Hello, dear colleagues!

The situation for the main currency pair does not change. The euro/dollar continues its downward trend, and the pair has already come close to the support line of 1.0992.

Daily

At the time of writing, there are attempts to bounce up from this level. However, so far they are so unconvincing that at any moment the decline may resume and the support at 1.0992 will be broken.

In this case, the bearish sentiment for the pair will significantly increase, and the downward trend will continue and possibly become even more intense.

The situation will change in favor of buyers if the pair returns above the Tenkan line of the Ichimoku indicator and breaks through the ill-fated resistance of sellers in the area of 1.1080-1.1100. At the moment, it is extremely difficult for players to complete this mission to increase the exchange rate. At the moment of writing this article, the euro/dollar is not yet able to rise above 1.1013.

Judging by the daily chart, the most likely scenario is a breakdown of the support at 1.0992 and a subsequent decline to the area of 1.0980-1.0960. Let's see what the technical picture looks like in smaller time intervals.

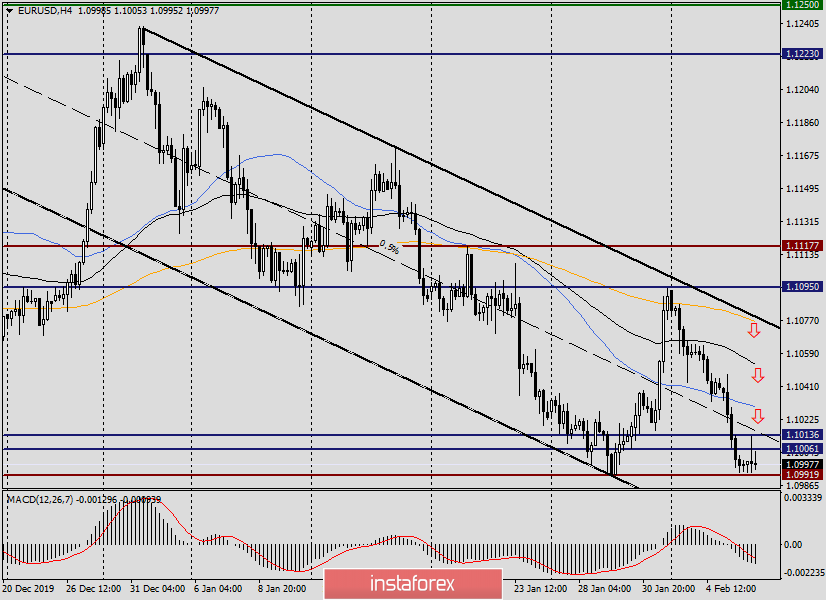

H4

This is still the same downward channel, but the market has not provided an opportunity to sell the pair near the 200 exponential moving average, the upper border of the channel, and the green support line is likely to be broken, and on the approach to one of the key levels of 1.1100.

Now the euro/dollar is trading under the middle line of the channel (dotted), making timid attempts to break above it.

If the euro have enough gunpowder and the pair manages to gain a foothold above the middle line of the channel, it is possible to increase to its upper border, that is, to the already designated price zone of 1.1080-1.1100.

Due to the fairly strong bearish sentiment for the euro/dollar, the option is extremely doubtful and quite complex. For such a rise, in my opinion, a powerful driver or a radical change in market sentiment is needed, as a result of which the US dollar will be under pressure from sales across the entire spectrum of the currency market. The arrows indicate the options that, in my personal opinion, I consider the most relevant for today.

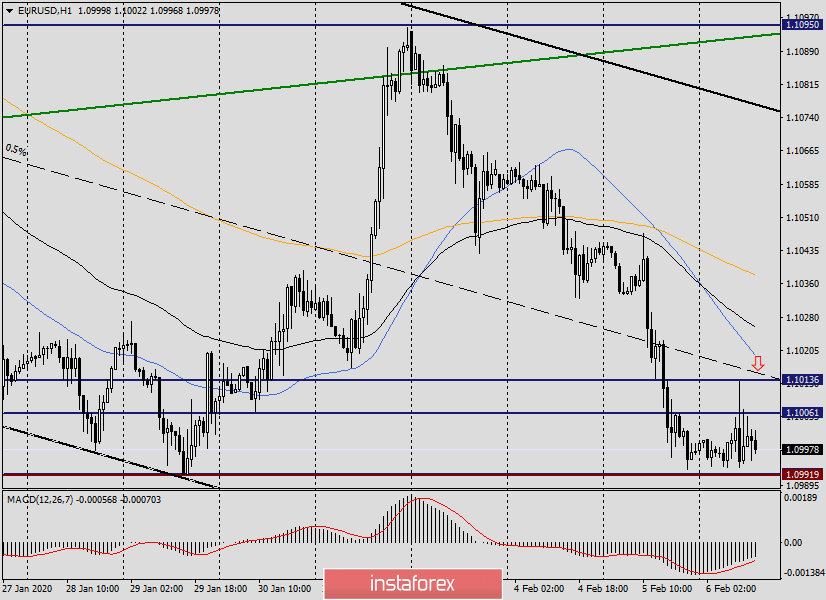

H1

In this timeframe, sales look like the main trading idea for the euro/dollar currency pair.

An interesting and most immediate option for opening short positions on the pair is the mark of 1.1015, where the current highs of today's trading session are slightly lower, and the average channel line is slightly higher, which has the property of providing strong support or resistance, that is, how to influence the price.

I will indicate the trading ideas that are the most relevant at this time.

As you have already understood, of course, these are sales. The nearest of which I propose to consider 1.1013/16. We try further (but less likely) ones if the pair rises to the price area of 1.1080-1.1100.

All the best and good luck with trading!