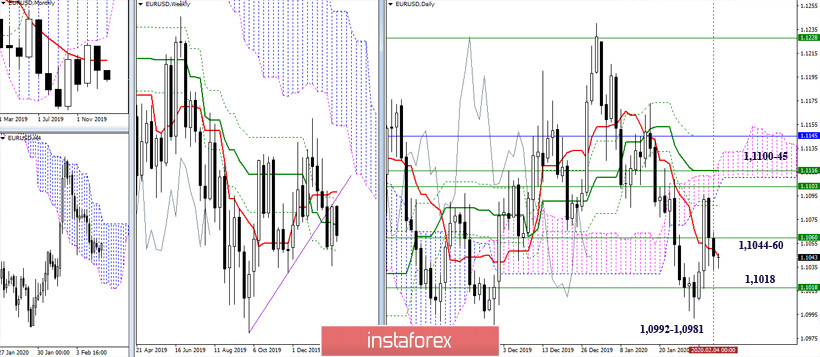

EUR / USD

The situation has not changed much over the past few days. Downward players did not achieve new results, but they continue to insist that the opponent's activity on the previous Friday does not have long-term prospects yet. Moreso, the daily short-term trend (1.1044) and the weekly medium-term trend (1.1060) are still attracting attention. The next important stages for the development and return of bearish moods and opportunities are the support levels of 1.1018 (the final boundary of the weekly golden cross) and 1.0992-81 (the nearest lows). Meanwhile, on the way to strengthen the bulls, there is a fairly wide resistance zone of 1.1100-45 (the daily cloud + the final boundaries of the daily death cross + the weekly Tenkan + the monthly Tenkan).

In the lower halves, there is a struggle for the current key levels located in the area of 1.1047-42 (Central Pivot level + weekly long-term trend). These levels have been holding the pair in their zone of influence for a long time, so they are likely to continue restraining the development of the situation today. A break above the level will give advantage to the bulls. Today's intraday resistances are 1.1066 (R1) - 1.1078 (R2) - 1.1092 (R3). Working below the levels (1.1047-42) may trigger new bearish activity. The support for classic Pivot levels on H1 is currently at 1.1030 - 1.1016 - 1.0999.

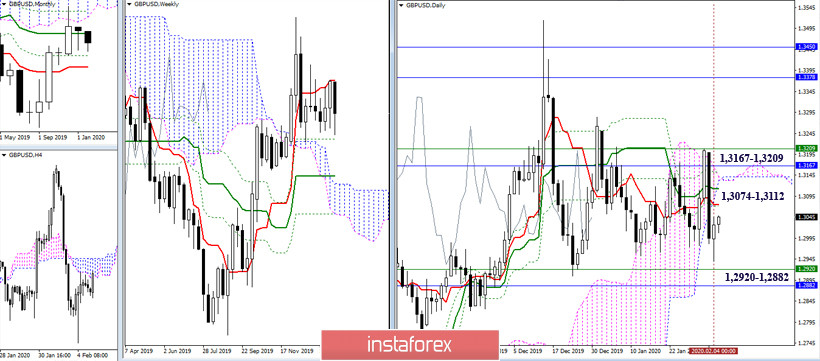

GBP / USD

We are now seeing another slowdown in the area of the lower borders of the consolidation zone. It also has the prospect of returning to its center. This situation did not change expectations, and the boundaries of the zone remain in their places at 1.3167-1.3209 (monthly Kijun + weekly Tenkan + daily cloud) and 1.2920-1.2882 (weekly Kijun and monthly Fibo). Further options and opportunities in the development of the situation can only be considered after the pair leaves the current zone of consolidation.

The uncertainty of the higher timeframes on H1 is supported by the weekly long-term trend, which has been in a horizontal position for a long time and does not change its preferences, despite the pair working above or below it. Now, when the pair is working above or below the key levels (1.3004 Central Pivot level + 1.3059 weekly long-term trend), we can only talk about the initial advantage of one of the parties, which remains within the consolidation of the older time intervals. The resistances of classic Pivot levels are now located at 1.3069 – 1.3110 – 1.3175, whereas support is at the levels of 1.2963 – 1.2898 – 1.2857.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)