Gold continues to grow as the US dollar index is still trapped within a down channel. DXY's further drop after today's economic figures could force gold to jump higher. Most likely, XAU/USD will register strong moves around the eurozone and US manufacturing and services data.

The United States Flash Manufacturing PMI could drop from 60.7 to 60.5 signaling expansion slowdown, while the Flash Services PMI is expected to grow from 54.9 to 55.3 points indicating further expansion.

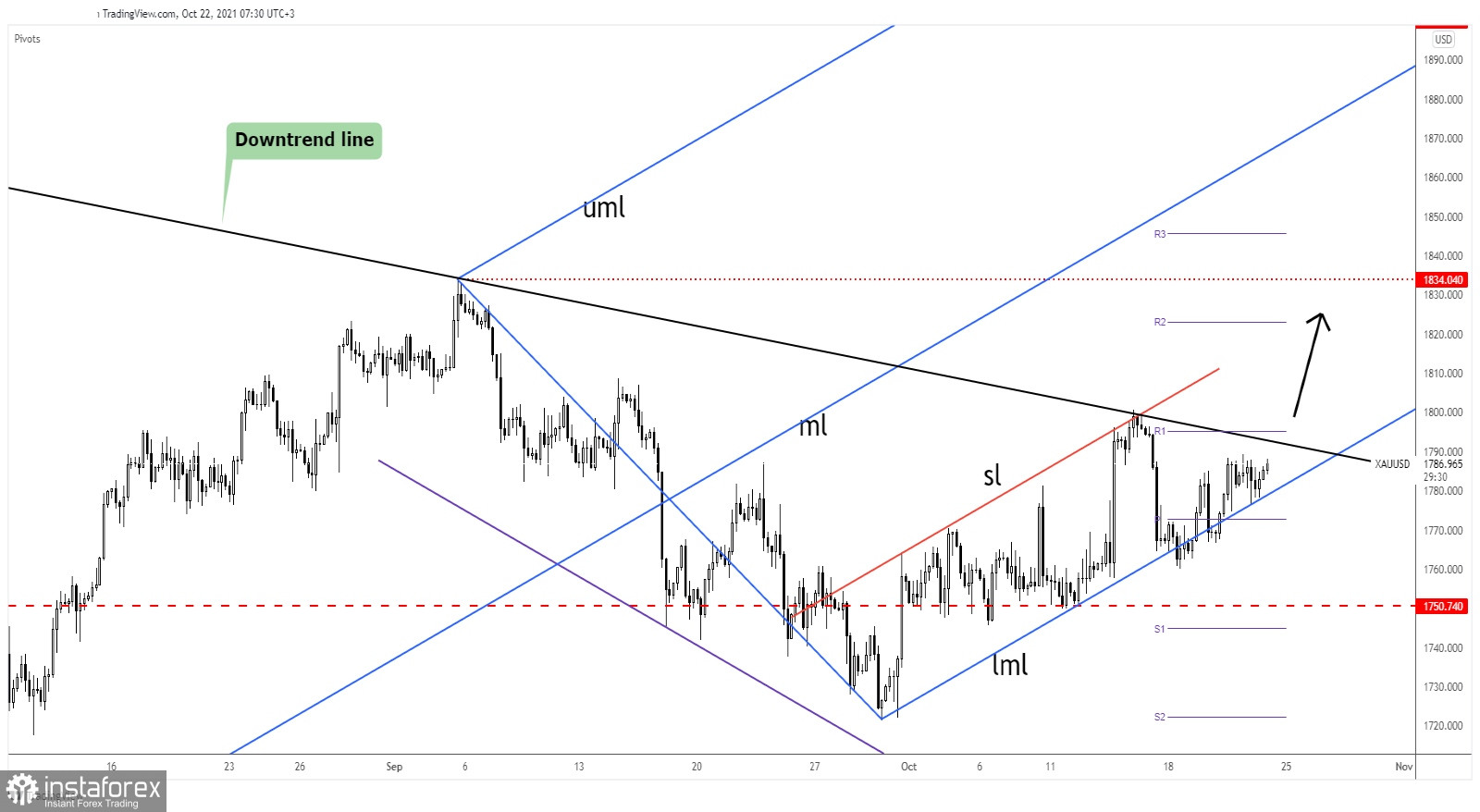

XAU/USD Up Channel!

Gold has found support again around the ascending pitchfork's lower median line (lml). It may soon reach a major downtrend line. Failing to take out the dynamic support indicates potential strong growth.

Only a valid breakout above the downtrend line, above the weekly R1 (1795.43) could validate a larger upwards movement. Staying near the downtrend line could announce an imminent upside breakout.

Gold Prediction!

A valid breakout above the R1 and above the downtrend line is seen as a buying opportunity. XAU/USD could jump towards fresh new highs as long as it stays within the ascending pitchfork's body.

The lower median line (lml) stands as strong dynamic support. A new higher high, jumping and closing above 1,800.64 former high could activate an upside continuation. 1,834.04 higher high is seen as a first upside target.